Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

80

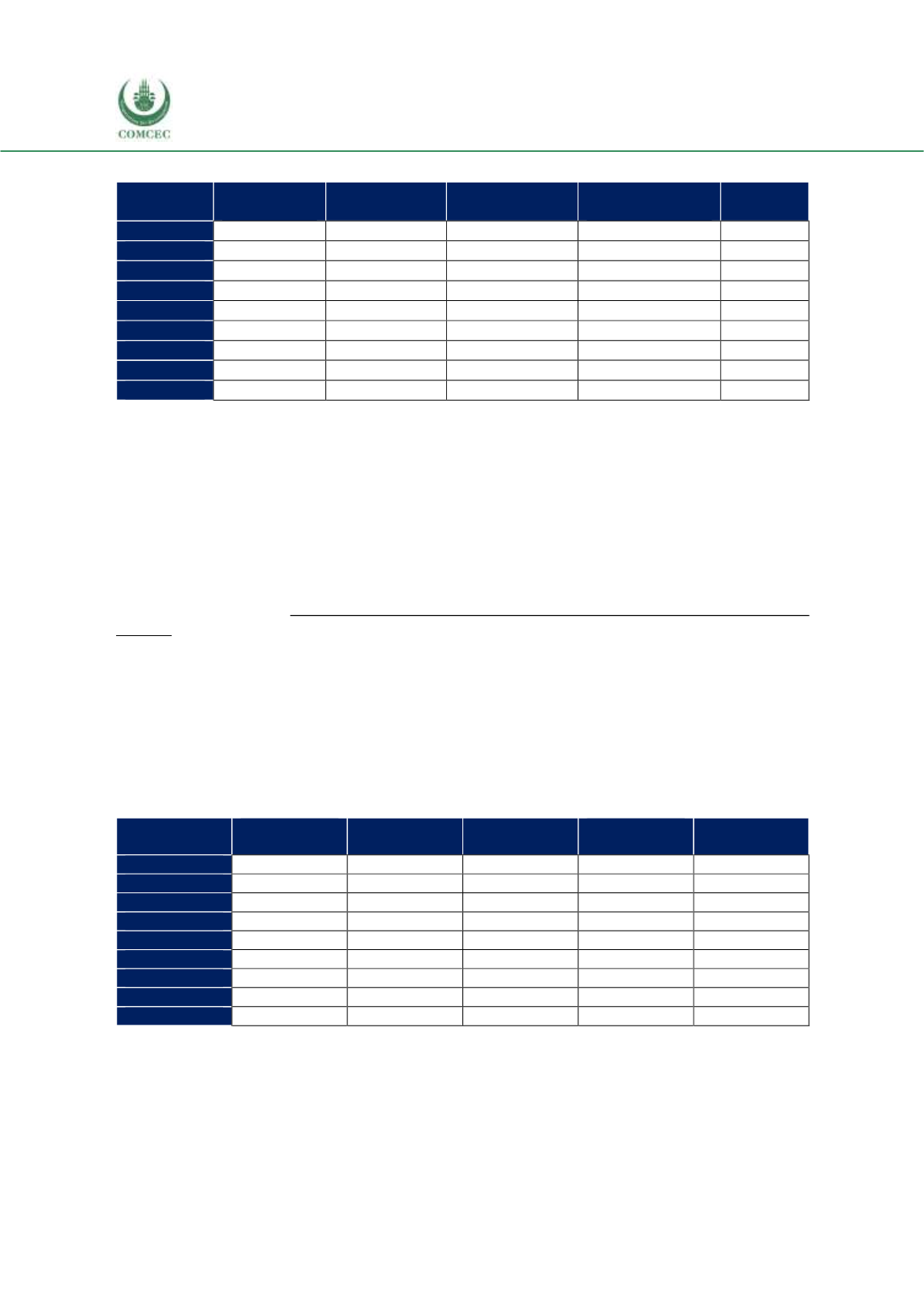

Table 4. 3 Distribution of Turkey’s Top 5 Export Products according to Destination, %

African

group

Asian group

Arab group

Non-OIC

Countries

Total

2008

1.1

4.7

22.8

71.3

100

2009

1.1

5.2

25.7

67.9

100

2010

1.1

5.2

26.3

67.4

100

2011

1.4

6.6

30.8

61.3

100

2012

1.4

4.7

34.5

59.4

100

2013

2.1

4.1

34.0

59.8

100

2014

1.7

4.2

33.4

60.7

100

2015

1.5

3.9

32.8

61.9

100

2016

1.5

4.3

36.5

57.7

100

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’ calculations

The products in the two list are not mutually exclusive. “Animal and vegetable oils, fats and

waxes” and “vegetables and fruits” are products that are both commonly exported to and

imported from OIC countries. The reason may be that the combinations of the product groups

according to higher digits are different and that export products and import products at higher

digit SITC levels are different.

Table 4.3 shows the distribution of the top 5 agricultural export products to the OIC according

to destinations. The share of non-OIC countries in total OIC exports of top five agricultural export

products has declined from 71.3% to 57.7% over the period between 2008 and 2016. During

the observation period, the share of the Arab group increased from 22.8% to 36.5% in total OIC

exports at the expense of non-OIC countries, while the shares of African and Asian group did not

change much.

Table 4.4 shows the distribution of top 5 agricultural import products from the OIC countries

according to the region of origin. The share of non-OIC countries in Turkey’s top agricultural

import products increased from 76.5% to 84.2%during the 2008-2016 period. During the same

period, the share of the Asian group declined from 21.5% to 12.9 and the share of African and

Arab group did not change much. The share of the Asian group declined at the expense of non-

OIC countries.

Table 4. 4 Distribution of Turkey’s Top 5 Import Products, according to Origin, %

African

group

Asian group

Arab group

Non-OIC

Countries

Total

2008

0.1

21.5

1.9

76.5

100

2009

0.3

13.9

2.9

82.9

100

2010

0.4

16.2

2.9

80.5

100

2011

0.6

15.0

1.1

83.3

100

2012

0.5

16.4

1.4

81.7

100

2013

0.5

13.4

1.2

84.9

100

2014

0.5

11.5

1.2

86.8

100

2015

0.6

11.4

1.5

86.6

100

2016

1.1

12.9

1.8

84.2

100

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’ calculations

Table 4.5 shows that Iraq is the largest importer of Turkey’s top five agricultural export products

in the OIC market. The share of Iraq in the last available three-year average is 43.7% while the

second largest market (Syria) has a share of 8.9%. The lower share is due to the ongoing

conditions in Syria. The third largest market is Saudi Arabia, followed by Iran and Sudan.