FACILITATING INTRA-OIC TRADE:

Improving the Efficiency of the Customs Procedures in the OIC Member States

57

indicate that the cost of implementing such measures vary across countries. The

coverage of such measures and the existing situation before implementing the measures

may be an important factor leading to such differences.

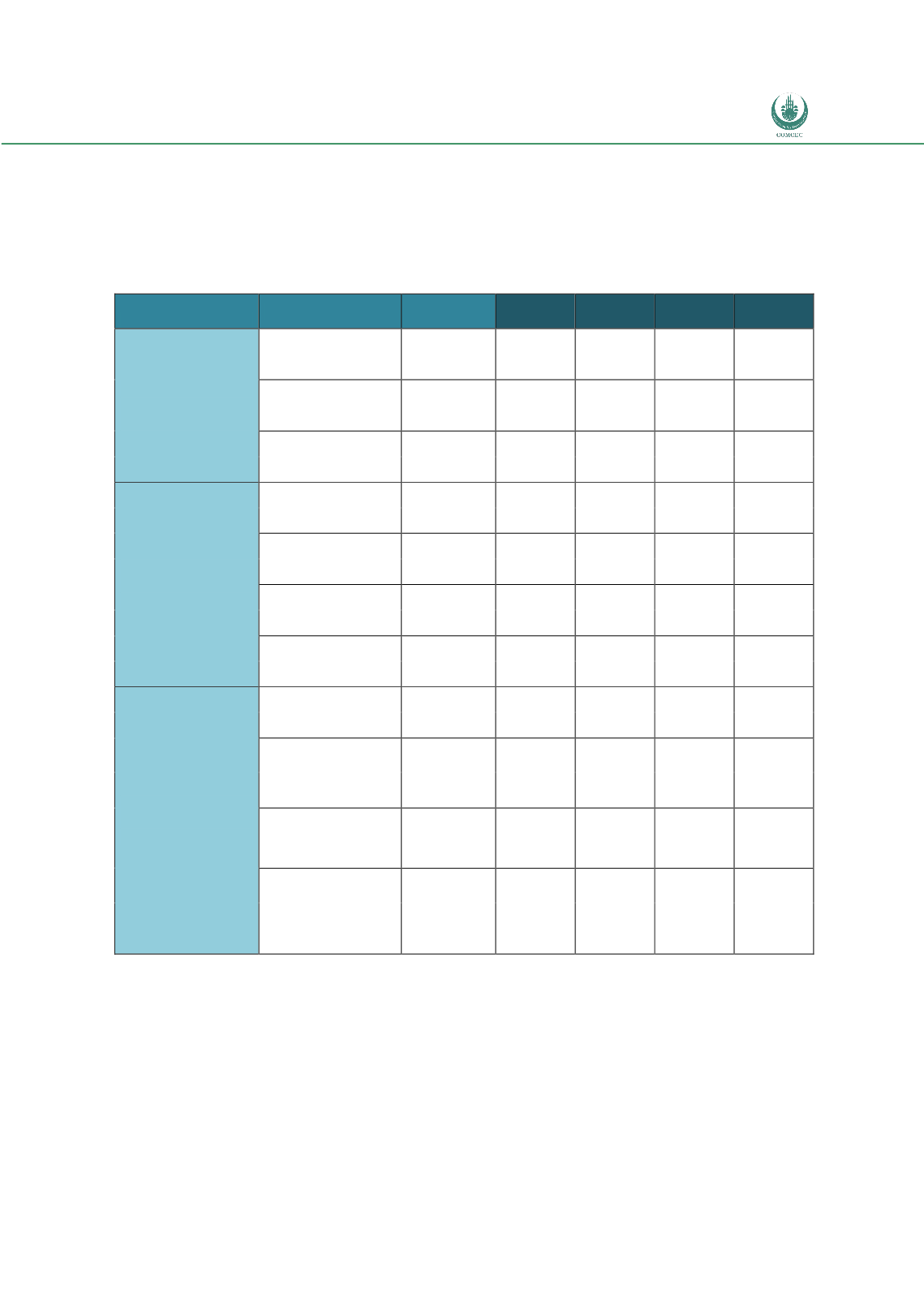

Table 9: Financial Cost of Selected Trade Facilitation Measures in Some Countries (in

Euros)

Measure

Action

Burkina

Faso

Colombia

Kenya

Mongolia

Transparency and

Predictability

Measure

Internet publication

inception 18800

50000

238870

operation

24345

Enquiry points

inception 48500

120000

43980

operation

41680

Advance rulings

inception 30000

76973

25000

20915

operation

657632

Procedural

Simplification and

Streamlining

Risk Management

inception 60000

771300

operation

250000

231745

Pre-arrival processing

inception 45000

1000000

290785

Post Clearance audits

inception 14000

400000

327785

operation

170880

Authorized Economic

Operators

inception 5500

1848145

120000

693920

operation

481099

32170

Cooperation and

Coordination between

Border Agencies

Single Window

inception 3049000

4100000

350000

17016345

operation

32615

Co-ordinated

documentary and

physical controls

inception

1025000

Development of

shared facilities with

neighbors

inception

59645

Allignment of

working

hours/procedures with

neighbors

inception

4390

Note: Operational costs are expressed on a yearly basis

Source: Data and information from Moise (2013)

There are several types of sources for financing the customs reform programs. The

government budget is the first option. The governments shall determine the customs

reform as one of its priorities. Because modernization of the customs will not only

facilitate trade but also increase the customs revenues.