149

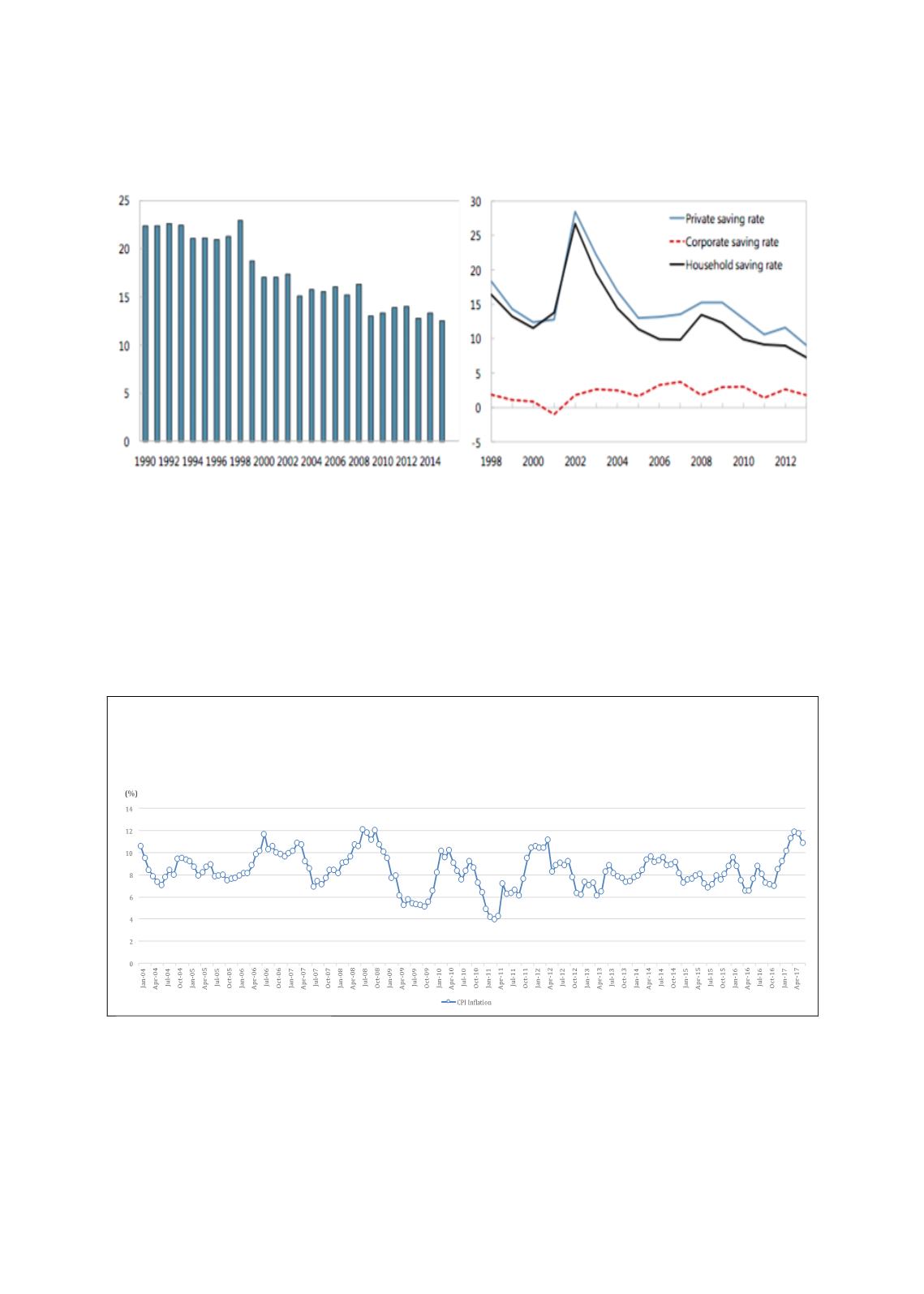

Chart 4.50: Turkey’s Historical Savings (as a Percentage of GDP) and Savings Rates

Sources: IMF calculations, Central Bank of the Republic of Turkey (CBRT), IMF World Economic Outlook (WEO)

In August 2016, the Turkish pension system underwent a change to automatically enroll the

working population in a private pension scheme. As at end-2016, the base of contributors had

increased to 6.6 million people, with a corresponding surge in participants’ funds to TL60.8

million (+26.7% from TL48.0 million a year earlier, including state contributions) (refer to Box

4.14). Given Turkey’s young population and rising income levels, the private pension system,

investment funds and insurance/

takaful

market offer considerable potential. Box 4.15 gives an

overview of investment funds industry in Turkey.

Box 4.13: Turkey’s Historical Inflation Rate

The Turkish economy has had a long history of rampant inflation. Major reforms by the government in 2002

and responsible fiscal management have brought down its inflation levels. According to the latest forecast by

the CBRT, however, the projected inflation rate for 2017 has been revised to 8.7%, driven up by higher food

prices. Prices of food, which makes up a fifth of the inflation basket, rose more than 14% in June 2017. At

month-end, the inflation rate stood at 10.9%, as depicted below.

Source: Turkish Statistical Institute