COMCEC Trade Outlook 2016

13

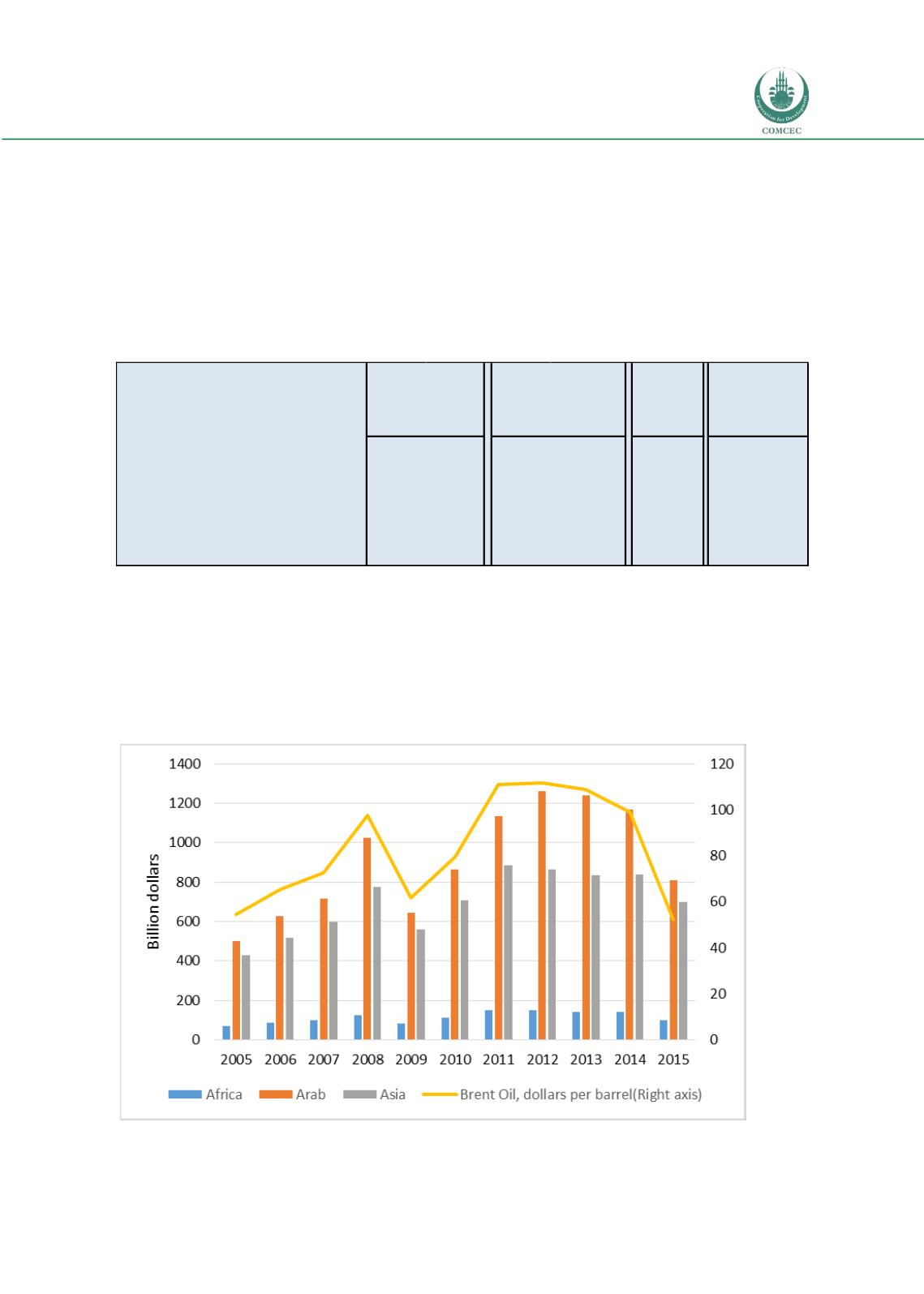

Prices of commodities, in particular fuels, declined sharply starting from June 2014. Brent oil

prices declined by almost 50 percent from98.9 dollar per barrel in 2014 to 52.4 dollar per barrel

2015. As a result, energy exporters of OIC were affected severely by this commodity price

decline. (WB 2016)

Table 2 shows the sectors which have the largest negative impact on the percentage fall of the

total OIC exports in 2015 in descending order. Mineral fuels and oils were accounted for 64 per

cent of the decline in total OIC exports.

Table 2: Sectoral Contributions to Change in Total OIC Exports

Source

:

ITC Trademap

Figure 10 shows the evolution of total OIC exports by region versus oil price developments.

Although both Arab region and Asian region exports move in tandem with oil prices, as Arab

regions exports is heavily dominated by mineral fuels there is a high correlation between the

Arab region’s exports and the oil price developments. The collapse in Arab region’s exports in

2015 was mostly attributable to recent oil price slump.

Figure 10: Evolution of the Value of Total OIC Exports by Region versus Oil prices

Source: IMF

Per Cent

Change

Contribution to

Change in Total

OIC Exports (%)

2014 2015

2014

2015

2015/2014 2015/2014

Mineral fuels, oils, distillation products, etc

53.3

47.5

1,215

699

-42.4

-22.6

Commodities not elsewhere specified

5.1

0.3

115

4

-96.7

-4.9

Electrical, electronic equipment

5.7

6.3

130

92

-28.9

-1.6

Machinery, nuclear reactors, boilers, etc

3.1

3.4

72

50

-30.4

-1.0

Pearls, precious stones, metals, coins, etc

3.2

3.8

72

56

-22.6

-0.7

Vehicles other than railway, tramway

2.1

2.5

49

37

-25.4

-0.5

Plastics and articles thereof

2.4

3.1

55

45

-16.9

-0.4

Per cent Share in

Total OIC Exports

Exports(billion dollars)