Increasing Broadband Internet Penetration

In the OIC Member Countries

99

represented more than 87% of Internet users. On the other hand, Cote d’Ivoire even lags the

rest of Sub-Saharan Africa, confirming the statistics in figure 28 indicating that Ivorian Internet

users tend to rely on the Internet for applications other than Facebook.

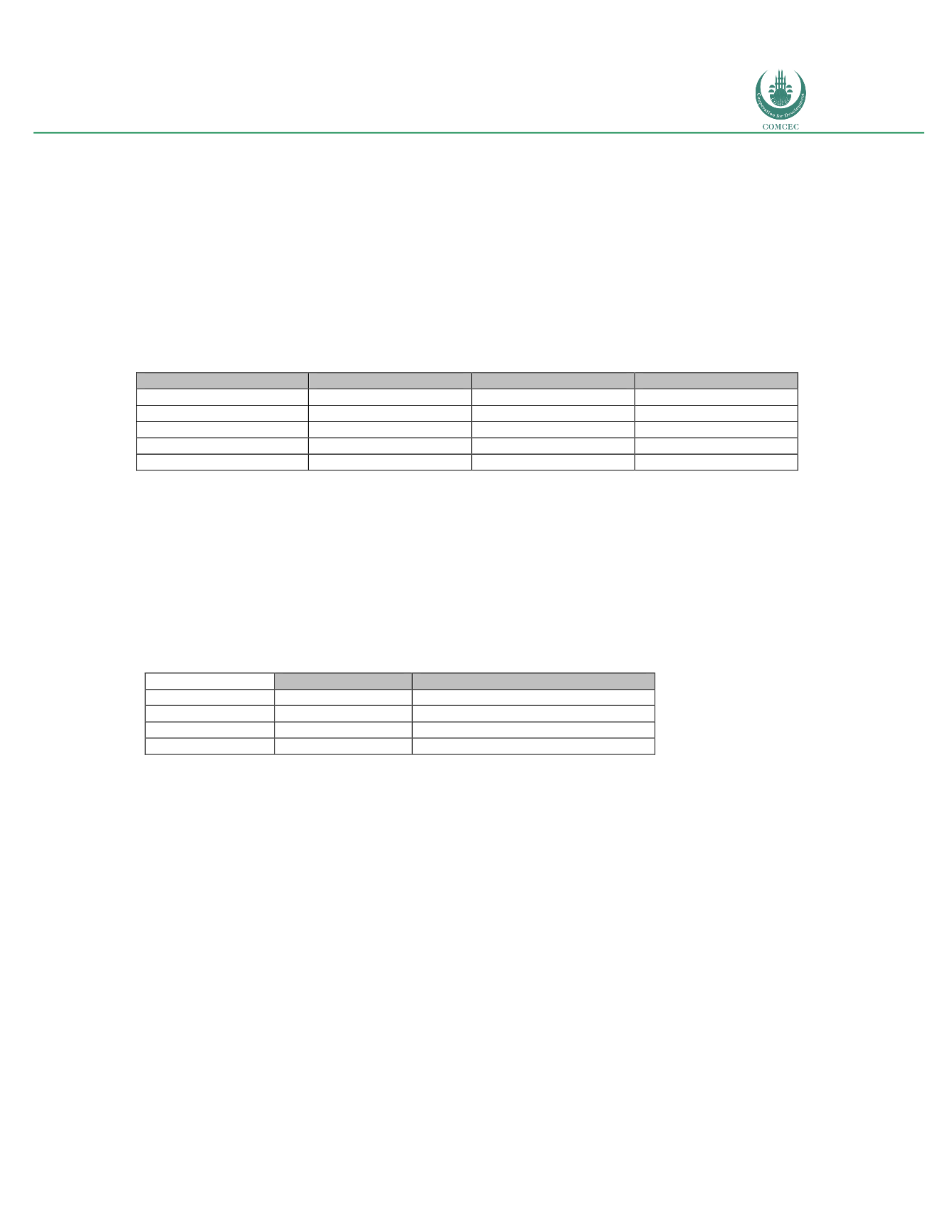

Beyond communications and e-commerce, one of commonly used applications is mobile

money. Cote d’Ivoire is one of the most vibrant mobile money markets in Africa. All three

mobile operators and two non-bank e-money issuers offer mobile money services (see table

43).

Table 43: Cote d’Ivoire: Mobile money services

Mobile Money Service

Service Provider

Partner

Date of Launch

Orange Money

Orange

BICICI (BNP Paribas)

12/2008

MTN Mobile Money

MTN

SGBCI (Société Générale)

10/2009

CelPaid

CelPaid

- - -

2/2011

Flooz

Moov

BIAO

1/2013

Mobile Banking

Qash Services

- - -

11/2013

Source: GSMA (2014)

As a result of this activity, there are close to 7 million registered mobile money accounts, more

than all bank and microfinance accounts put together. This development is fostered by the

forced introduction of electronic transactions. For example, as of 2015, all secondary school

fees had to be paid using mobile money, while half of electric bills are paid using the platform.

As a result, the number of subscribers to mobile money in 2016 reached almost 7 million (see

table 44).

Table 44: Number of MNO-only subscribers to mobile money (2014-2016)

2014

2016 (2Q)

Orange

3,524,717

4,819,769

MTN

1,467,264

1,492,726

MOOV

1,068,551

426,245

Total

6,090,532

6,873,309

Source: Autorité de régulation des télécommunications/TIC de Cote d’Ivoire

Major factors that influence use of fixed and mobile broadband

The major factors that influence non-adoption of the Internet in Cote d’Ivoire will now be

assessed. For this purpose, one should start by measuring the extent of the broadband demand

gap. The demand gap measures the difference between the population that can purchase

broadband service because of service availability, and the population that actually acquires

service, which quantifies the number of non-adopters for reasons other than coverage.

Considering that mobile broadband coverage of the population has reached 83% at the end of

2015, this would indicate that the demand gap is 51%. As table 45 indicates, the demand gap

has been increasing over time because the rate at which operators are deploying 3G networks

is higher than the speed of subscriber growth (see table 45).