140

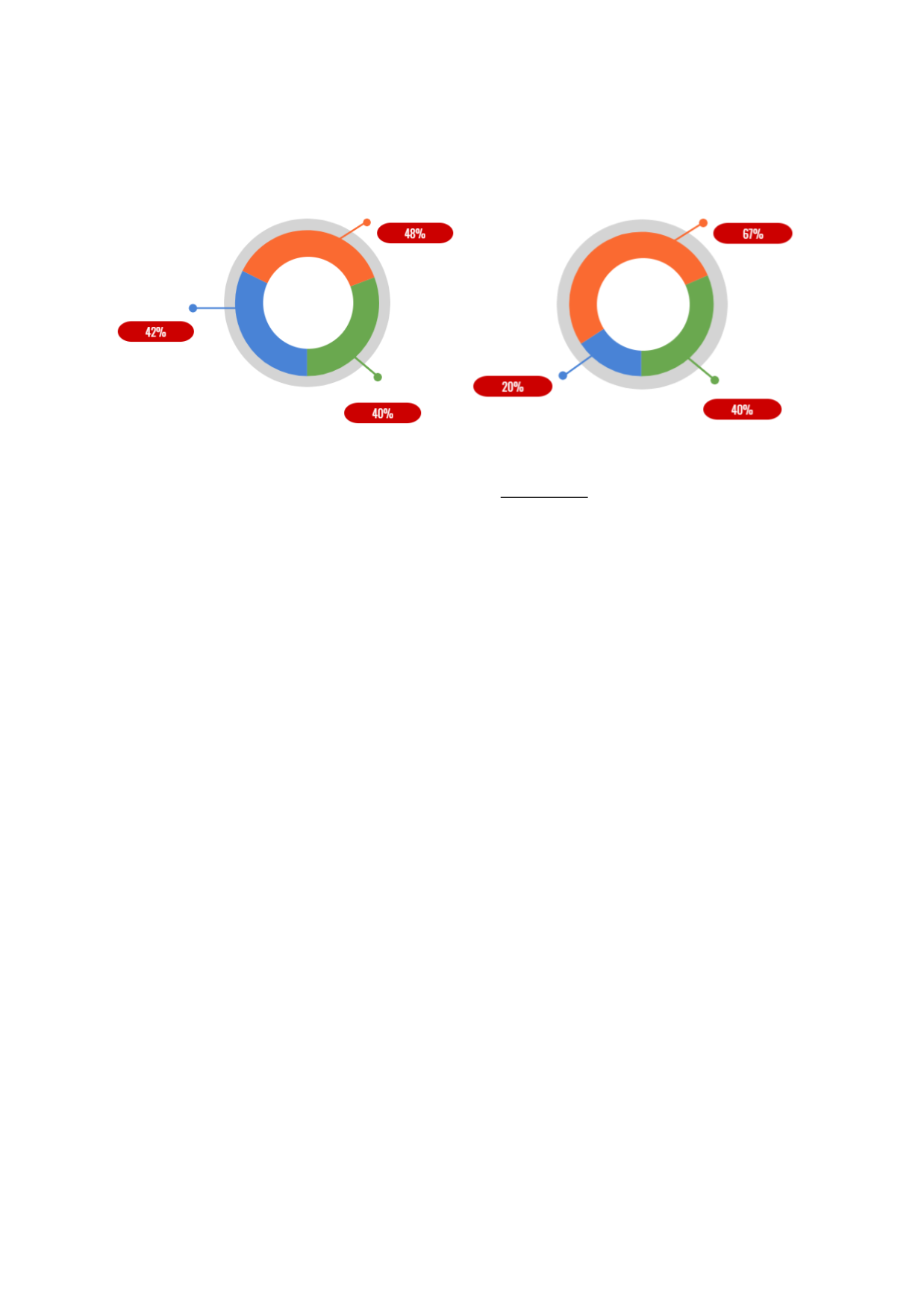

Chart 4.45: Turkey’s Outstanding Capital Markets vs Bank Financing Relative to GDP

2010

Outstanding

amounts as a %

of GDP at

USD732.0

billion

Loans/Financing

Outstanding

2016

Outstanding

amounts as a %

of GDP at

USD857.0

billion

L

Bonds Outstanding

Source: CMB Annual Reports, Turkey IMF Country Report No. 17/35, The Banks Association of Turkey Report

2016

Based on our methodology, Turkey is placed under “developing” status due to sustained sukuk

issuance by the public and private sectors, and the country’s concerted efforts in building a

viable Islamic finance ecosystem.

4.5.2

GROWTH OF THE SUKUK MARKET IN TURKEY

The formal regulation of the development of sukuk began with the Capital Markets Board of

Turkey (CMB) issuing the Communiqué on the principles regarding lease certificates and ALCs

in April 2010. Through the issuance of the Communiqué, the CMB aims to facilitate the

development of an alternative instrument for Islamic finance and has created a new era for the

Turkish capital market. According to the Communiqué, only ALCs that function as SPVs are

allowed to issue lease certificates. Subsequently, in 2012 the Law on Regulating Public Finance

and Debt Management was amended to facilitate Turkey’s first sovereign sukuk issuances in

international and domestic markets within the same year. The sovereign issuance was issued

by Müsteşarlığı Varlık Kiralama AS (HMVKŞ), as ALC set-up by the Undersecretariat of Turkey.

On June 2013, the CMB released a second Communiqué on lease certificates (which supersedes

the first); this expands the principles governing lease certificates and originators of ALCs. Since

trusts are not regulated under Turkey’s civil law, the ALCs can be incorporated as joint stock

companies, as per the guideline in the second Communiqué. Figure 4.13 summarises the key

phases that Turkey has undergone in strengthening its sukuk regulations.