DRAFT

Improving the SMEs Access to Trade Finance

in the OIC Member States

61

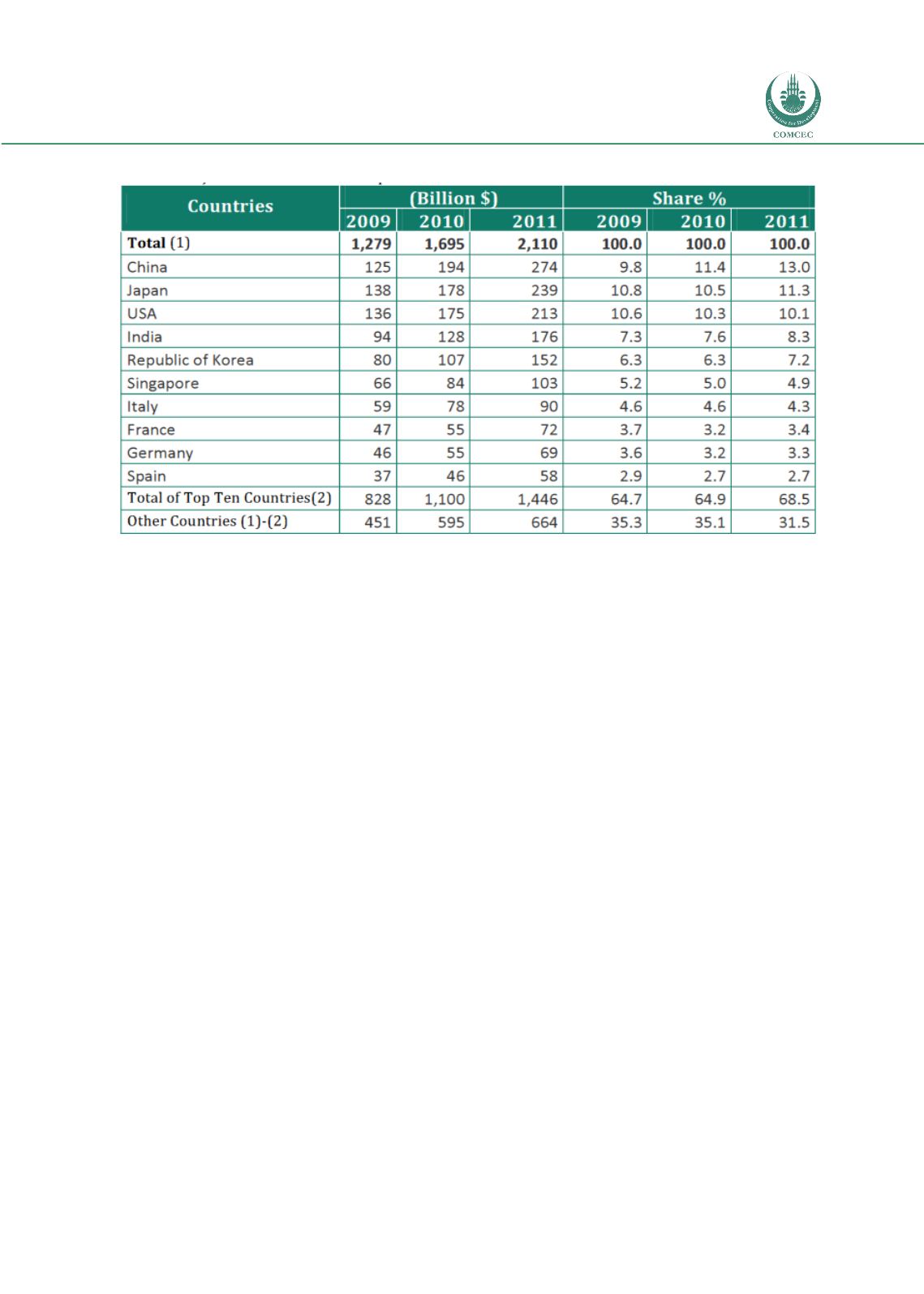

Table 6: OIC Export Markets

Source: COMCEC Trade Outlook 2013/ITC TradeMap

In addition to the overarching desire among OIC Member States to champion and enable

greater collaboration and increased trade flows, the data suggest a need to diversify trade

activity on several levels:

Engaging a larger number of OIC Member States in a greater share of global and intra-

OIC trade flows

Expansion of trade activity beyond oil and oil-related products and services

Active pursuit of new trade markets, particularly in light of ongoing sovereign crisis

issues in Europe and ongoing economic issues in the United States

GCC and other Arab states have worked actively to diversify economic activity and to develop

new markets internationally, and such efforts must clearly continue. The availability of

adequate levels of trade finance link directly to the above objectives, as does the success and

sustainable activity of SMEs across OIC Member States.

OIC Member States engaged in oil export include: Algeria, Azerbaijan, Cameroon, Chad, Cote

d’Ivoire, Egypt, Gabon, Iran, Iraq, Kazakhstan, Kuwait, Libya, Malaysia, Nigeria, Qatar, Saudi

Arabia, Sudan, Syria, Turkmenistan, U.A.E, Uzbekistan and Yemen. Those not involved in oil

exports include: Afghanistan, Albania, Bahrain, Bangladesh, Benin, Brunei, Burkina Faso,

Comoros, Djibouti, Gambia, Guinea, Guinea-Bissau, Guyana, Indonesia, Jordan, Kyrgyz,

Lebanon, Maldives, Mali, Mauritania, Morocco, Mozambique, Niger, Oman, Pakistan, Palestine,

Senegal, Sierra-Leone, Somalia, Suriname, Tajikistan, Togo, Tunisia, Turkey and Uganda.

The top ten leaders in intra-OIC trade account for a significant share of intra-Member trade

flows, with the UAE long serving as a regional re-export hub, but also more recently extending

its influence and reach as a global hub for logistics, transport and trade activity. The early

adoption of emerging trade financing solutions such as the Bank Payment Obligation, by Dubai

Trade on behalf of its member companies, provides one illustration of the linkage between the