FACILITATING INTRA-OIC TRADE:

Improving the Efficiency of the Customs Procedures in the OIC Member States

64

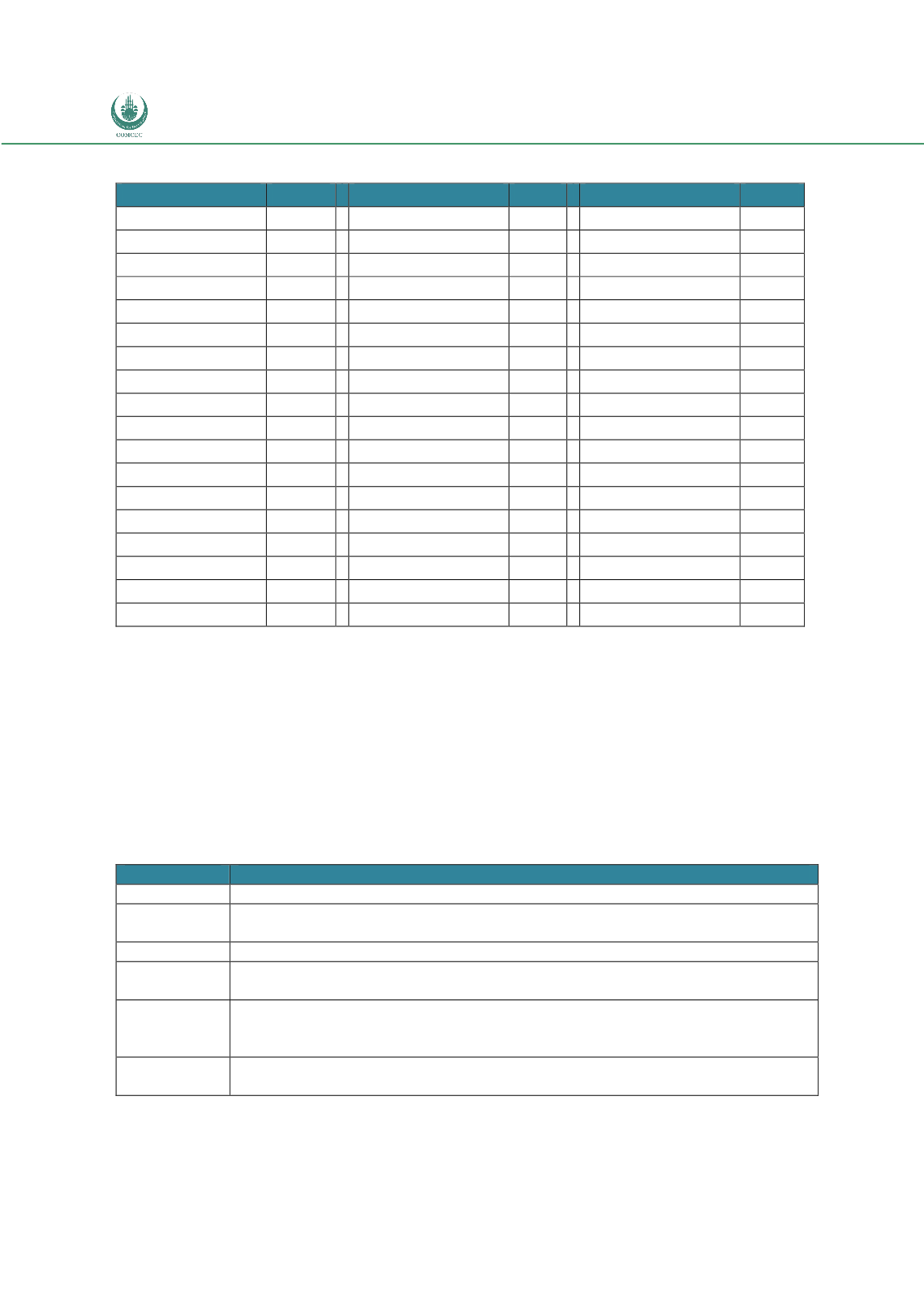

Table 11: Customs Clearance and Technical Control Cost in OIC Member States

Country

USD

Country

USD Country

USD

Iraq

700

Mozambique

340

Togo

190

Cameroon

670

Uganda

325

Djibouti

170

Guinea Bissau

556

Afghanistan

300

Bangladesh

150

Chad

525

Burkina Faso

300

Comoros

150

Gabon

500

Cote d'Ivoire

300

Morocco

150

Syria

450

Mauritania

300

Kuwait

145

Niger

430

Guinea

250

Gambia

135

Azerbaijan

425

Palestine

250

Indonesia

125

Kazakhstan

425

Tunisia

250

Bahrain

110

Kyrgyz

420

Suriname

245

Egypt

100

Tajikistan

420

İran

220

Guyana

100

Lebanon

400

Pakistan

220

Qatar

100

Yemen

385

Algeria

200

Brunei

80

Sierra Leone

380

Benin

200

Albania

65

Mali

375

Maldives

200

Jordan

65

Nigeria

360

Saudi Arabia

200

Oman

65

Senegal

360

Turkey

200

Malaysia

60

Sudan

350

Uzbekistan

200

UAE

30

Source: Doing Business 2014

Note: Data on Somalia and Turkmenistan is not available

Collecting duties from the exports is also a common practice in some of the OIC

Member States. According to WTO, these countries include Sierra Leone (diamonds),

Uganda (coffee and cotton), Tunisia (crude oil), Mali (cotton), Benin (cocoa beans,

crude oil and precious metals) etc. In some of the Member States all the exports are

subject to fees. Fees collected by some of the Member States are illustrated by Table 12

below.

Table 12: Fees collected from the Exports in Some of the Member States

Country

Fees

Mali

0.65 per cent of the f.o.b. value for the Import Inspection Program (PVI).

Mauritania

1 percent as a Statistical fee

Nigeria

0.5 percent levy is imposed on all exports in lieu of pre-shipment inspection.

Pakistan

0.25% of the f.o.b. value is levied on all exports (except from export processing zones)

as export development charge to finance the Export Development Fund (EDF)

Suriname

A consent fee of 0.1%. A statistical fee of 0.5% applies to exports of all products

except bauxite, which is subject to a statistical fee of 2%.

Turkey

A fee ranging from 0.02% to 0.1% of the f.o.b. value of exports is charged as a service

commission.

Source: WTO Country Trade Policy Reviews