147

corporates to tap the capital markets and potentially optimise their financing costs. Direct

funding via corporate bonds also reduces the need for foreign funding and renders the

economy less vulnerable to external shocks. Bond markets contribute to financial stability by

spreading credit risks across the economy while shielding the banking sector in times of stress.

The average coupon rate on corporate debts issued since 2015 comes up to 12.1%, compared

to 11.1% for short-term deposits and 10.4% for 2-year government bonds.

7

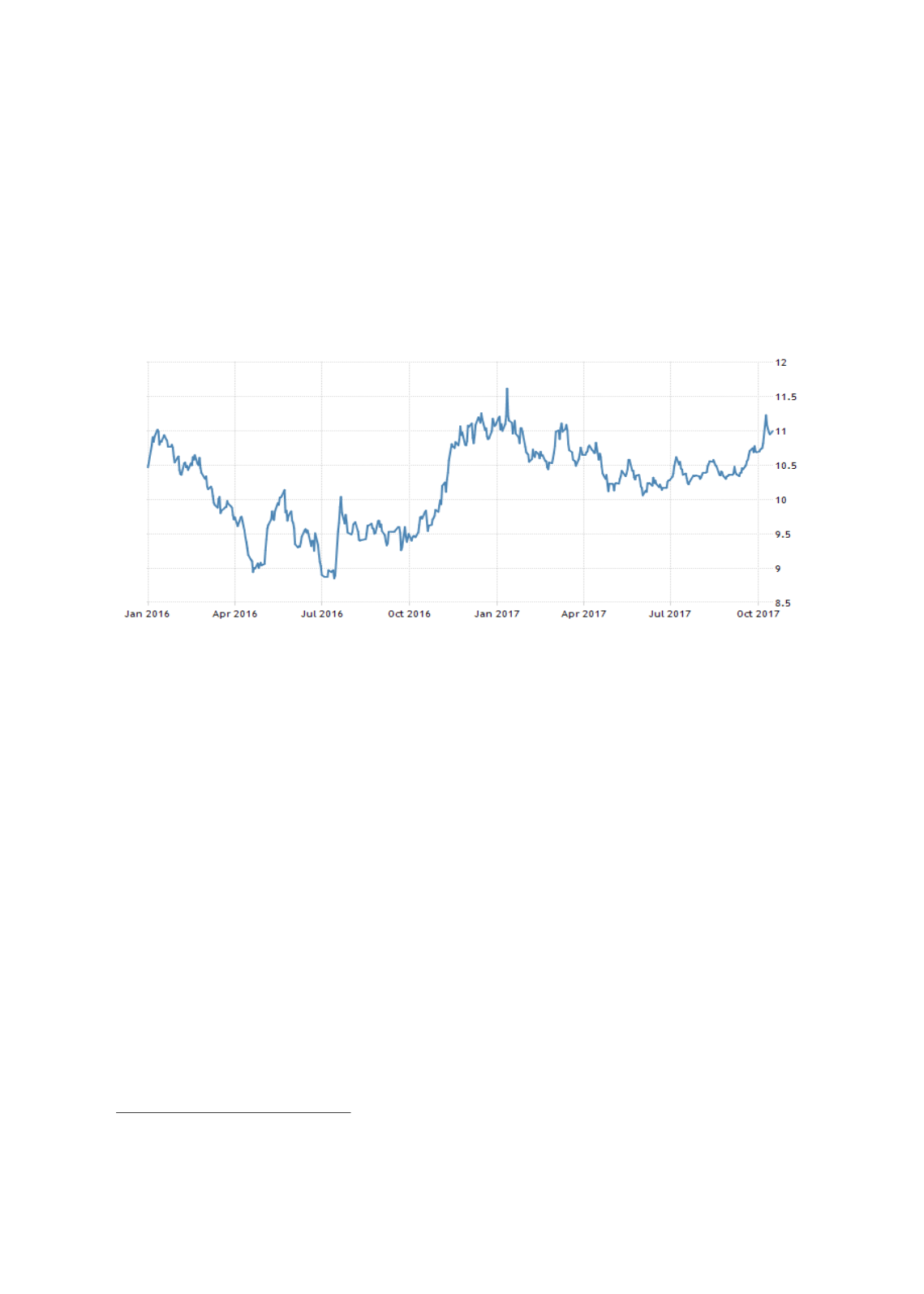

Chart 4.49: Turkey 10-Year Sovereign Bond Yield

Sources: Undersecretariat of Treasury, Trading Economics

In Turkey, the pioneers in the domestic corporate bond market are banks, factoring companies

and financial intermediaries. Corporates that enter the bond market are priced above the

sovereign benchmark, according to their risk premium. This risk premium can be measured

based on the credit rating of the company. In Turkey, credit rating is not mandatory for the

issuance of debt securities. Nevertheless, the majority of Turkish issuers have credit ratings.

The bulk of sukuk has been originated by Turkish participation banks for liquidity

management purposes, and some as funding conduits for leasing companies. To date, only the

sukuk issued by Aktif Bank Sukuk Asset Leasing Company, a subsidiary of Aktif Bank in 2013

has been used for project financing―the development of the Istanbul International Financial

Centre. The 1-year sukuk with a nominal amount of TL100.0 million had been 3 times over-

subscribed. The government needs to make more concerted efforts to identify potential sukuk

champions from among SOEs or GLCs to raise sukuk and provide the necessary benchmark

yield curves to support other corporate issues. Table 4.24 gives a snapshot of benchmark

corporate issuances in Turkey.

7

Turkey corporate bonds need a rescue plan

, Bloomberg, 24 August 2017

%