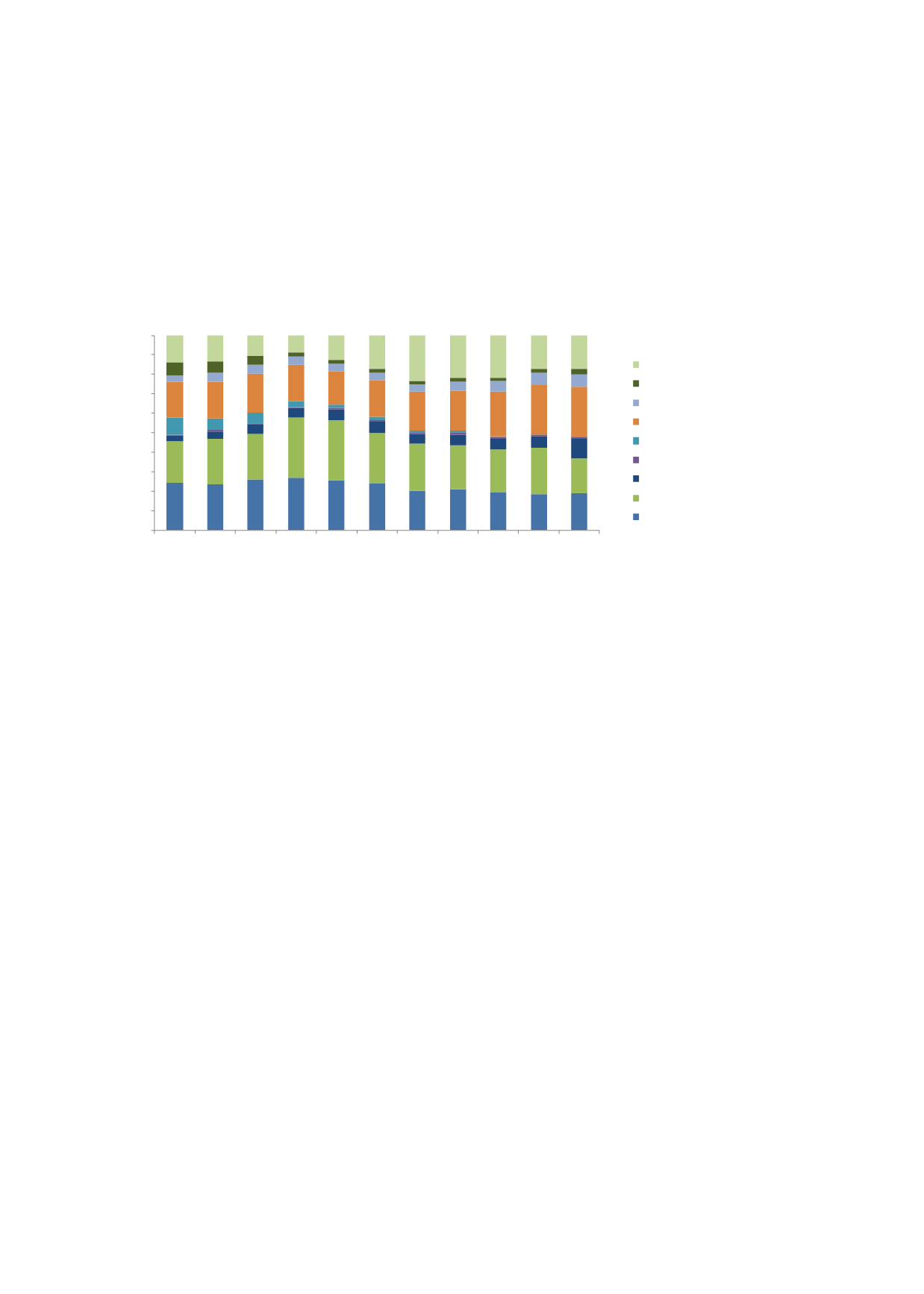

151

investors. As a result, short- to medium-term appetite has driven the maturity profiles

(average tenures of less than 5 years) of debt securities issued in Turkey. Greater participation

by NBFIs (e.g. pension funds, asset fund managers, insurance/

takaful

operators) that have

long-term

assets

to

match

the

long-term

financing

requirements

of

the

government/corporates will facilitate the issuance of long-dated papers. Chart 4.51 illustrates

the categories of investors for Turkey’s domestic government debt securities.

Chart 4.51: Domestic Government Debt – Classification by Holder (2006 To 2016)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Foreign holders

CBRT

Securities mutual funds

Corporate investors

Retail investors

Development and investment banks

Foreign banks

Private banks

Public banks

18

%

17

%

26

%

19

%

10

%

Source: Undersecretariat of Treasury

4.5.4

KEY FACTORS UNDERPINNING TURKEY’S SUKUK MARKET

The growth of Turkey’s sukuk market has been predominantly driven by sovereign issuances

and participation banks. Concerted efforts in the areas, as shown in Figure 4.16, underpin

Turkey’s progress in turning its sukuk market into viable financing solutions, to support the

country’s budget deficits and participation banks’ funding requirements. However, additional

measures need to be in place to heighten the appeal of sukuk in attracting more private sector

issuers.

Since the inception of the sukuk market in 2010, Turkey has made commendable progress in

contributing to the growth of global sukuk issuance. Nonetheless, there is still room for

improvement vis-a-vis accelerating the development of its sukuk industry. Figure 4.17

highlights the stages of progress made and its growth potential as a financing alternative in

funding economic development.