DRAFT

Improving the SMEs Access to Trade Finance

in the OIC Member States

63

As noted earlier, the growth and impact of Islamic Trade Finance will correlate directly to the

evolution and broader leveraging of Islamic Finance practices, the growth of Islamic Finance

assets and the wider – and more coordinated/aligned governance of Islamic Finance practice

across OIC Member States, and across other jurisdictions where such activity has attracted

significant interest.

“…the establishment of International Islamic Trade Financing Corporation (ITFC) in

2008 has catalyzed increased trade financing interventions. The cumulative net trade

financing approvals for OIC member states has increased by 63 percent from $ 24.4

billion in 2005 to $ 39.9 billion in 2011.”

Source: Arab News, 2013

While there is significant focus globally on the opportunities linked to involvement and

engagement with global supply chains, it has been observed that OIC Member States have

perhaps a more compelling and immediately achievable opportunity in linking to regional

supply chains and value chains, in line with the OIC intention of promoting greater and more

diverse trade flow among Member States.

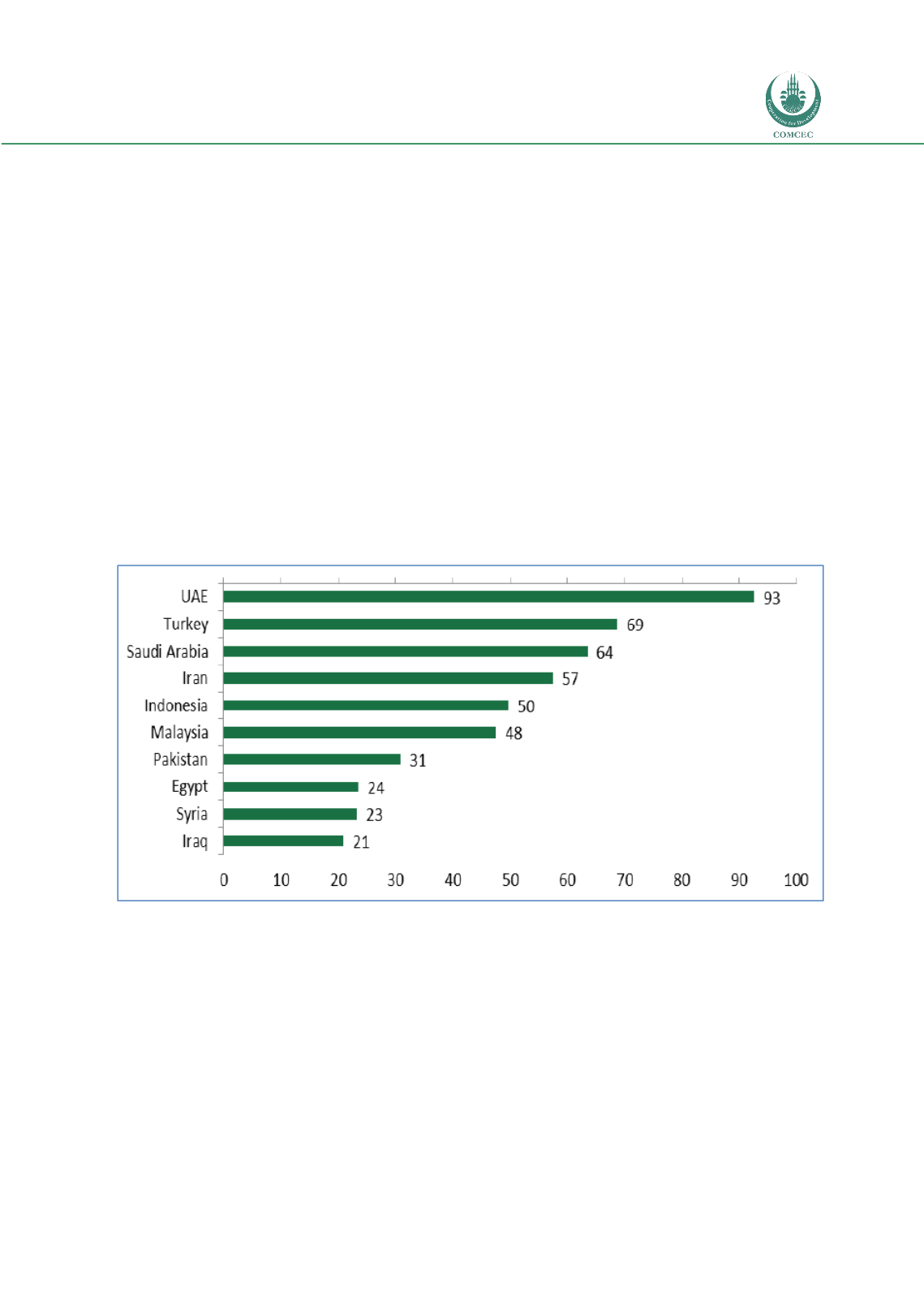

Figure 23: Leading Actors in Intra-OIC Trade

Source: COMCEC/SESRIC

Research shows that most value chains still tend to be regional, despite growing

internationalization. Baldwin has called this Factory Asia, Factory North America, and

Factory Europe. Some of the inter-regional FTAs currently under negotiation such as

the Trans Pacific Partnership (TPP) or the EU-US FTA covers the areas where Global

Value Chains are concentrated. Such agreements might lock out non-parties and

prevent their participation into existing value chains located within those regions.

Growing demand in Organization of Islamic Cooperation (OIC) member countries make

these markets lucrative for other OIC member countries. These markets can also be

friendlier for producers based in OIC member countries in particular for small and