142

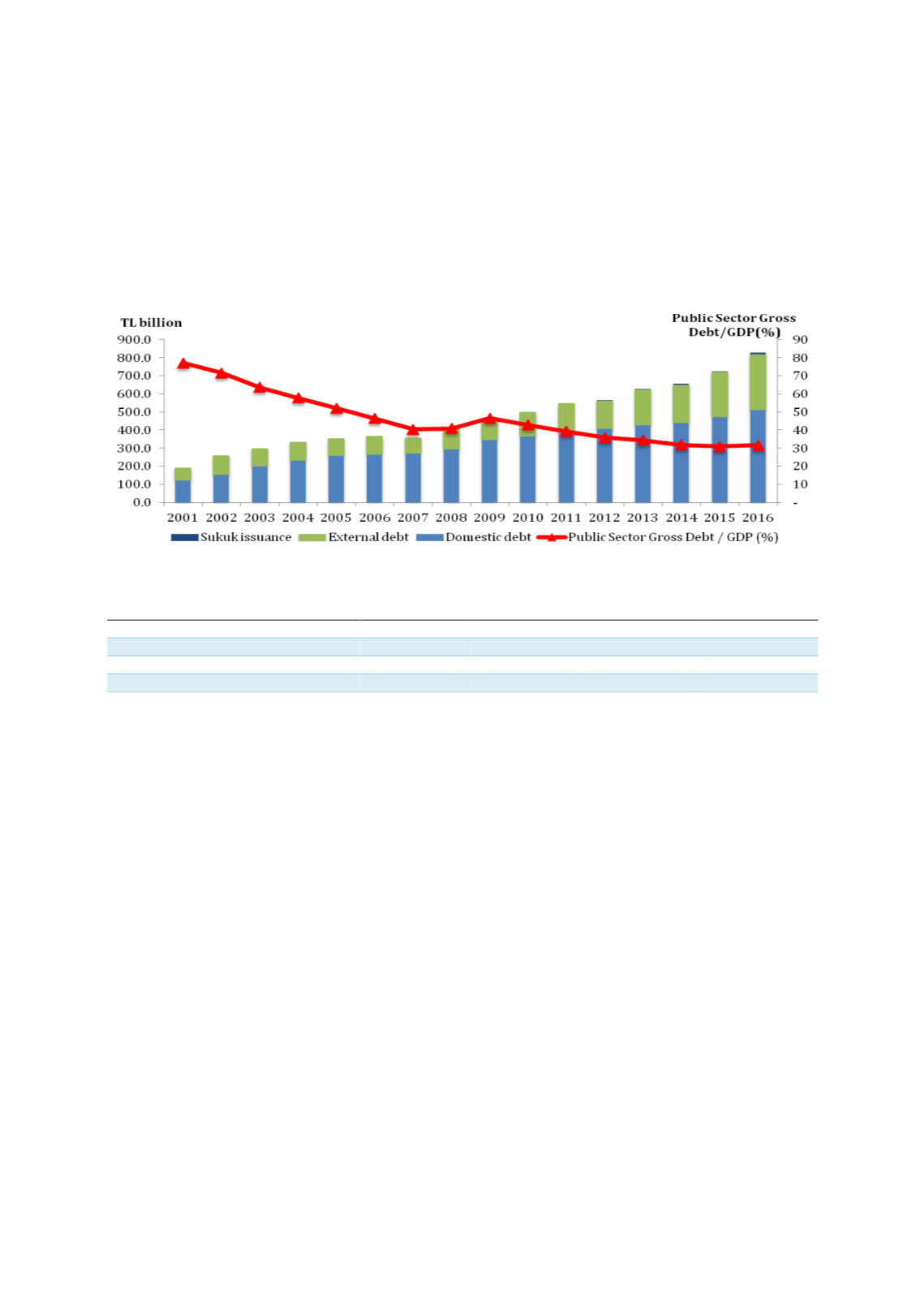

runaway inflation. As at end-2016, the gross public debt had more than halved to 32% while

its inflation rate was brought down to only 8.5% (as depicted in Chart 4.47). Improved

management of public debt through optimising borrowing costs, among other solutions, had

extended the maturities of debt issues; fixed-rate LCY borrowings had been among the

measures that had enabled Turkey to lighten its debt burden.

Chart 4.47: Turkey’s Gross Public Sector Debt (2001-2016)

Source: Undersecretariat of Treasury

Table 4.20: Turkey’s Budget Deficits (2014-2017f)

TL billion

2014

2015

2016e

2017*

Government revenue

425.4

482.8

554.1

574.6

Government expenditure

448.8

506.3

584.1

601.1

Budget deficit

(23.4)

(23.5)

(29.9)

(26.5)

Source: Ministry of Finance (MOF), Turkey

* Based on figures as at end-November 2017.

Turkey has historically relied heavily on capital-market instruments through the issuance of

domestic and external bonds to finance government budgets (refer to Table 4.20 on Turkey’s

budget deficits from 2014 to 2017). With the amendment of the law for sukuk issuances in

2012, Turkey issued its first USD and LCY sukuk in 2012, which facilitated the setting up of

sovereign benchmark yield curves for corporate sukuk issuance. To date, even though

sovereign sukuk only accounts around 3% of its total sovereign debt issues, commitments

under the MTP (2016-2018), MTP (2017-2019) and MTP (2018-2020) appear to have set the

stage for interest-free instruments to potentially form part of future budgetary requirements.

Hazine Müsteşarlığı Varlık Kiralama A.S. (HMVKS) has issued sukuk in the local market

regularly since 2012 according to a calendar that has been announced at the beginning of the

year. The maturity of the sukuk was 2 years between 2012-2015, however, since 2016, the

HMVKŞ has issued both 2 and 5 years sukuk. Moreover, the HMVKŞ started to issue CPI

indexed ijarah sukuk since 2016 in the the local market, as well as fixed lease rate sukuk. Also,

to diversify sukuk instruments, in 2017 the HMVKŞ started to issue gold denominated ijarah

sukuk in the local market to retail investors.

In the international market, the HMVKŞ has issued USD denominated sukuks that have

maturities between 5 and 10 years. Table 4.21 shows the number of domestic and

international sukuk issuances by Turkish government from 2012 to October 2017.