FACILITATING INTRA-OIC TRADE:

Improving the Efficiency of the Customs Procedures in the OIC Member States

63

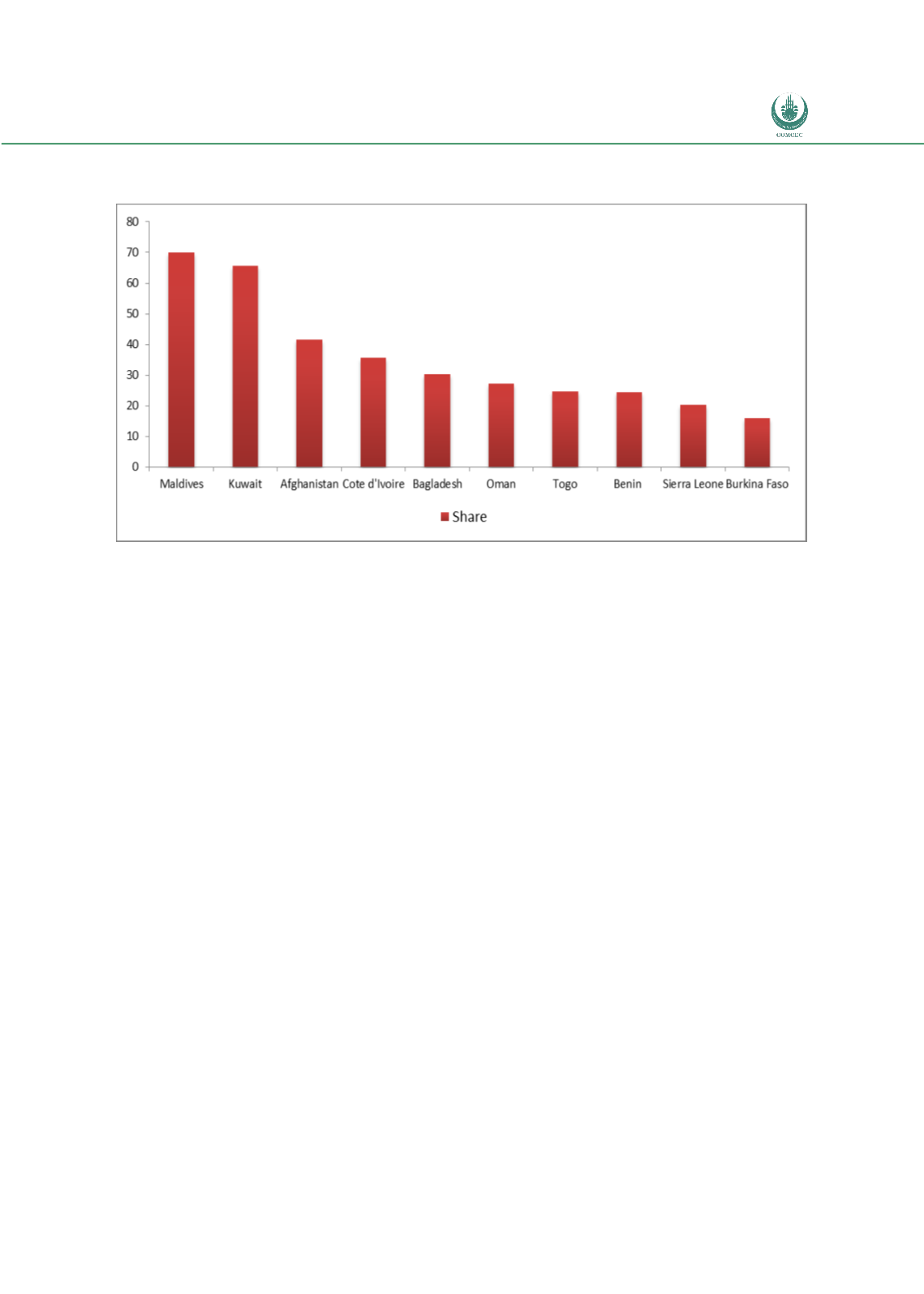

Figure 6: Share of Duties and Taxes Collected by the Customs in total tax revenues in

Some Member States in 2011

Source: World Bank, WCO

In line with this important mandate, the Customs Administrations in the Member States

are mostly operating under the Ministry of Finance or National Revenue Authority

except in few countries such as Turkey (Ministry of Customs and Trade), Bahrain

(Under the Ministry of Interior) etc.

According to Trading Across Borders Index, firms need to pay for document

preparation, customs clearance and technical control, ports and terminal handling and

inland transport and handling. The share of each item in total expenditures varies among

the countries. For example inland transport and handling has the biggest share in

landlocked countries.

With regards to customs clearance and technical control, firms in many OIC Member

States need to pay a considerable amount of money to customs administrations or

customs agents etc. Besides the customs duties, VAT and excise tax, user fees, statistics

fees, inspection fees and other duties are collected during the customs clearance process

depending on the policy of the country. Table 11 below shows the Customs Clearance

and Technical Control Cost in the OIC Member States estimated by the Doing Business

Report 2014.