FACILITATING INTRA-OIC TRADE:

Improving the Efficiency of the Customs Procedures in the OIC Member States

62

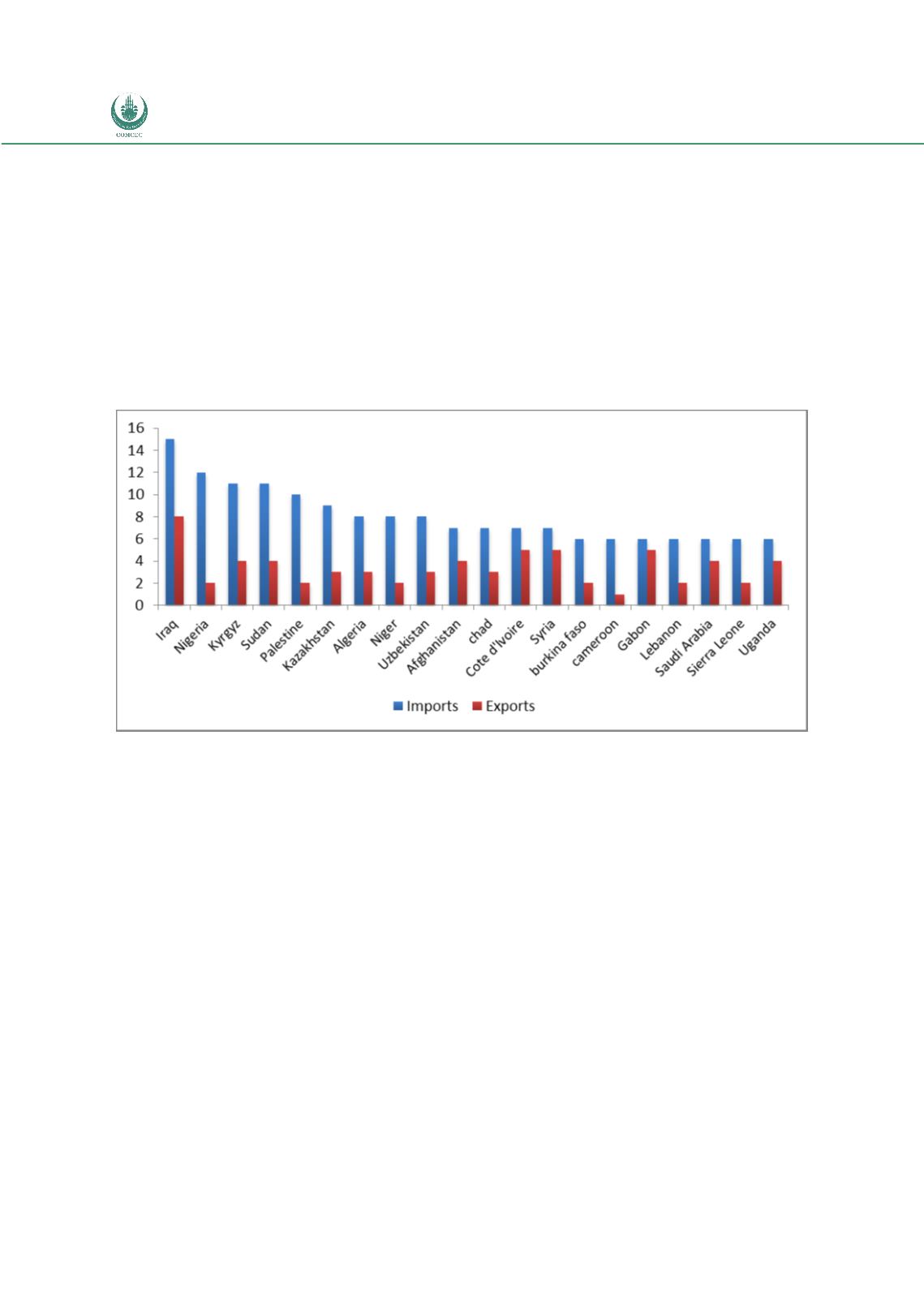

Another finding of the Index is higher customs clearance and technical control time

required for imports than the time required for the exports (See Figure 5 below).

While majority of the Member States are still experiencing long clearance times, some

of the Member States have reduced the clearance time dramatically during the recent

years. According to the Index, customs clearance and technical control time for imports

is only one day in UAE, Oman, Brunei and Malaysia.

Figure 5: Customs Clearance Time for Imports in Selected OIC Member States

(days)

Source: Doing Business Report 2014

3.1.2. Fees and Charges

In many member states, the revenues collected by the customs administrations have the

biggest share in total government revenues. Customs duties, Value Added Tax (VAT),

excise tax, fees and charges collected by the Customs Administrations exceeded 50

percent in total government revenues in some of the Member States (see Figure 6 in

next page).