Increasing Agricultural Productivity:

Encouraging Foreign Direct Investments in the COMCEC Region

46

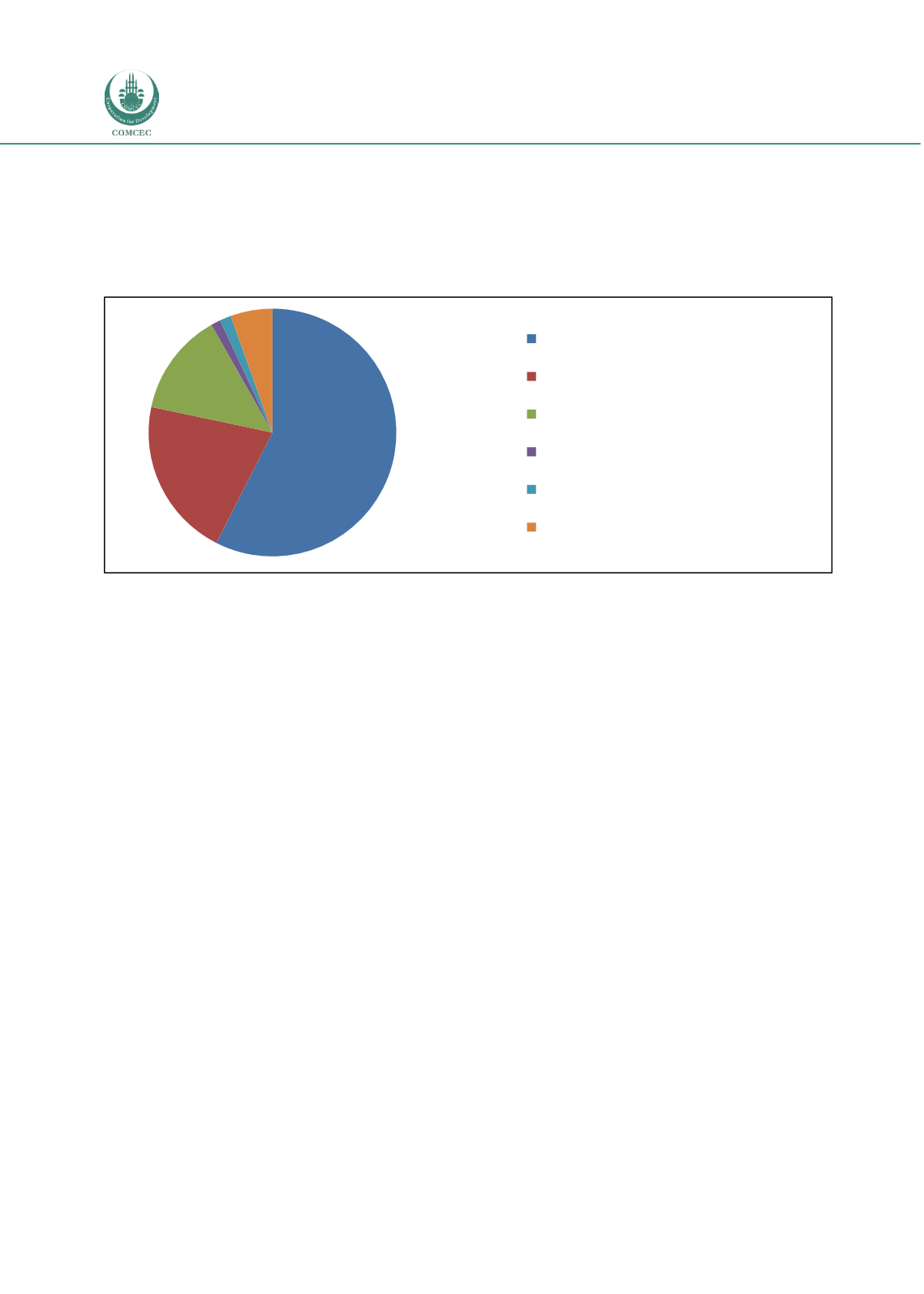

In terms of company size, the majority of companies have an annual turnover of USD 5.00 billion

or higher (in 160 out of 371 FDI projects), while 58 FDI projects were conducted by companies

with a turnover between 1 and 4.99 billion. As illustrated in Figure 18, smaller companies, up to

49.9 million of annual turnover, account for 19 projects or 5 percent of the total sample.

Figure 18: Size of Companies by Turnover by Number of Agricultural FDI Projects

Source: fDi Intelligence from The Financial Times Ltd

This kind of information is critical when defining an investor targeting profile and executing an

investor lead generation strategy. It provides further insights in how to prioritize agricultural

investors and justifies why limited resources and personal attention is disproportionally more

allocated towards the global players at the expense of smaller companies.

3.1.5

Industry and Sub-sector Analysis at Category of Agricultural Activity Level

Figure 19 shows that although a total of 24 sub-industries were included in this analysis, Food &

Tobacco came out as the dominant industry accounting for 80 percent of projects tracked in

2012. Project volume in this sector peaked in 2011 and 2012, with 37 projects tracked. This

industry is followed by Agricultural Chemical and Rubber products.

160

58

38

44

15

USD 5.00 bn or higher

USD 1.00 bn to 4.99 bn

USD 100.00 m to USD 999.99 m

USD 50.00 m to USD 99.99 m

USD 25.00 m to USD 49.99 m

USD 24.99 m or less