Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

62

successful pursuit of commercial activity in international markets, and the contribution to such

success, that can be made by effective and affordable trade financing, particularly when it

extends into the SME segment of business.

Additionally, a recent announcement indicating that Dubai seeks to become a hub of Islamic

Finance reinforces the integrated and strategic approach taken by the Emirate in its view of

the potential for and complementarity of Islamic and conventional finance models.

“Transforming Dubai into a global center for Islamic sukuks is intended to cement

confidence in our economy among international financial circles,” [Sheikh Mohammed

bin Rashid al-Maktoum] carried on to say. Sheikh Mohammed stressed the importance

of activating the role of Islamic economy in the UAE’s national economy. “Today, Dubai

possesses all the potential and privileges that qualify it to achieve its goal of becoming a

global center for Islamic sukuks. We will work on completing the necessary

organizational framework and mobilize efforts and energies, national cadres and

experts to give this sector the anticipated momentum.” The new initiative will

encourage organizations to issue sukuks instead of bonds and builds on Sheikh

Mohammed’s January declaration to create an Islamic finance council to regulate

Shariah-compliant equity — and his desire to integrate Islamic economy as part of the

overall Dubai economy.

Source: Al Arabiya, 2013

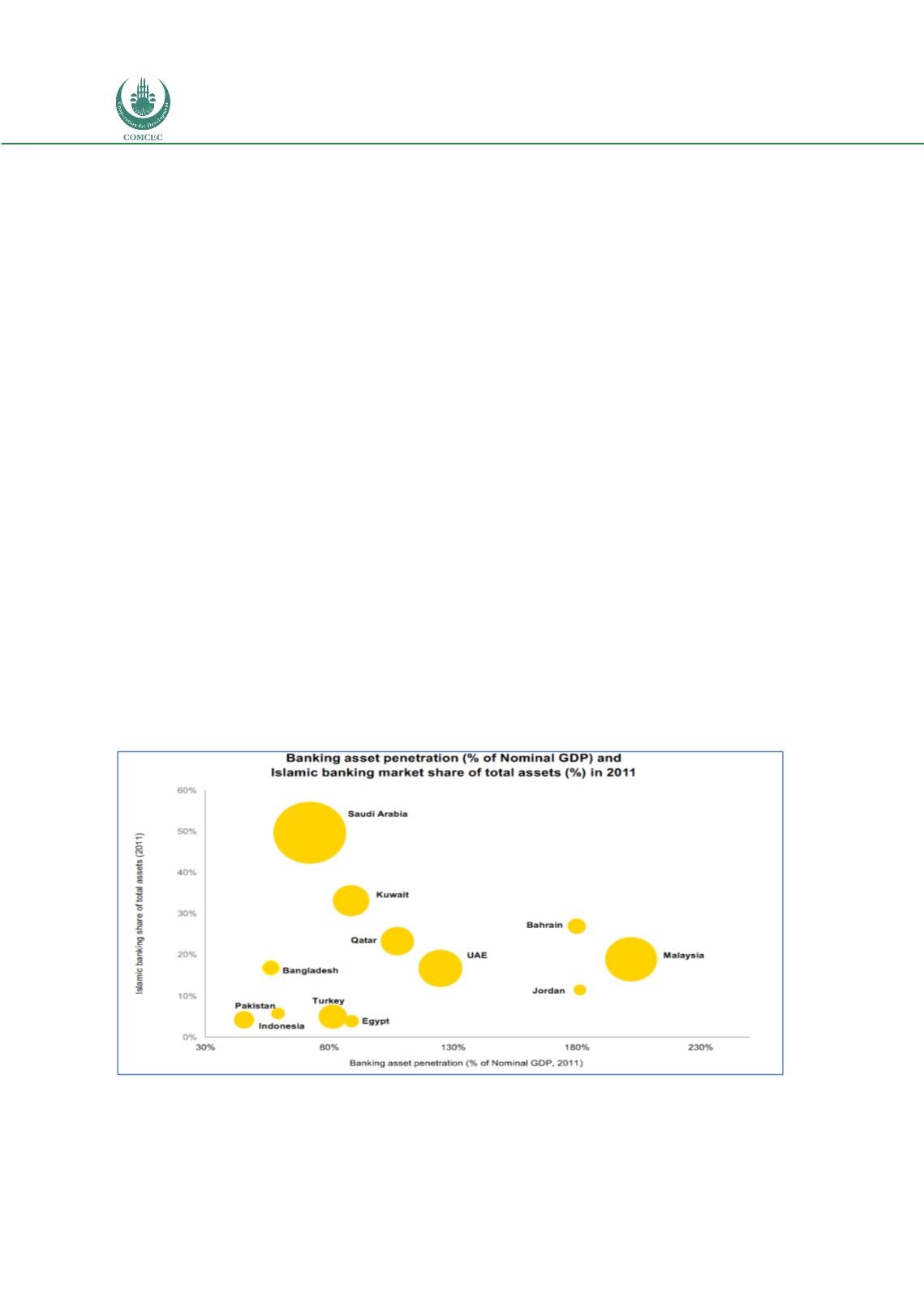

According to the Ernst & Young Islamic Banking Competitiveness Report, 2013, Islamic

Banking assets reached about US $1.3 trillion in 2011, and exhibited growth rates averaging

19% annually over the past four years. The top four markets globally account for 84% of

Islamic Banking assets, with markets like Saudi Arabia, Malaysia, Qatar, Turkey and Indonesia

deemed to present high potential as centres of Islamic Finance.

Figure 22: Banking Asset Penetration

Source: Islamic Banking Competitiveness Report Ernst & Young, 2013