COMCEC Trade Outlook 2016

4

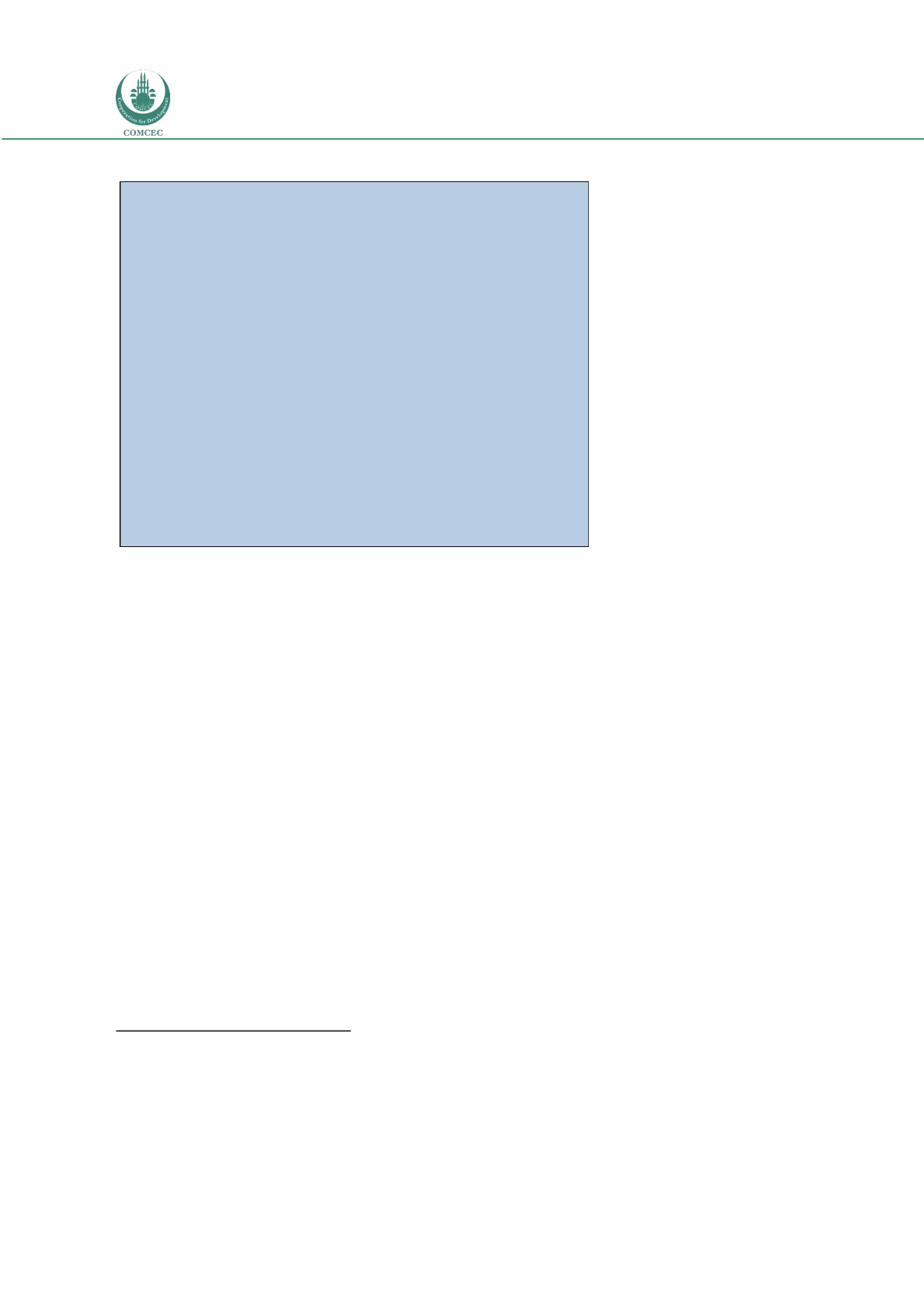

Table 1: Trade Volume and GDP, Annual % change

Source

:

WTO

Additionally some structural changes such as slower pace of trade liberalization and the

maturation of global value chains also contributed to recent world trade slowdown. Yet short

term factors are estimated to have the lion’s share in world trade slowdown.

2

IMF

3

discusses also in detail structural factors that might have affected the world trade. It points

to a structural shift in the relation between the growth of world GDP and world trade as

observed in the income elasticity of trade (the ratio of trade growth to GDP growth). While the

income elasticity of world trade was 2.0 for the period 1986 to 2000, it declined to 1.3 for the

period 2001 to 2014. This means world trade became less responsive to GDP growth. The

decrease in income elasticity of trade is explained partly by the slowing pace of fragmentation

of production into global value chains.

2

For a more detailed discussion see Constantinescu, Ileana Cristina; Mattoo, Aaditya; Ruta, Michele. 2016.

Global

trade

watch:

trade

developments

in

2015

.

Washington,

D.C.:

World

Bank

Group.

http://documents.worldbank.org/curated/en/2016/03/26040867/global-trade-watch-trade-developments-2015

3

IMF WEO 2015 Chapter 1.

2013

2014 2015

Volume of world trade

2.4

2.8

2.8

Exports

Developed economies

1.7

2.4

2.6

Developing and emerging economies

3.8

3.1

3.3

North America

2.8

4.1

0.8

Europe

1.7

2.0

3.7

Asia

5.0

4.8

3.1

Imports

Developed economies

-0.2

3.5

4.5

Developing and emerging economies

5.0

2.1

0.2

North America

1.2

4.7

6.5

Europe

-0.3

3.2

4.3

Asia

4.8

3.3

1.8

World Output real GDP at market exchange rates (2005)

2.2

2.5

2.4

Developed economies

1.0

1.7

1.9

Developing and emerging economies

4.5

4.2

3.4

North America

1.5

2.4

2.3

Europe

0.4

1.5

1.9

Asia

4.4

4.0

4.0