COMCEC Trade Outlook 2019

14

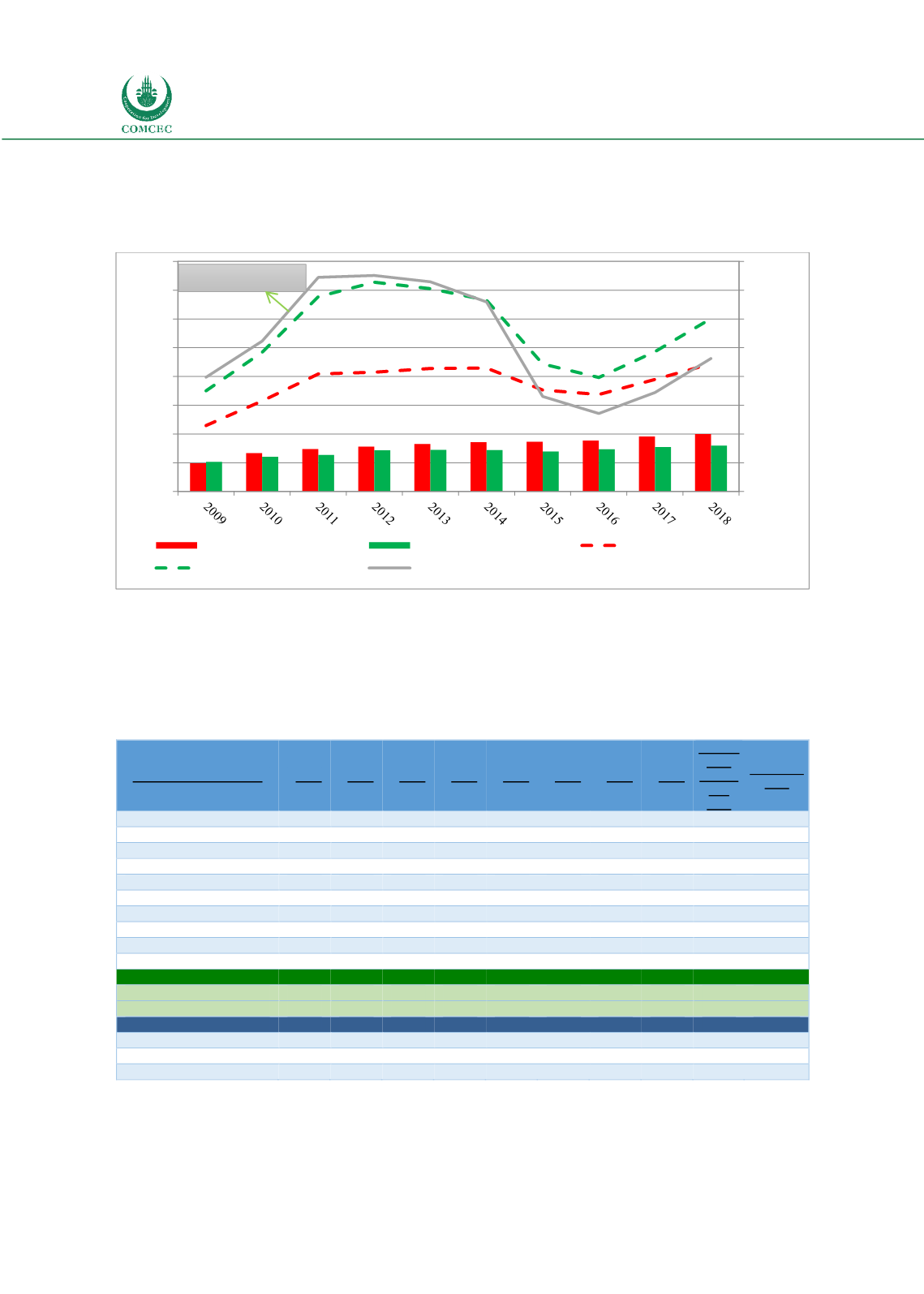

slight increase in OIC export volume indicated that the most of the increase in total OIC exports

was driven by rising export prices in 2018. It should also be noted that oil production curbs in

some oil exporters of OIC limited quantity exported.

Figure 13: Export Value versus Export Volume Indices for the World and the OIC

Source: IMF, UNCTADSTAT

Table 2 illustrates that OPEC countries oil production decreased by 0.4 percent in 2017 and 0.8

per cent in 2018. Saudi Arabia, UAE, Kuwait, Qatar, Algeria were among the major oil exporting

OIC countries that decreased their oil production in 2017 and 2018 compared to the previous

year (2016).

Table 2: Oil Production thousand barrels daily

Thousand barrels daily

2011

2012

2013

2014

2015

2016

2017

2018

Growth

Rate

Annual

(%)

2018

Share (%)

2018

Saudi Arabia

11079 11622 11393 11519 11998 12406 11892

12287

3.3%

13.0%

Iran

4452

3810

3609

3714

3853

4586

5024

4715

-6.1%

5.0%

Iraq

2773

3079

3103

3239

3986

4423

4533

4614

1.8%

4.9%

United Arab Emirates

3303

3440

3577

3603

3898

4038

3910

3942

0.8%

4.2%

Kuwait

2909

3164

3125

3097

3061

3141

3001

3049

1.6%

3.2%

Nigeria

2461

2412

2279

2276

2201

1900

1991

2051

3.0%

2.2%

Kazakhstan

1684

1664

1737

1710

1695

1655

1838

1927

4.8%

2.0%

Qatar

1824

1928

1991

1975

1933

1938

1874

1879

0.3%

2.0%

Algeria

1642

1537

1485

1589

1558

1577

1540

1510

-2.0%

1.6%

Libya

516

1539

1048

518

437

412

929

1010

8.7%

1.1%

Total World

84009 86228 86647 88736 91547 91822 92502 94718

2.4%

100.0%

OPEC

36724 38292 37293 37228 38601 39736 39673

39338

-0.8%

41.5%

Non-OPEC

47285 47936 49354 51508 52946 52086 52828

55380

4.8%

58.5%

memo item:

US

7870

8910 10073 11773 12773 12340 13135

15311

16.6%

16.2%

Russian Federation

10533 10656 10807 10860 11

007 11269 11255

11438

1.6%

12.1%

Canada

3515

3740

4000

4271

4388

4451

4798

5208

8.5%

5.5%

Source: Source: Reproduced from BP Statistical Review of World Energy 2019

Note: Includes crude oil, shale oil, oil sands and natural gas liquids.

20

70

120

170

220

270

320

370

420

80

130

180

230

280

330

380

430

480

2000:100 Oil Price Index

2000: 100 Index

World Export Volume Index

OIC Export Volume Index

World Export Value Index

OIC Export Value Index

Oil Price Index

Brent Oil Price Index