Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

83

Turkey applies preferential tariffs to a diverse set of countries. The entire list includes the EU

and EFTA countries, countries in special groups such as the LDCs and the GSP countries, and

countries that are the beneficiaries of the incentive arrangement for sustainable development.

Table 4.7 lists 35 OIC member countries that export to Turkey under preferential tariffs.

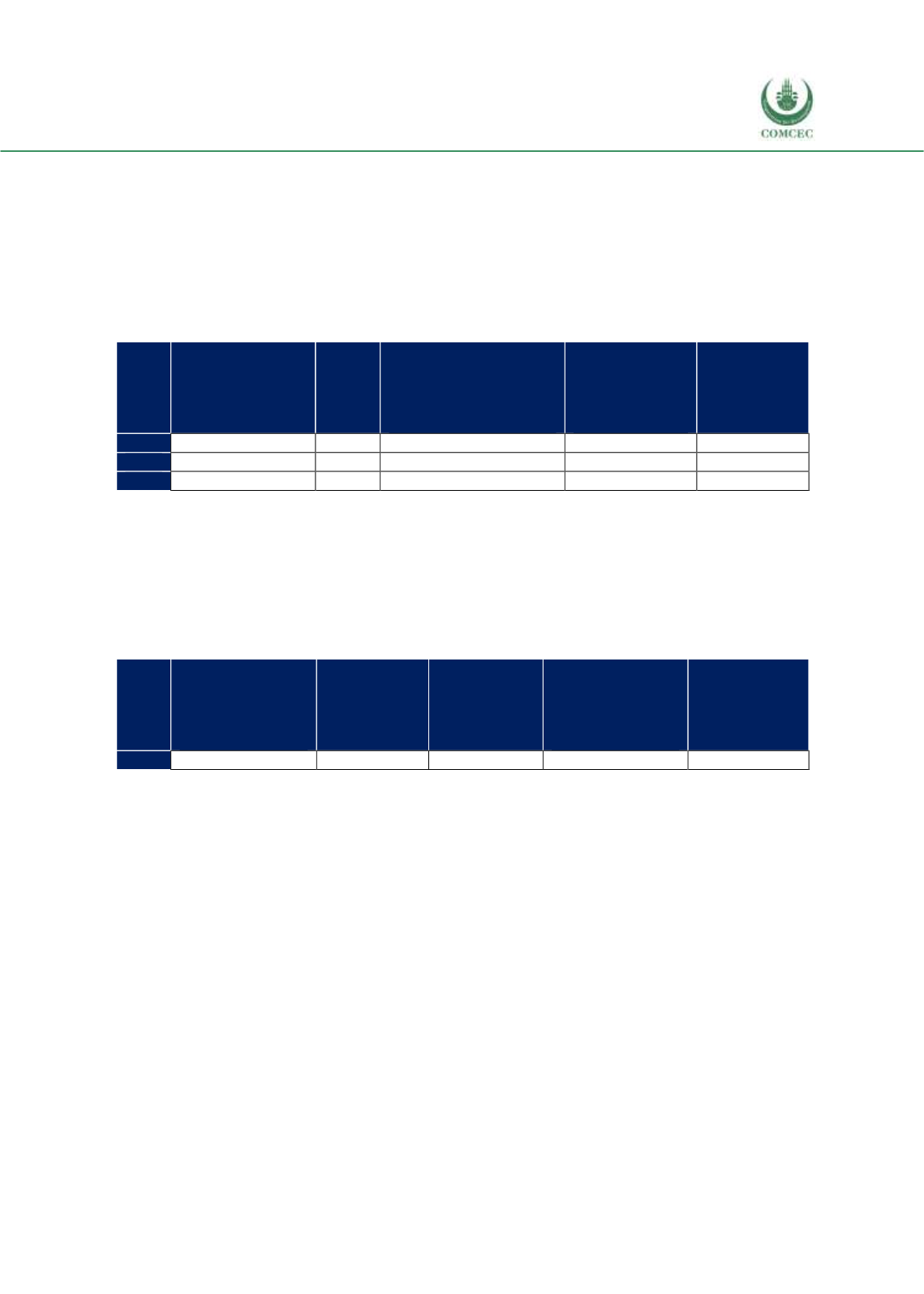

Focusing on the top 5 import products from the top 5 OIC exporters (Table 4.8), the tariff rate of

the “Animal and vegetable oils, fats and waxes” remains same over the last three years while the

tariff rate for coffee, oil seeds and vegetables and fruits were reduced.

Table 4. 8 Tariffs Set by Turkey for Top 5 Import Products from the OIC Exporters, %

41-42-43:

Animal and

vegetable oils,

fats and waxes

263:

Cotton

07:

Coffee, tea, cocoa,

spices, and

manufactures thereof

22:

Oil-seeds and

oleaginous

fruits

05:

Vegetables

and fruit

2014

27.2

0.0

29.2

16.9

29.4

2015

27.5

0.0

20.5

12.5

28.9

2016

27.5

0.0

20.5

12.5

28.9

Source: ITC Macmap, CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’

calculations

Note: Top 5 products are identified considering 3 year average between 2014 and 2016 and ad valorem

equivalent (%) rates are considered for applied tariff rates.

With regards to tariff rates for Turkey’s top five export products, Table 4.9 presents the available

data. The 2016 tariff rates demonstrate that tariff rates for dairy products are lowest while the

tariff rates for beverages and tobacco are highest.

Table 4. 9 Tariffs Set by OIC Countries for Turkey’s Top 5 Export Products, %

04:

Cereals and

cereal

preparations

05:

Vegetables

and fruit

11-12:

Beverages

and tobacco

41-42-43:

Animal and

vegetable oils,

fats and waxes

02:

Dairy

products and

birds’ eggs

2016

20.3

13.0

41.7

11.6

9.0

Source: ITC Macmap, CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’

calculations

Note: Top 5 products are identified considering 3 year average between 2014 and 2016 and ad valorem

equivalent (%) rates are considered for applied tariff rates.

NTMs

Turkey has harmonized the SPS measures with the EU by adopting the main framework law on

SPS. Following the 2010 adoption of the main framework law on SPS (the Law on Veterinary

Services, Plant Health, Food and Feed), Turkey has adopted and implemented many of the

regulations during the review period, thus, approximately 100 regulations have been put in

place as secondary legislation. Regarding TBT matters, Turkey revised its regulations in 2012 to

conform to the EU in the areas of CEmarking, conformity assessment bodies, and notified bodies.

Both imports and exports are subject to a number of border measures in Turkey, including

outright prohibitions, licensing, controls, and restrictions (WTO, 2016)

Table 4.10 summarizes the numbers of NTMs that have been imposed by Turkey and that are

currently in force for agri-food products, agricultural raw materials and fish products. Clearly, a

vast majority of NTMs imposed by Turkey are either export subsidies or SPS measures. Besides,

nearly all of the NTMs reported are imposed on agri-food products.