DRAFT

Improving the SMEs Access to Trade Finance

in the OIC Member States

65

3.2.2. Asia

The undeniable pull exercised by Asia currently in terms of both import and export trade

flows, as well as bi-directional foreign investment flows have now has now extended well

beyond the activities of China and India, to encompass, impact and benefit numerous OIC

Member economies, including Indonesia and Malaysia among others.

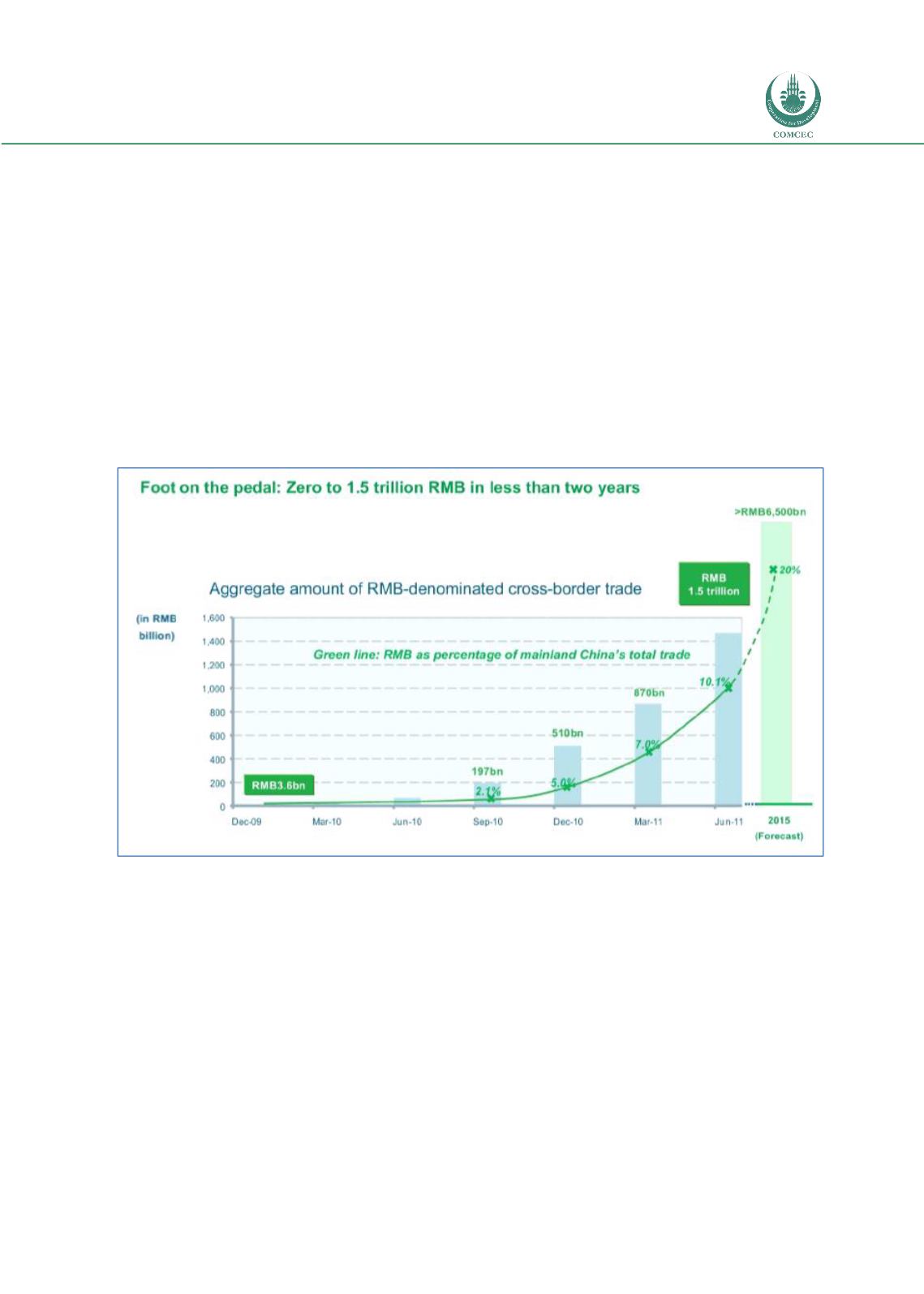

While the role of Islamic Finance and Trade Finance cannot be understated in major markets

in Asia, and the longer-term tendency to gravitate to Shari’ah compliant mechanisms will be

equally observable in those markets, it is worth noting the increase regional influence of China,

including in the promotion of the Renminbi in regional trade flows. The internationalization of

the Chinese currency and the convergence of the on-shore and off-shore exchange rate (CNH

and CNY) are progressing apace, and the RMB is a credible third option as an international

reserve and trade currency, after the US Dollar and the Euro.

Figure 24: RMB-Denominated Trade Flows

Source: Standard Chartered Bank, 2011

In addition to the striking rise of the RMB as a regional currency of trade finance, Asia exhibits

a clear preference for the use of open account trade and for adoption of new modes of conduct

of international commerce. The Bank of China was one of the two first institutions to complete

a live Bank Payment Obligation transaction in 2010, and recent developments in the region are

very much reflective of a desire to be at the leading edge of international commercial practice.

While there are several reasons noted as motivation for the use of the Renminbi in the conduct

of commercial activity, trade and trade-related considerations figure prominently in this

respect, and the growth of the RMB as an international currency will be managed very

conservatively by Chinese authorities, continuing to focus initially on markets and trading

partners in Asia, including several OIC Member States.