COMCEC Trade Outlook 2016

17

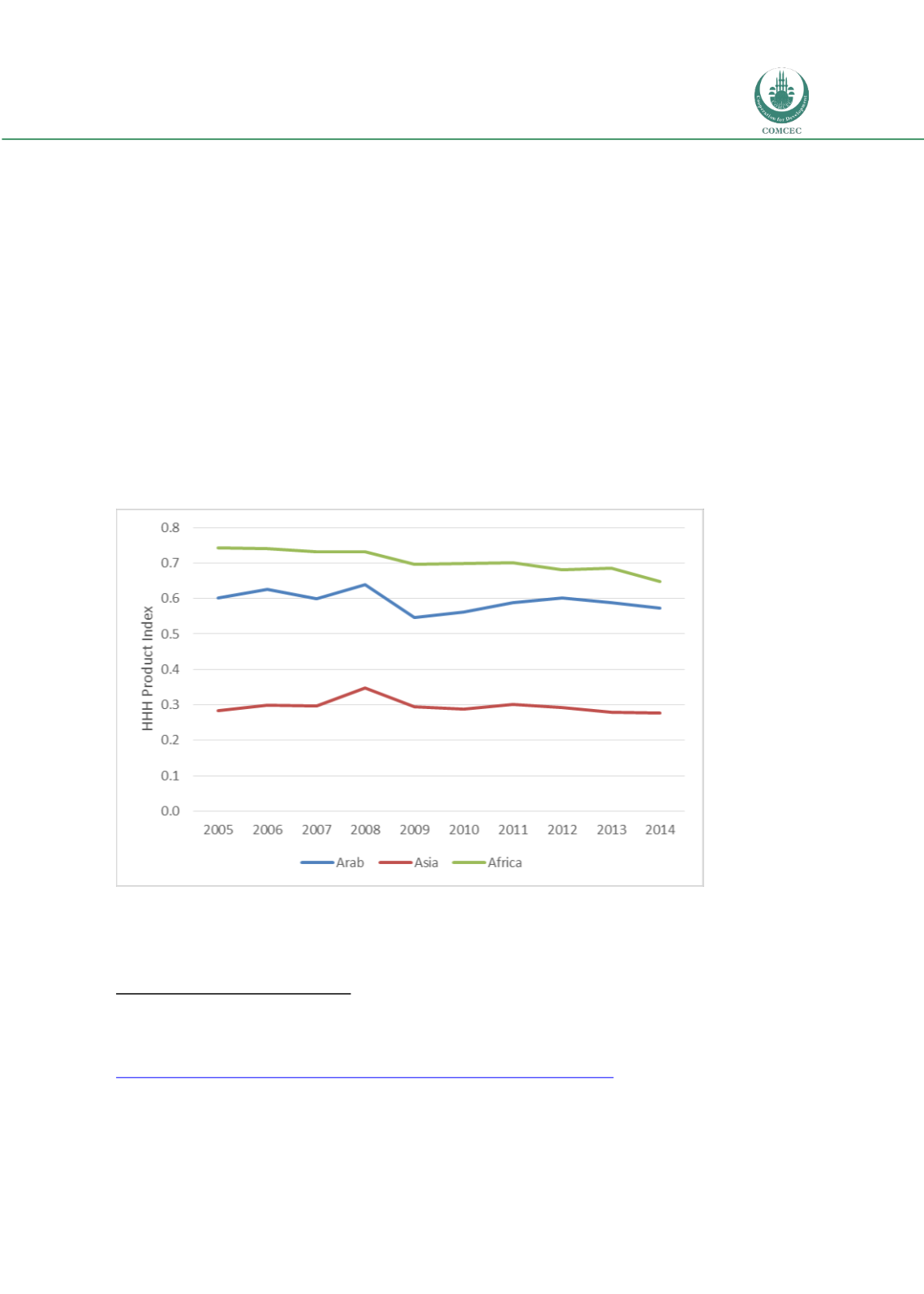

The resilience of a country against external economic shocks varies depending on among others

the degree of export diversification. One common measure of concentration is Herfindahl-

Hirschmann Index (HHI)

8

which can take values between 0 and 1 where being close to 0

indicates well diversified exports while a higher value indicates greater concentration of exports

on a few commodities. Figure 15 illustrates the evolution of product diversification in the OIC

geographic regions for the period 2005-2014 measured by HHI. This measure shows a little

tendency towards increasing product diversification across all the regions and there is

considerable disparity among regions. Africa has the highest HHI with 0.65 in 2014 which points

to a high export product concentration. On the other hand Asia which has the lowest HHI with

0.28 in 2014 has a more diversified export product base. Turkey has the most diversified export

product structure with a HHI of 0.07 in the OIC. In the Arab region HHI takes the value 0.57 in

2014, however when looked closely within Arab region some major oil exporters have a very

concentrated export product structure measured by HHI such as Iraq (0.97), Libya (0.76) Saudi

Arabia (0.74) and Kuwait (0.66).

Figure 15: Herfindahl-Hirschmann Index (Product HHI) Index by region

9

Source: Author’ calculations based on UNCTADSTAT data

8

The Herfindahl-Hirschmann Index (HHI) is calculated by taking the square of export shares of all export

categories in the market:This index gives greater weight to the larger export categories and reaches a value of

unity when the country exports only one commodity.

http://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=1209

Note: Regional concentration ratios are trade weighted averages of country concentration indices where

country’s share in regional exports used as weights.