COMCEC Trade Outlook 2016

14

Oil price shock has different effects on oil exporters and importers. While the oil exporters lose

export and fiscal revenues that might lead to possible losses in growth, oil-importing countries

could benefit from reduced oil import bills and increased real incomes. However those oil

importer countries having close ties with oil exporters through services exports and investment

could be adversely affected. (IMF, 2015a)

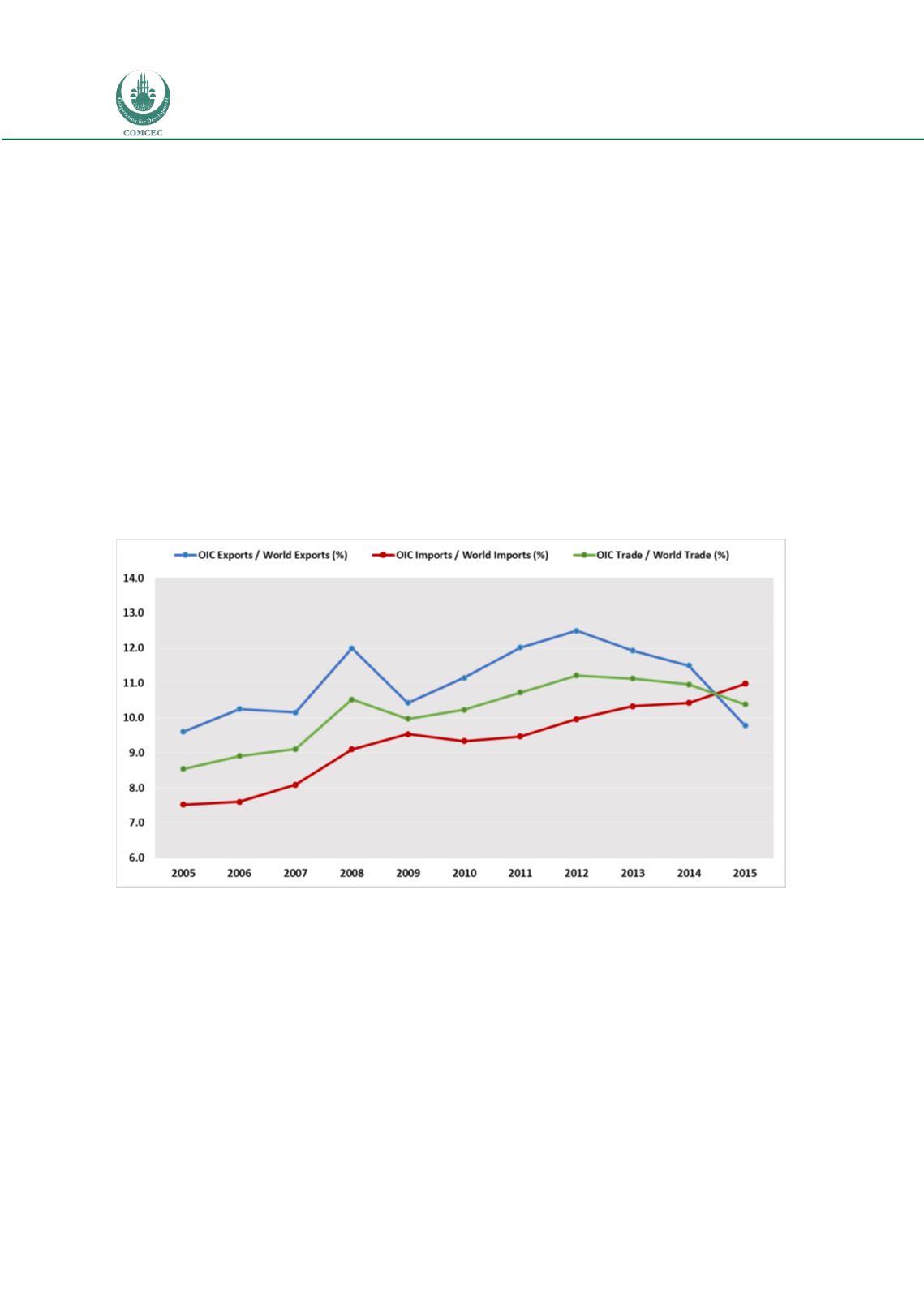

The share of OIC countries in world trade, reached 10.5

percent in 2008 before falling to 10.0 per cent in 2009 (see

Figure 11). The share of OIC countries in global trade

recovered strongly after the crisis and peaked at 11.2 per

cent in 2012. However the share of OIC countries in global

trade receded to 10.4 per cent in 2015 due to sharp decline

in exports.

The share of OIC countries in global exports increased steadily after the global crisis and peaked

at 12.5 per cent in 2012. However OIC’s share in world exports decreased to 9.8 per cent in 2015

due to steep fall in total OIC exports.

Figure 11: Share of OIC in Global Trade

Source: IMF Direction of Trade Statistics

Figure 12 belowdemonstrates value versus volume

(i.e. eliminating the effects of prices and exchange

rates) developments in total OIC and world exports.

In value terms (i.e. in US dollars), OIC exports

yielded higher growth rates than that of world

exports especially during the oil price boom period

between 2003 and 2012. Total OIC exports moves closely with oil prices owing to heavy

dominance of oil in OIC exports. Due to recent oil price collapse dollar value of OIC exports fell

sharply in 2015. However it should be noted that due to increased supply especially in fuels, the

“OIC countries’ share in

global trade receded to

10.4 per cent in 2015”

“Due to increased supply in

oil, OIC export volume

increased slightly despite fall

in export values in 2015”