COMCEC Trade Outlook 2016

7

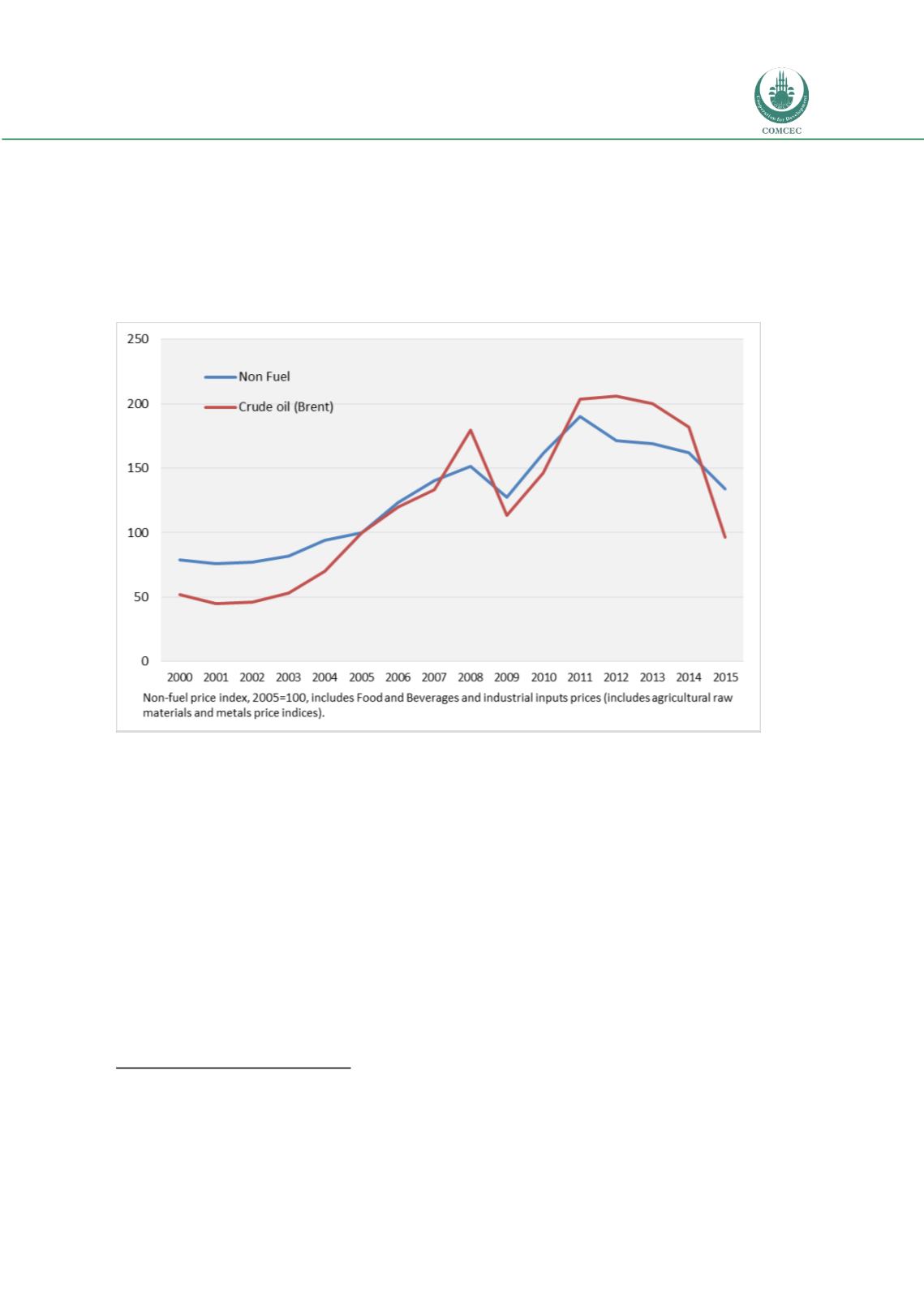

Oil price collapse was a combination of both demand side and supply side factors including the

surge in crude oil production in countries outside the OPEC

5

, especially in the United States,

increased oil supply due to continued OPEC production, Iran’s return to oil market, the weakness

of demand and improved energy efficiency in vehicles. (IMF 2016) found that abundant supply

accounts almost all the decline in oil prices. According to (Arazki et al 2015) increased financial

flows to oil in recent years may have also an impact on increased volatility of oil prices.

Figure 5: Evolution of Oil and Non-Fuel Commodity Price Indices (2005=100)

Source: IMF

High increases in oil prices reflected themselves in

the rising share of commodities in global trade. Thus,

the share of mineral fuels in global exports rose from

9.8 per cent in 2001 to 16.3 per cent in 2014, moving

up to the first place. However due to fall in oil prices,

share of mineral fuels in global exports declined to

11.4 per cent in 2015. On the other hand, the share of

electrical, electronic equipment in world exports

moved to first place in 2015 from second place in 2001. Figure 6 below, shows the composition

of world exports in 2015 compared to 2001.

5

According to (WB 2016) OPEC production increased further, reaching a three year high, with much of the

increase coming from Saudi Arabia and Iraq.

htttp://pubdocs.worldbank.org/en/898911452202217524/Global-Economic-Prospects-January-2016-Global-Outlook.pdf

“The share of commodities

in the world trade increased

due to soaring commodity

prices”