136

Withholding tax

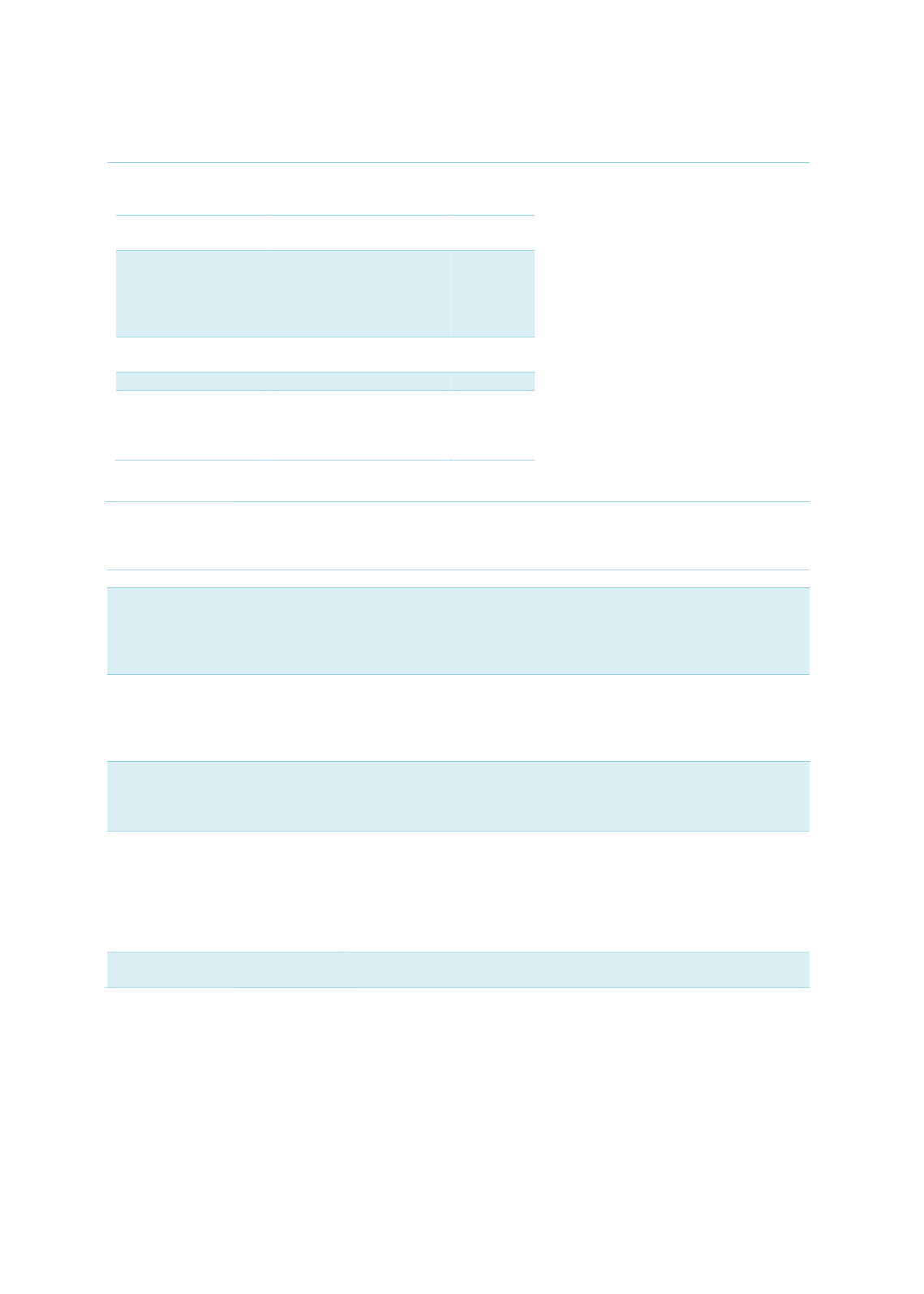

Withholding-tax related to debt securities in Indonesia

Type of debt

Type of investor or

institution

Tax rate

Government

securities

Domestic banks

Approved pension funds

Domestic mutual funds

Other domestic investors

Foreign investors

0%

5%

15%

20%

FCY government

securities

Any investor

Exempt

BI certificates

Any investor

20%

Corporate bonds

Domestic banks

Approved pension funds

Domestic mutual funds

Other domestic investors

0%

5%

20%

Source: ASEAN+3 Bond Market Guide 2017

Different tax rate imposed on different

groups of investors. To create a level

playing field for all NBFIs is to consider

full exemption/or reductions across

the board. The sacrifice in foregoing tax

revenue from withholding taxes will

have a ripple effect on the fund flows

into Indonesia’s capital markets.

Sources: RAM, ISRA

Table 4.17: Recommendations to Improve Supply (Sell Side) – Medium-Term Solutions

Issues and challenges

Supply (sell side) opportunities

Create a sustainable supply of

corporate sukuk

Encourage SOEs and corporates to issue retail sukuk linked to

infrastructure projects.

Explore new sukuk programmes directed specifically at religious funds

(hajj fund, zakat, waqf) that are linked to directly finance the

government’s infrastructure projects.

Lack of understanding among

corporates on ICM access (i.e.

unfamiliarity with Islamic

structures and principles)

There are ongoing efforts by the regulators to raise market awareness

of ICM products. However, the level of awareness remains low.

The government and the regulators can dedicate sections on their

websites to share comprehensive information on sukuk and its

processes, to increase knowledge and build market awareness.

Improve sukuk’s cost

competitiveness to encourage

corporates to issue sukuk

The OJK has initiated a reduction in registration fees for sukuk. Other

applicable fees should be reviewed for waivers or exemptions.

However, the tax authorities should also collaborate with the OJK to

propose viable stimuli to encourage corporate issuance.

Promote activity in the Islamic

money market

Following the release of the Islamic Repo guidelines in 2015, there has

been market activity although this has yet to reach the regulators’

targeted volumes.

Greater understanding of Islamic banks’ issues and challenges can

facilitate better volumes of Islamic repo and look at alternative forms

of liquidity-management tools offered in other countries, which can be

adopted in Indonesia.

Expansion of ICM products

Promote product innovation with social welfare benefits (i.e awqaf-

linked sukuk).

Sources: RAM, ISRA