143

Table 4.21: Turkey's Public Sector Sukuk Issuances

2012 2013 2014 2015

2016

Oct-2017

Number of sukuk issuances in the local

market

1

2

2

2

5

8

Issuances in local market (million TL)

1.624 3.333 3.173 3.390

6.262

4.462

Number of sukuk issuances in

international market

1

1

1

-

1

1

Issuances in international market

(million USD)

1.500 1.250 1.000

-

1.000

1.250

Share of sukuk issuances in total

annual borrowing

3.7%

3.8%

3.7%

3.5%

8.5%

5.5%

Share of sukuk issuances in total debt

stock *

0.8%

1.8%

2.3%

2.6%

2.7%

3.1%

Source: Undersecretariat of Treasury

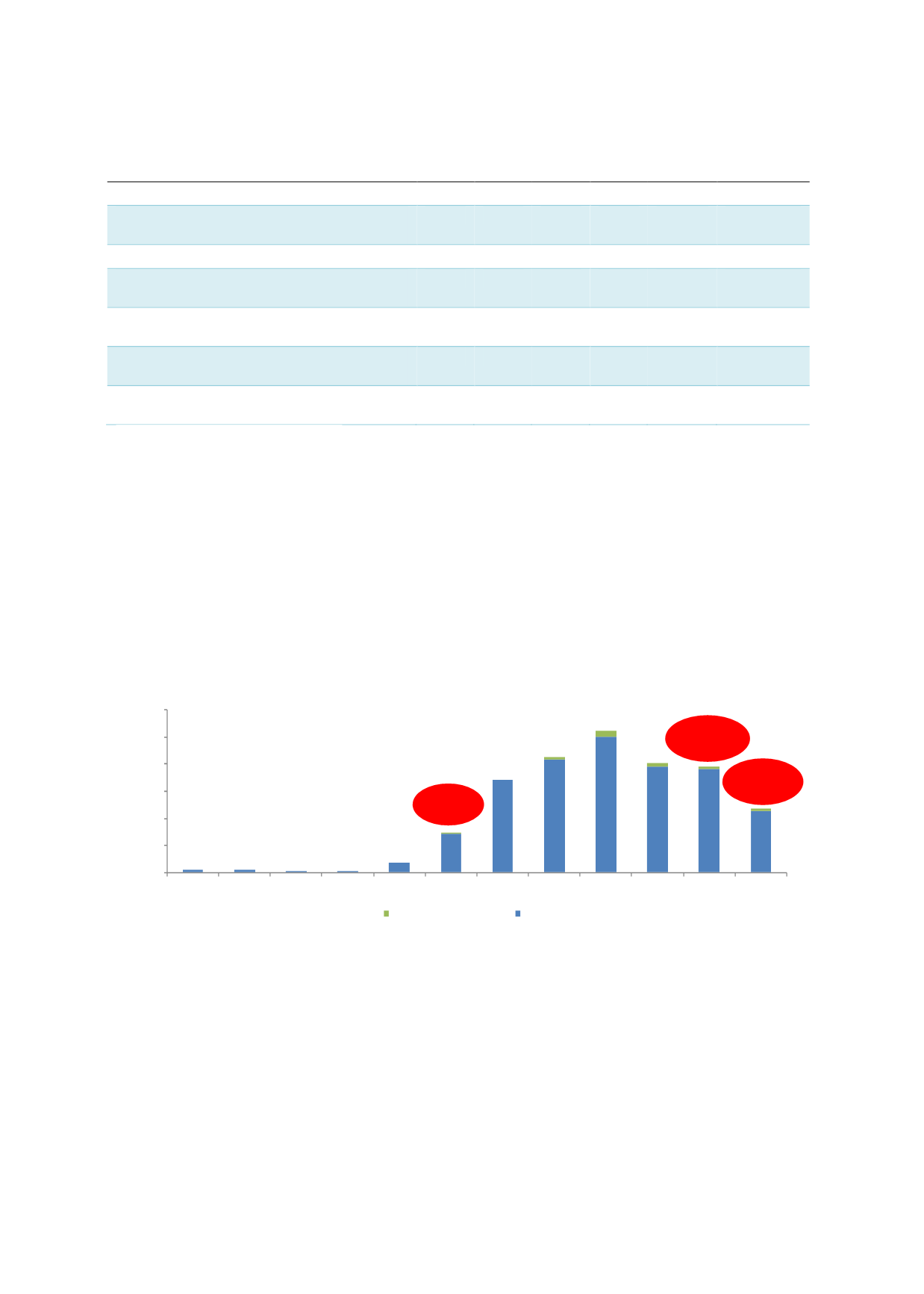

Domestic Market – Private Sector Issuance

The domestic corporate bond market in Turkey only picked up when the Banking Regulation

and Supervision Agency (BRSA) issued guidelines relating to the issuance of TL bonds by

Turkish banks in October 2010. Following the introduction of sukuk guidelines that same year,

there was a spike in sukuk issuance by participation banks. As at end-2016, sukuk made up

approximately 3% (or USD865.3 million) of the private sector’s bond issuance (refer to Chart

4.48).

Chart 4.48: Turkish Private Sector’s Conventional vs Sukuk Issuance

0.00

10.00

20.00

30.00

40.00

50.00

60.00

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 June 2017

USD billion

Sukuk issuance

Conventional issuance

USD350

million

USD973.9

million

USD865.3

million

Sources: CMB, Bloomberg, Eikon-Thomson Reuters

In light of participation banks’ large appetite for Shariah-compliant investments to support

liquidity management, the government and the regulators should encourage SOEs and blue-

chip companies to issue sukuk. East Asian countries (Malaysia and Thailand) have used tax

incentives to make it attractive for the corporate sector to issue bonds in their local markets.

Similarly, the Turkish authorities have―over the last decade―taken regulatory and fiscal

initiatives to build the necessary ecosystem for a corporate (e.g. utilities-backed companies)

bond market to thrive in (as highlighted in Figure 4.14). Nonetheless, additional tax waivers

(e.g. removal of withholding tax on investments in debt securities) and the relaxation of rules

to allow FCY issuance in domestic markets may facilitate the build-up of a sukuk pipeline.