Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

66

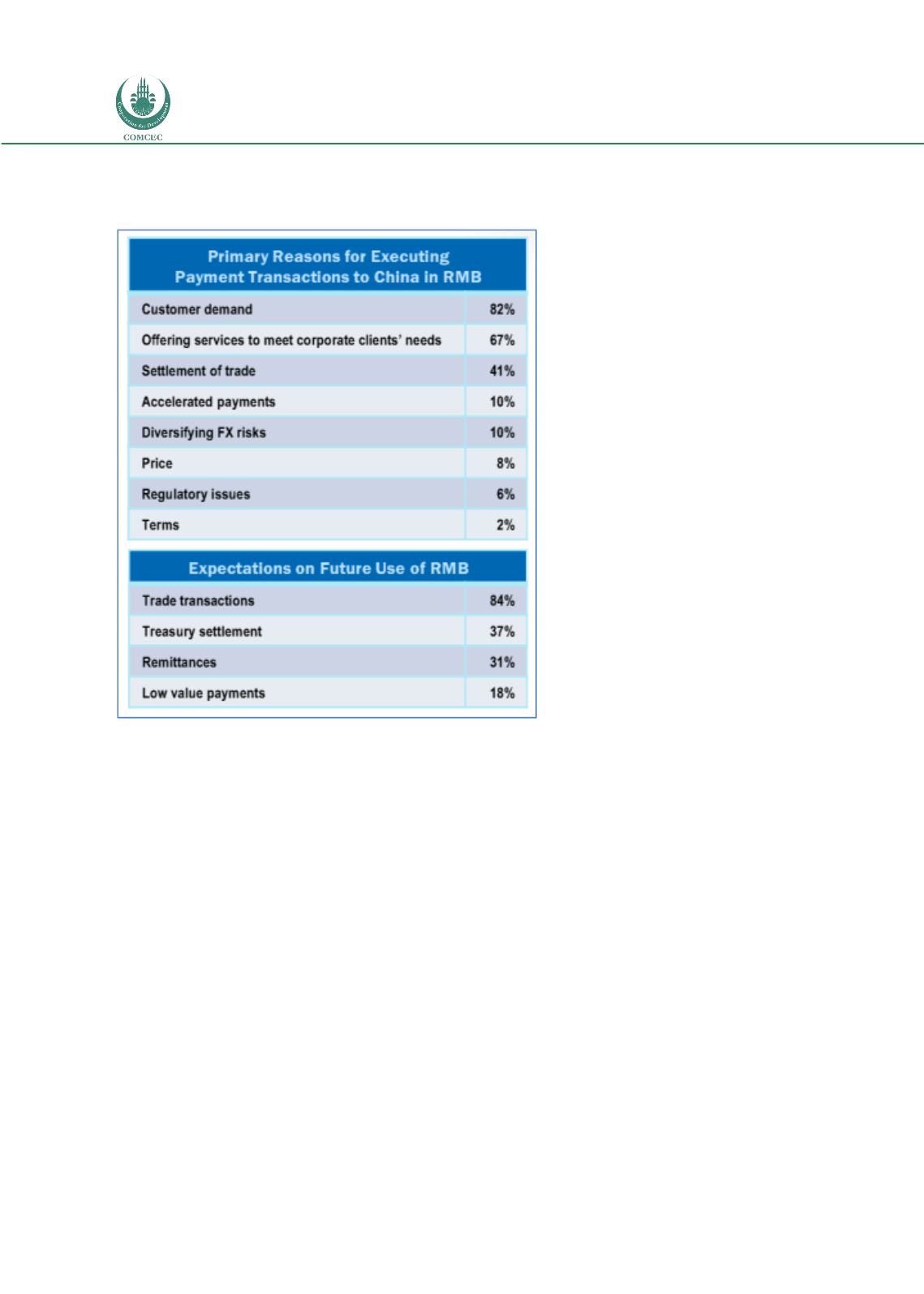

Table 7: RMB Adoption

Source: FI Metrix, 2013

The evolution of the RMB will certainly be a key influence on the development of intra-Asia

trade flows over the coming medium term, taking on increasingly global character and

influence as acceptance of the RMB and confidence in the underpinning economic and political

fundamentals continues to grow.

As with other markets around the globe however, the broader engagement of Asia-based

businesses in pursuit of international opportunities will be directly relevant to the objectives

and priorities of the COMCEC and of OIC Member States. Already, trade flows between Saudi

Arabia and China and between China and the UAE are the subject of attention. Additionally, the

long-standing commercial relationships between India and Indian expatriates, and business

partners across the MENA Region remain important.

There are increasing trade and investment flows between countries worldwide,

especially between Asia and the Middle East, which offer substantial opportunities for

the Islamic trade finance sector. Trade between the two economic blocks has grown

from USD804.9bln as at end-2010 to just under USD1.2tln as at end-2012.

Source: Insights: Islamic Trade Finance, MIIFC 2013