COMCEC Trade Outlook 2019

10

2.

MERCHANDISE TRADE BETWEEN OIC AND THE WORLD

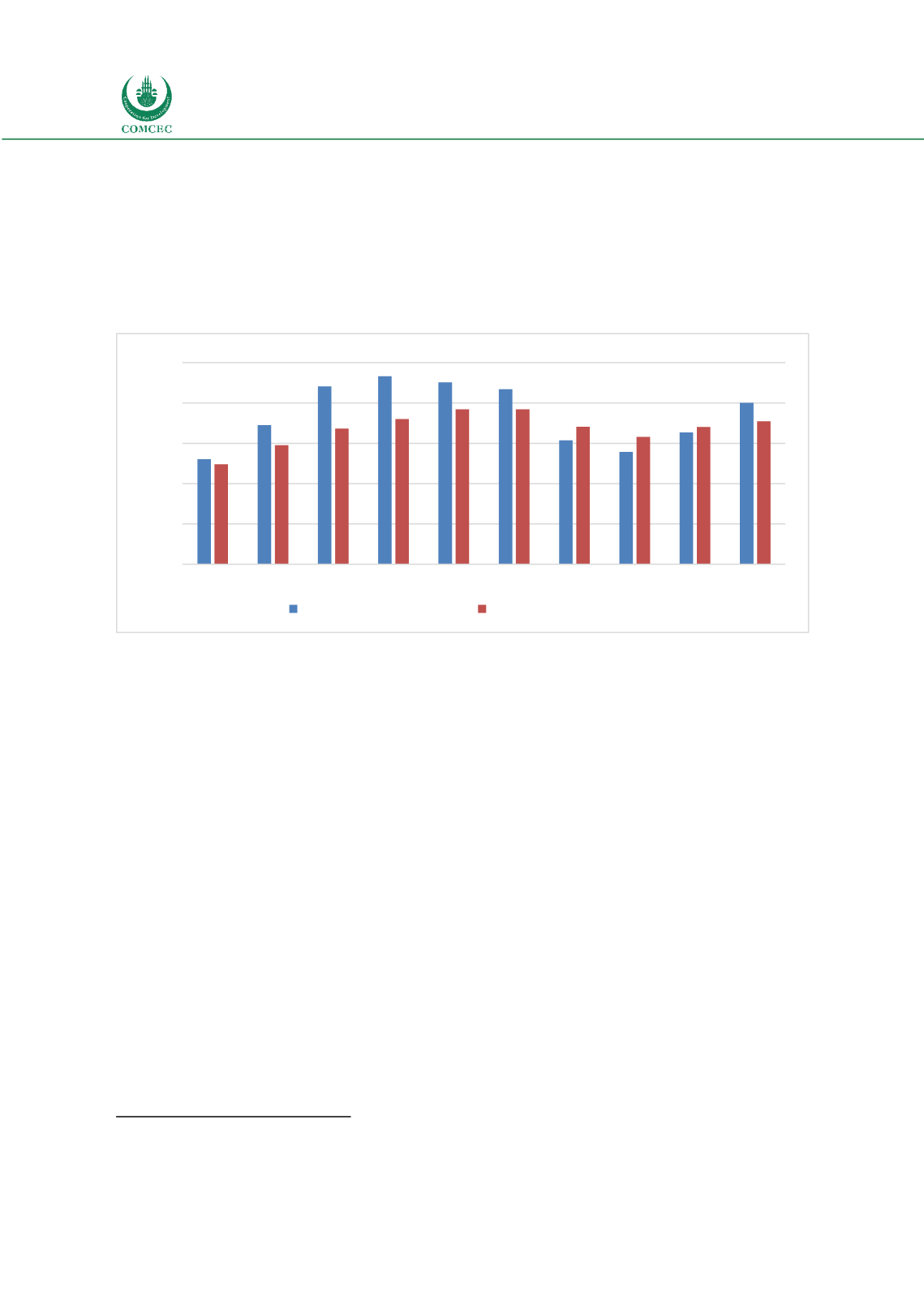

As indicated in the Figure 8 below, the total OIC exports which have been on a downward trend

since 2012 contracted severely in 2015 and 2016. However, in 2018 total OIC exports recorded

an increase and amount to 2 trillion USD. Compared to the previous year (2017), the total OIC

exports increased 22 per cent. Meanwhile total OIC imports increased 4 per cent in 2018. It was

1.7 trillion USD in 2017 and amounted to 1.77 trillion USD in 2018.

Figure 8: Total OIC Exports and Imports

Source: IMF Direction of Trade Statistics

Several factors accounted for the strong performance in total OIC exports in 2018 including the

revival of global economic activity and rising commodity prices. On the other hand, ongoing

political developments in many countries in the Middle East constrain further increases in the

OIC trade. Rising commodity prices, in particular oil prices led to increased export revenues of

resource based countries which in turn resulted in more import demand.

Growth performance and rebalancing of Chinese economy away from manufacturing and

investment to services and consumption being the main export market for OIC countries is

particularly important as further slowdown in Chinese growth might have negative implications

on OIC exports. Chinese economy maintained a remarkable growth by growing 10.3 per cent

annually between 2000 and 2010 which led the surge in commodity prices in 2000s. However

the pace of growth has slowed down since 2011 and recorded as 6.9 per cent in 2017. It is

estimated to be slowing further in the coming years

9

. This could have negative spillovers on OIC

exports via downward pressure on commodity prices and lower import demand.

Commodity prices, in particular fuels, declined sharply starting from July 2014. Oil prices almost

halved from 96.2 USD per barrel in 2014 to 50.8 USD per barrel in 2015 mainly due to the shale

oil production in US and oversupply in global oil markets. Although oil prices bottomed out 30.8

USD per barrel in January 2016, they averaged 42.8 USD per barrel in 2016. Oil prices were on

an increasing trend between August 2017-November. OPEC and non-OPEC oil exporters

including Azerbaijan, Kazakhstan and Russian Federation agreed to curb oil production from

January 2017 to March 2018 to 1.8 million barrels per day.

10

They had further agreed to extend

9

IMF WEO April 2018 Database.

10

UN World Economic Situation and Prospects, 2018

0.0

0.5

1.0

1.5

2.0

2.5

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Trillion USD

OIC Merchandise Exports

OIC Merchandise Imports