Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

60

related to SMEs are concerned. Political authorities, business leaders and academics across the

globe speak of the importance of SMEs and the need to assure their access to adequate levels of

finance, yet, whether the political context is market-driven or centrally managed, whether

SMEs are the primary drivers of commercial activity or seen as “second tier” commercial

entities, the themes repeat.

The Islamic Centre for Development of Trade identifies several significant obstacles to the

development of intra-OIC trade flows, ranging from tariff and non-tariff barriers, to

infrastructure challenges such as the lack of adequate logistics and transport infrastructure

(“Annual Report on Trade Between the OIC Member States, 2013”). Additionally, the Centre

explicitly notes “Inadequate and insufficient financing instruments especially, for the benefit of

SME-SMI” as a further obstacle to the development of trade between OIC Member States.

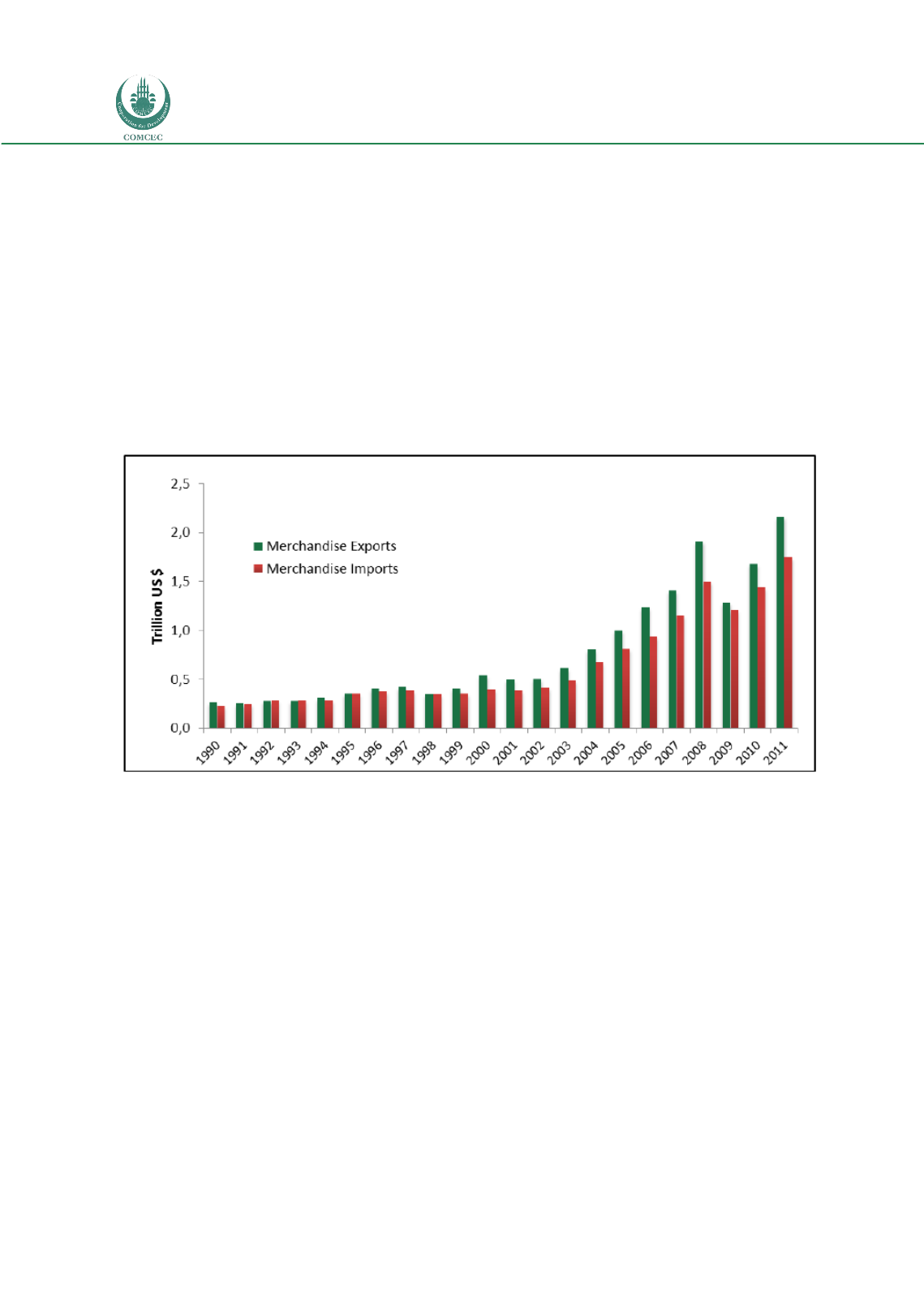

Figure 21: Total OIC Imports and Exports

Source: COMEC Trade Outlook 2013/SESRIC

Despite these various obstacles, merchandise trade flows involving OIC Member States have

shown clear growth trends over the last two decades. That said, it has been noted that the

value of trade flows has trended upward in part due to the influence of oil exports and the

rising price of oil over the course of a protracted commodity boom. Notably, the most

internationally active OIC Member States account for the vast majority of trade flows, as noted

earlier; likewise, OIC trade evidences a significant degree of concentration in terms of the

markets with which leading OIC Member States engage in trade activity, and currently,

significant positive impact involving trade with partners in Asia.