FACILITATING INTRA-OIC TRADE:

Improving the Efficiency of the Customs Procedures in the OIC Member States

58

For example Goorman (2004) examined the impact of the Peru’s customs reform which

was initiated in 1990. According to the study, within the reform process, customs laws

were harmonized and adapted to international standards. Customs Administration was

restructured, increased the number of professional personnel, an integrated computer

system was developed, shifted the emphasis of customs control to post-clearance audit

and adopted a new valuation and import verification program. The study concluded that,

as a result of these reforms, clearance time reduced from 20 days to 1-24 hours and the

revenues increased dramatically from USD 626 million to USD 2.403 million between

1990-2002 period. Table 10 demonstrates the impact of the Peru’s reform.

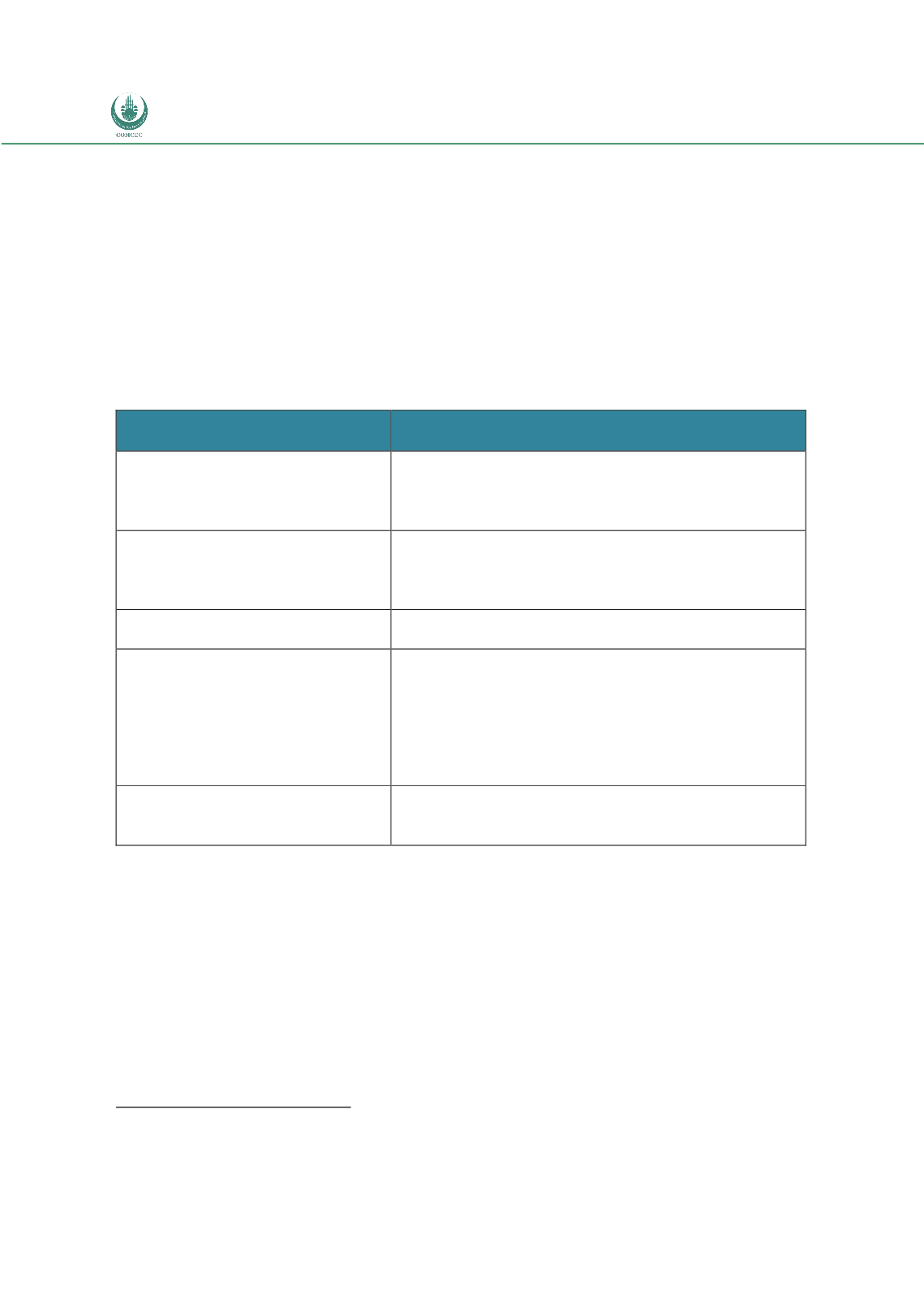

Table 10: Customs Administration Reform in Peru

1990 (pre-reform)

2002 (post-reform)

Tariff and Trade Regime

39 tariff rates, 14 surtaxes

Range of rates: 10-110

Prohibitions: 539 items

4 rates (7 rates including surtax)

Range of rates:4-25

Prohibitions: in 1997 25 items

Personnel and training

Total staff:4.700

Professionals: 2.5 percent of staff

No training program

Total staff: 2.540

Professionals: 60 percent of staff

One-year full time course at the National Customs School

Computerization

No computerization

All customs functions and operations computerized

Customs control and clearance

process

Paper declaration and process

100 percent physically checked

Payment at customs

Clearance times: over 20 days

Electronic declaration lodging and processing

Based on risk analysis, 15 percent physically checked

Payment at bank, electronic or otherwise

Clearance times: 1 to 24 hours depending on goods

category

Revenue Collection

USD 626 million

23 percent of budgetary revenue

USD 2.423 million

36 percent of budgetary revenue

Source: Milner et al. (2008) based on findings of Goorman (2004)

Another option for financing customs reforms is co-financing. International financial

institutions such as World Bank, ADB and IDB are giving special emphasis on

financing reform projects. For example, Kazakhstan’s customs reform project is one of

the comprehensive reform process which is worth of 62 million USD and was financed

by Kazakhstan and the World Bank (43,5 million USD is paid by the government and

18,5 million USD was financed by the World Bank). The project was initiated in 2007

and will be finalized by the end of 2014.

5

5

For more information visit

http://www.carecprogram.org/index.php?page=carec-project-details&pid=218