148

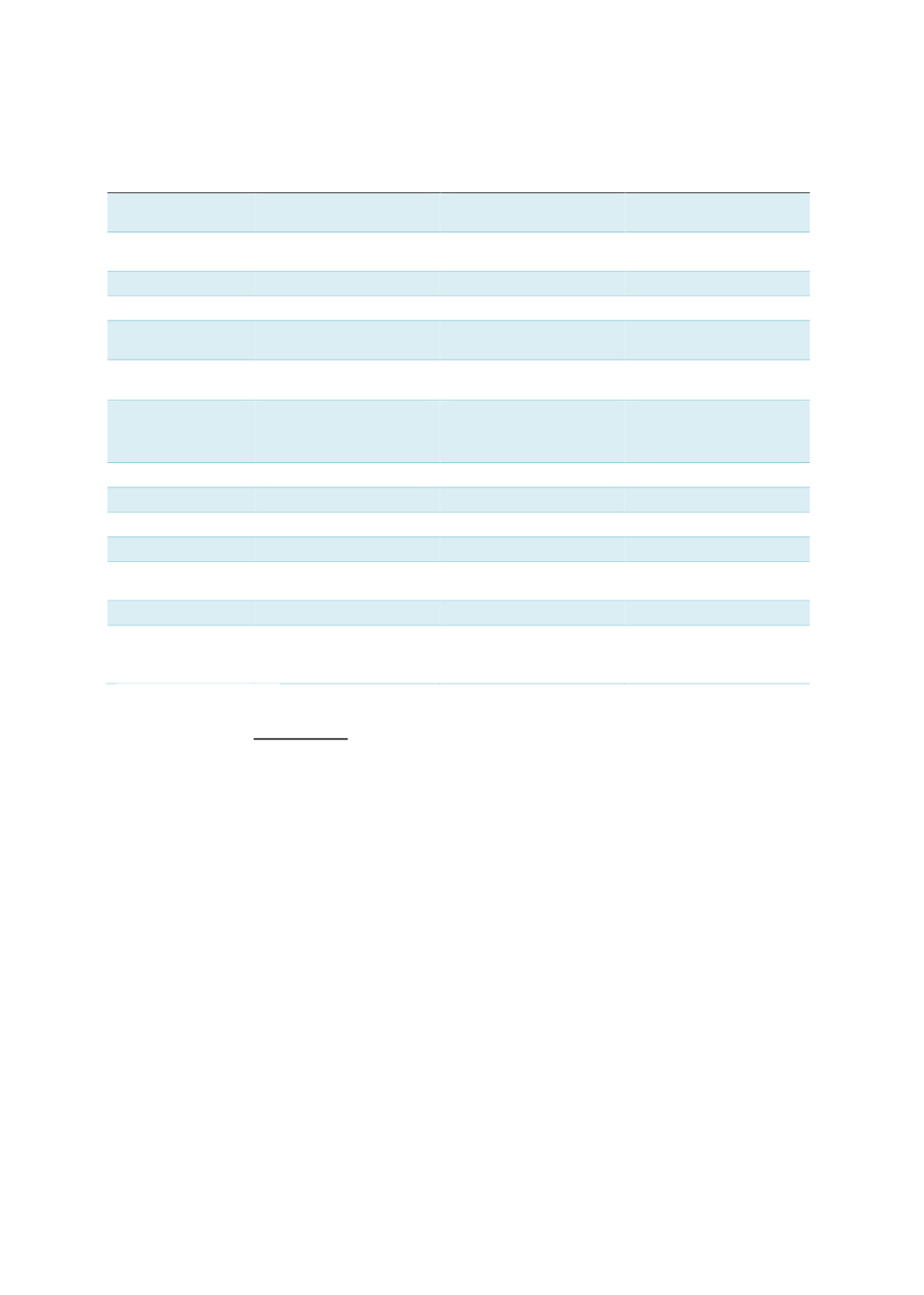

Table 4.24: A Snapshot of Benchmark Corporate Sukuk Issuances in Turkey

Sukuk issuer

KT Kira Sertifikaları

Varlık Kiralama A.Ş.

KT Sukuk Company

Limited

TF Varlik Kiralama A. Ş.

Originator

Kuveyt Turk

Participation Bank

Kuveyt Turk

Participation Bank

Türkiye Finans

Participation Bank

Currency format

Ringgit

US Dollar

Ringgit

Structure

Wakalah

Ijarah

Murabahah

Obligor/sukuk

ratings

AA3 (RAM)

BBB- (Fitch)

AA3 (RAM)

Sukuk assets

Shariah-compliant

commodities

Shariah-compliant

commodities

Shariah-compliant

commodities

Purpose

To be used for general

corporate and funding

purposes

To boost the company’s

capital

To be used for general

corporate and funding

purposes

Issue date

31 March 2015

17 February 2016

30 June 2014

Tenure

10 years

10 years

20 years

Maturity

31 March 2025

17 February 2026

30 June 2034

Amount

RM2 billion

USD350 million

RM3 billion

Periodic

distribution

5.72%

7.90%

6.0%

Listing

n.a

Irish Stock Exchange

n.a

Geographical

distribution of

investors

Malaysia

n.a

Malaysia

Sources: RAM, Kuveyt Turk

Analysis of Sukuk Investments – Demand (Buy Side)

High inflation (as described in Box 4.13) and an unstable macroeconomic environment have in

the past limited the growth of domestic institutional investors. According to the IMF Report, as

indicated in Chart 4.50, Turkey’s saving rate is considerably lower than the global average

(IMF, 2016). Although the private sector’s savings rate had averaged 18% of GDP between

1998 and 2003, it has stayed below 13% since 2010. The public savings rate stands at around

3% while the investment rate has increased, from 17% in 2002 to 20% in 2014. Given this,

domestic savings―both public and private―no longer cover investments, thereby opening a

large gap between savings and investments and, in turn, a current-account deficit.