Facilitating Trade:

Improving Customs Risk Management Systems

In the OIC Member States

51

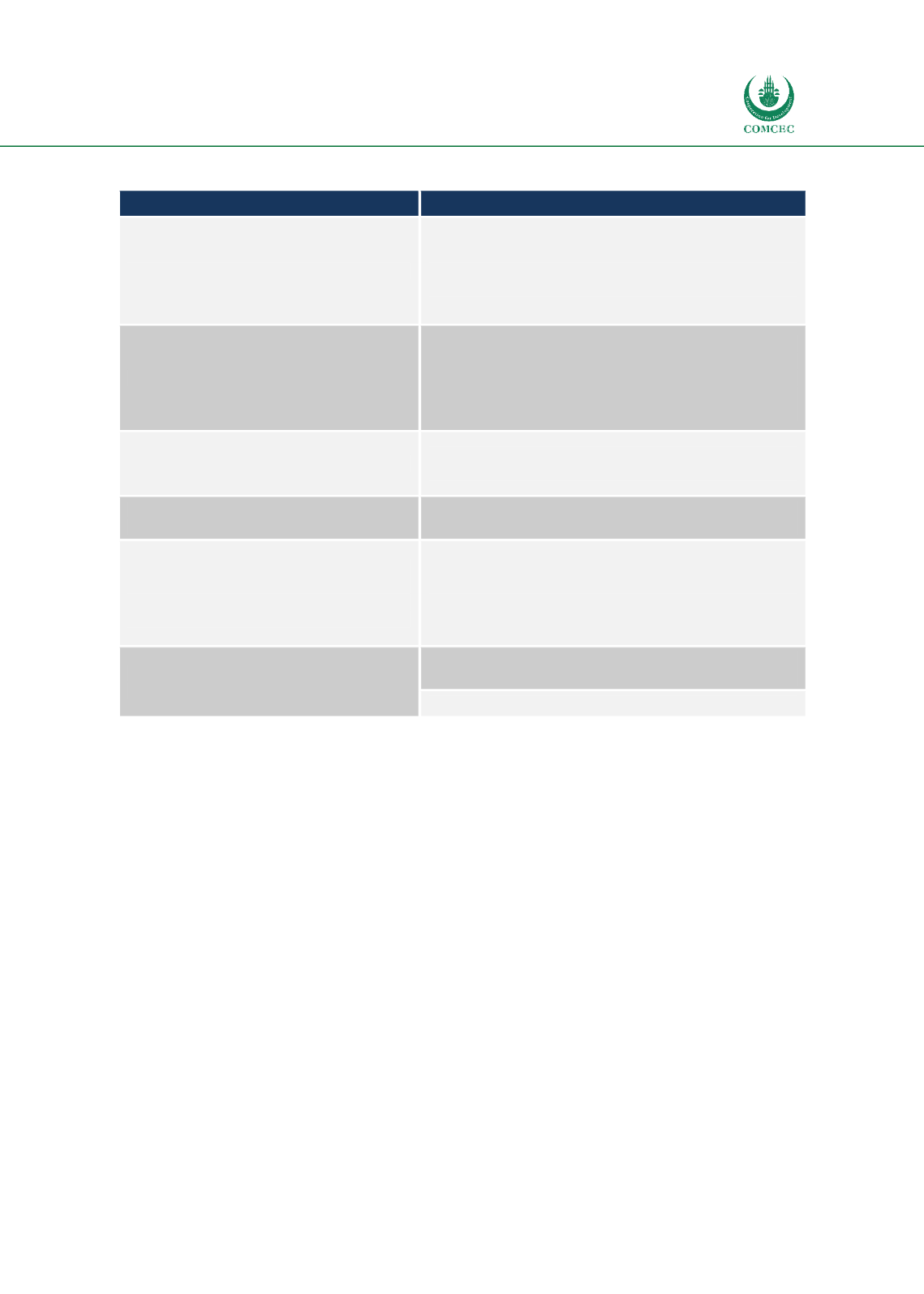

Table 7: Kosovo CRM previous and current approach

Previous approach

Risk-based approach

100% physical inspection of shipments

26434 CD 11% green channel with 5% random selectivity,

154268 CD 67% yellow channel, 36730 CD 16% red

channel, 4883 CD 2% blue channel, 8457 CD 4% orange

channel, average effectiveness 3.66 % (2015 offences,

criminal reports)

No CRM selectivity

463 risk profiles and 9 selectivity lists activated in the AW.

Risk profiles kept being analysed and consequently

modified (42), de-activated (35) or added (18) -

approximately 1200 profiles were applied in the CDPS’s

from 2005 till 2017

No CRM/Intelligence Unit established

Intelligence and Risk Analysis Sector established and

incorporated within the Department for Law Enforcement

No reporting/analysis services, no feedback

from control

Implementation of DWH and Business Intelligence

platform

Use unsecured, different and technologically

obsolete text and data processing system for

management of Law Enforcement

information (CRM and Intelligence)

Implementation/Integration of Law Enforcement IT

System

Single Customs National Domain data

repository

Exchange of customs data in real time with neighbouring

countries (SEED)

Risk Assessment on pre-arrival information

Source: Author’s compilation

3.2.1.6

Border Clearance Performances

KC is sustainably improving the border clearance performance also through the successful

operation of its Monitoring Office introduced at the end of 2013. There are 27 experienced

officers in the HQ unit dealing with verification of import declarations supported by AW

selectivity features including valuation issues and SAD (CD) validation rules. All Customs

procedures, including international transit, use pre-arrival information for early controls with

the AW Selectivity module. Excise declarations are currently processed on paper.

Undervaluation of imports presents a significant risk to the KC. KC has developed an AW

Valuation module for managing lists of specific goods with an additional HS sub-classification of

four extra digits. The sub-classification helps distinguish customs values of specific goods, i.e.

brands, models, used or new, and so on. Currently, there are few thousand codes maintained for

that purpose in the KC. The Monitoring Office also checks declarations and clearance activities

to minimize undervaluation risk.

Post Clearance Audit selects trade operators based on risk analysis. Depending on the level of

risk, the PCA decides to undertake desk audit and/or visit the company, and at the same time,

they are opening a case in the LES. The first activity is always a preparatory task (desk audit)

assigned to each member of the team including the team leader.

If the outcome of the

preparatory tasks identifies additional risks, the Head of the PCA can extend the scope of the

controls to include these other/additional risks. Depending on the findings, the audit officers