Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

58

same core issues, with obvious differences in degree and emphasis in countries and regions

where extreme circumstances prevail. Even in such circumstances however, it is notable that

there is an awareness of the international nature of trade finance and cross-border

partnerships.

Azizi Bank, based in Afghanistan, was represented at a major international banking conference

recently (Sibos 2013, Dubai), and seeks to grow its network of partner banks, explicitly

indicating a trade finance capability headed by the Chief Credit Officer of the bank, even as the

institution builds out its core banking offerings and national branch network under the most

difficult of circumstances (Source: Azizi Bank).

The challenges around SME access to trade finance may be universal across a wide range of

markets, but the need for access to more trade finance among SMEs in particular, is also

common among jurisdictions, even when SMEs make up the majority of commercial ventures

in a given jurisdiction, country or region.

3.2. Current State Highlights

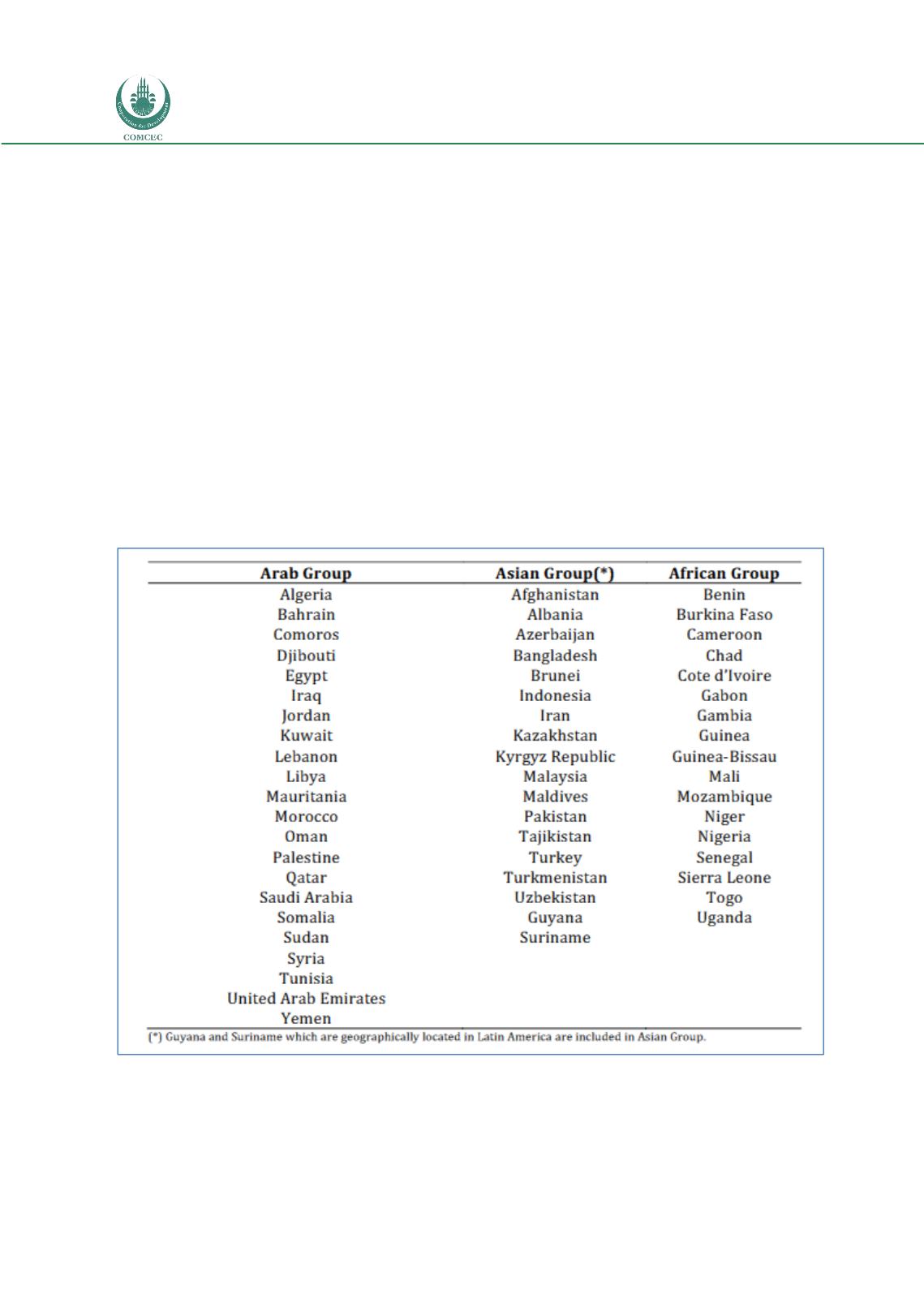

Table 5: OIC Member States

Source: Trade Outlook 2013, COMCEC

Given the geographic scope and the number of OIC Member States, and the fairly consistent

nature of challenges and issues around trade finance, including trade finance needs and issues

related to SMEs, it has been deemed appropriate to consider the issues related to OIC Member