Increasing Agricultural Productivity:

Encouraging Foreign Direct Investments in the COMCEC Region

42

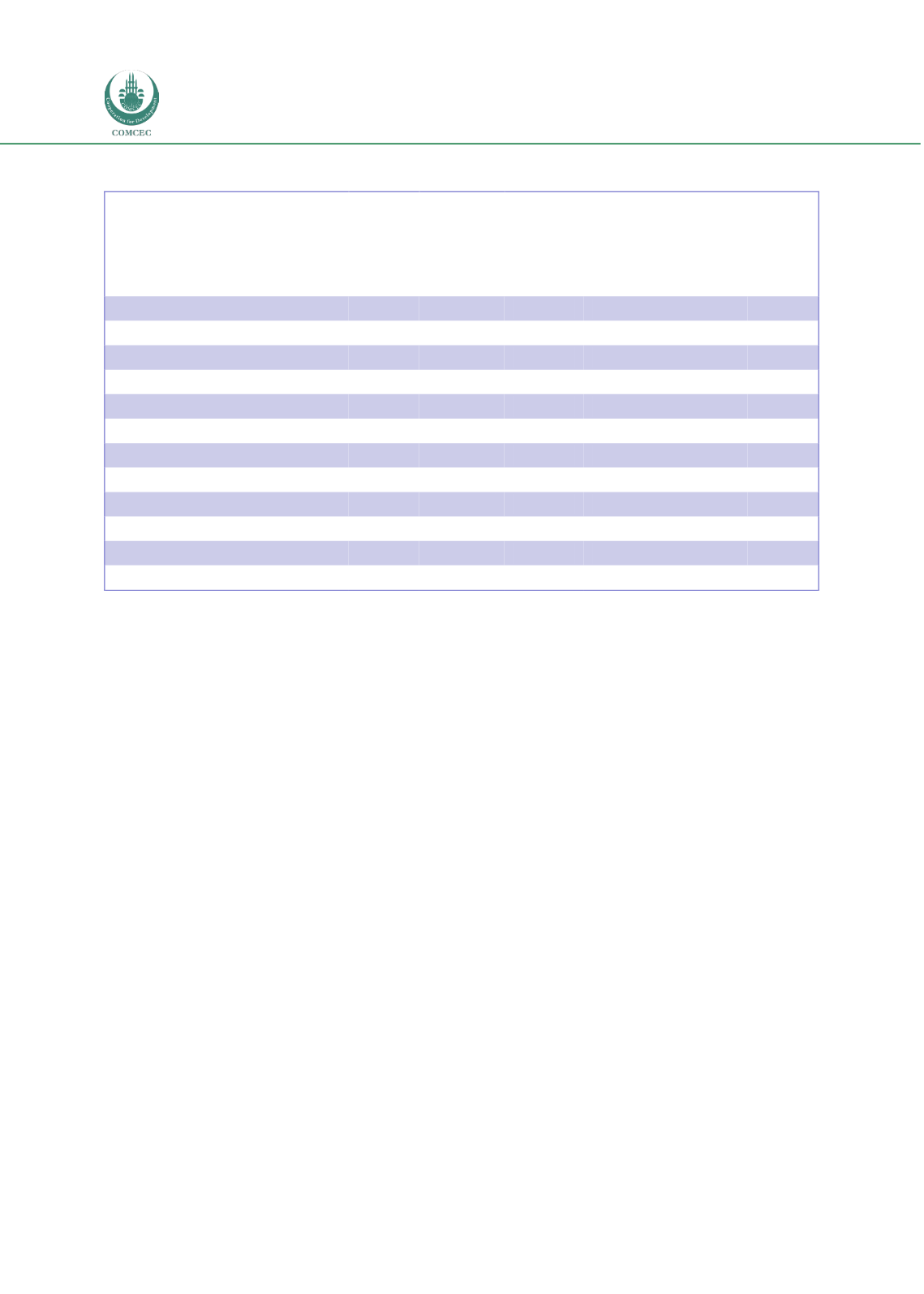

Table 16: Agricultural FDI Trends by Destination Country in the COMCEC Region (2003-2012)

Destination country

No of

projects

No of

companies

Jobs Created

Capital investment

Total

Average

Total (USD

m)

Average

(USD m)

Indonesia

68

55

20,277

298

6,776.70

99.70

Malaysia

50

41

9,561

191

2,304.70

46.10

Turkey

30

27

6,805

226

4,033.20

134.40

Nigeria

22

18

9,183

417

3,227.20

146.70

UAE

21

16

7,600

361

3,282.20

156.30

Egypt

21

20

4,314

205

1,921.70

91.50

Morocco

15

14

3,869

257

1,348.30

89.90

Mozambique

13

13

6,984

537

2,781.10

213.90

Uganda

10

7

2,664

266

594.40

59.40

Côte d'Ivoire (Ivory Coast)

10

10

1,870

187

351.70

35.20

Other destination countries

111

102

42,783

385

18,581.70

167.40

Total

371

279

115,910

312

45,202.90

121.80

Source: fDi Intelligence from The Financial Times Ltd

Indonesia is the top destination country, accounting for one-sixth of projects tracked. Project

volume in this destination country peaked during 2009, with 13 projects tracked. Indonesia has

received the highest number of total jobs and greatest investment with a total of 20,277 jobs and

investment of USD 6.78 billion. Mozambique has the largest project size on average in terms of

both investment and job creation. Turkey, Nigeria and the UAE complement the top five

destination countries.

When allocated into bands, projects creating 100 jobs or more represent the majority of

projects, while projects creating between 25 and 49 jobs represent about one-tenth of projects.

In other words, FDI projects in agriculture are labour intensive and therefore appealing for

countries dealing with high unemployment.