Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

82

agricultural support has declined from about 4.5% in the early 2000s to nearly 2.5%, it is still

sizably larger than the OECD and EU averages of about 0.6%. Besides, the share of price supports

within the total agricultural support is about 3-4 times larger than the EU average.

Tariffs

Tariffs in agriculture are typically larger than tariffs in non-agricultural sectors. According to the

most recent WTO Tariff Profile Summary for Turkey, the simple average MFN applied tariff for

agriculture (roughly equal to 40%) is about 8 times larger than the corresponding average for

non-agricultural products in 2017. The corresponding ratio for 2016 is around 10.

The frequency distribution of MFN applied tariffs show that a majority of tariff rates in 2017 are

larger than 15% where nearly half of all agricultural tariff lines have rates larger than 25%.

Looking at the product lines, applied MFN rates for animal and dairy products remain larger

than 100%. With the notable exception of cotton that has 0% MFN applied tariff rate, all

agricultural products have MFN rates remaining larger than 10%.

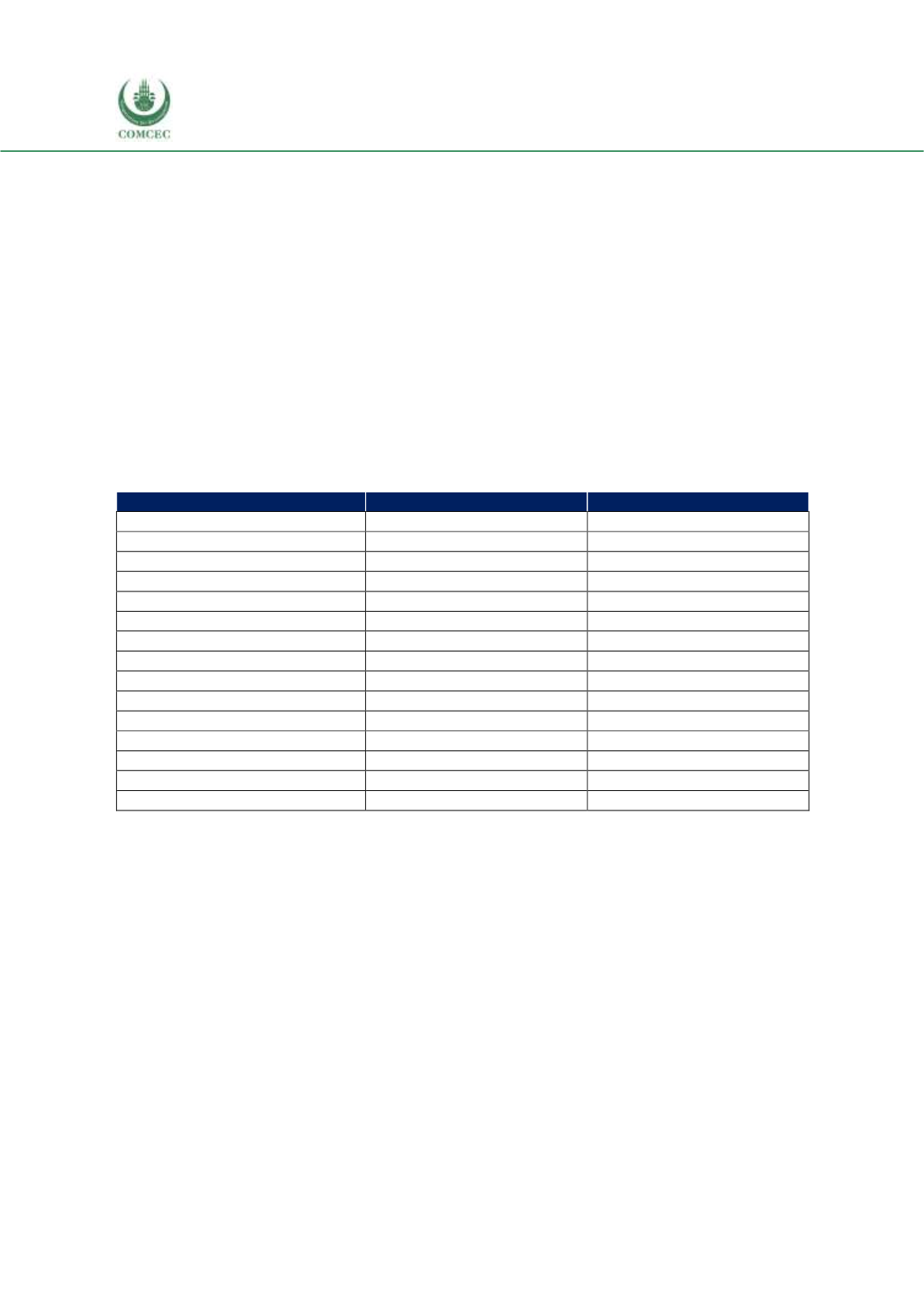

Table 4. 7 OIC Member Countries that Export to Turkey under Preferential Tariffs

African Group

Arab Group

Asian Group

Benin

Comoros

Afghanistan

Burkina Faso

Djibouti

Albania

Chad

Egypt

Bangladesh

Côte d'Ivoire*

Jordan

Indonesia*

Gambia

Mauritania

Iran

Guinea

Morocco

Kyrgyzstan

Guinea-Bissau

Somalia

Pakistan

Mali

Palestine

Tajikistan

Mozambique

Sudan

Uzbekistan

Niger

Tunisia

Malaysia

*

Nigeria*

Yemen

Senegal

Sierra Leone

Togo

Uganda

Source: WTO RTA Database.

Note: Countries marked with an asterisk are among the top 5 OIC countries from which Turkey’s top

import products are imported. Countries written in boldface letters have a free trade agreement in force

with Turkey.

A quick comparison with the EU reveals that Turkey’s applied average MFN tariffs are larger

than the EU levels in animal products, dairy products, fruits and vegetables, and coffee and tea.

On the other hand, in beverages and tobacco, fish and fish products, cereals and preparations,

sugars and confectionery and in other agricultural products, average applied MFN rates are

nearly identical for EU and Turkey.

Turkey’s overall applied tariff average increased due to requests by domestic producers. There

is a possibility that the tariff rates will increase further. Tariff schedules are bound 100% of

agricultural tariff lines and 34% of industrial tariff lines. There are significant differences in the

rates of agricultural versus industrial products and average rates for agriculture are 49% and

only 5.5% for industrial products. Tariff protection is particularly high, averaging over 80%, on

meat, dairy, sugar and confectionary.