Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

36

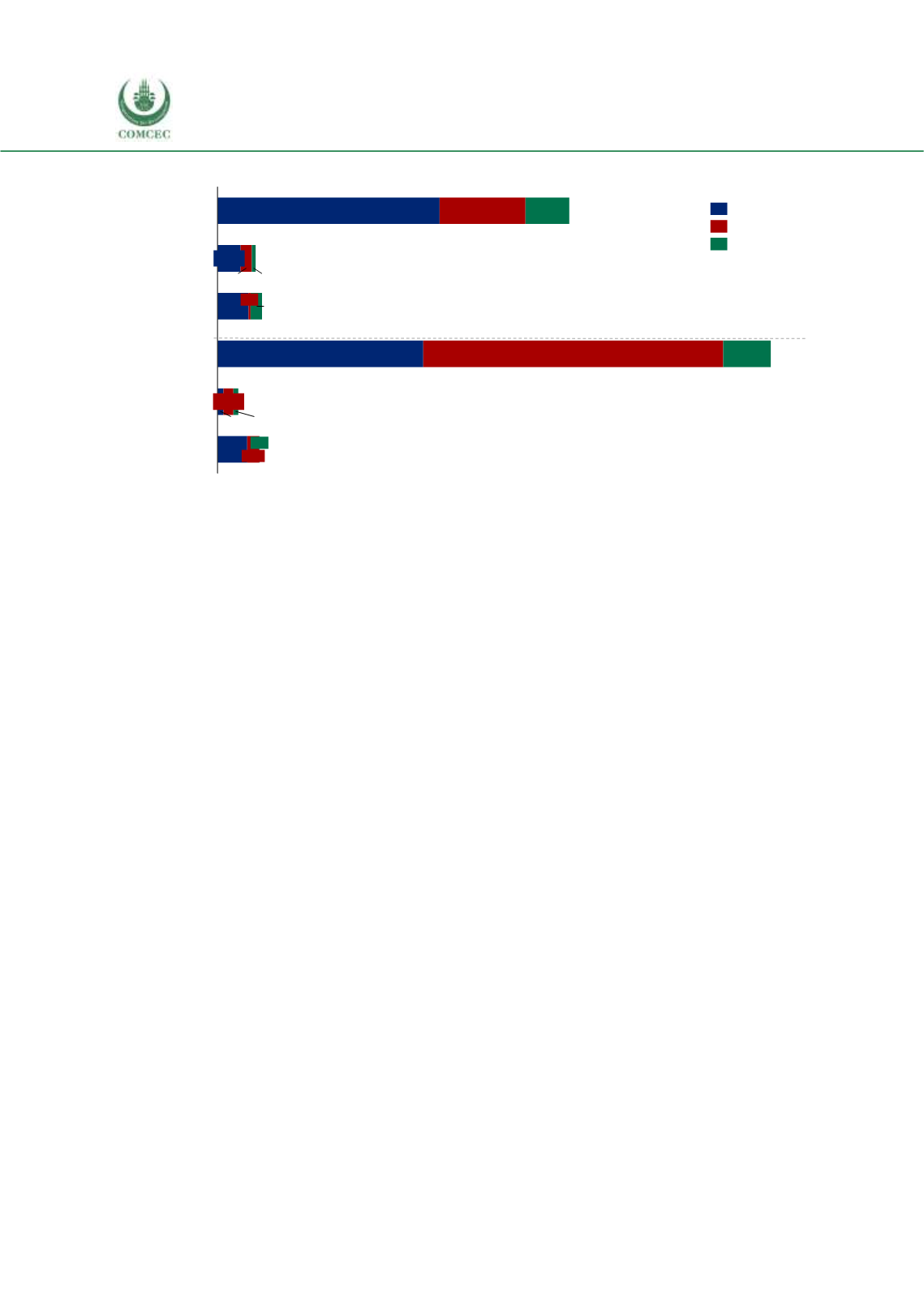

Figure 3. 4 OIC Groups’ Export and Import Shares, 2016

Source: ITC Macmap, CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’

calculations. Note: OIC countries’ total export volume of agri-food products, fish products and agricultural

raw materials are 116, 13, and 15 billion USD, respectively. OIC countries’ total import volume of agri-food

products, fish products and agricultural raw materials are 183, 7, and 14 billion USD, respectively.

The African countries are not self-sufficient in terms of agricultural production and considerably

depend on imported agricultural products rather than being net exporters. Indeed, the OIC

agricultural production is mainly concentrated in a limited number of member countries; most

notably Indonesia, Nigeria, Turkey, Pakistan, Iran, Egypt, Malaysia, Bangladesh, Sudan and

Algeria. More than 75% of the total agricultural products are produced by these member

countries (COMCEC, 2017a).

With regards to imports, the Arab group is the largest importer of agri-food products and fish

products while the Asian group is the largest importer of agricultural raw materials. The Arab

countries supply majority of their food requirements from the foreign countries as reflected

from the large share of the Arab countries in total food and fish imports. The Asian group’s

imports of agricultural raw materials is large in comparison to the other country groups,

reflecting the role of Asian countries in using the agricultural raw materials for processing and

exporting. The African group countries have lowest shares both in exports and in imports,

reflecting low production volumes for creating exports as well as low purchasing power to

afford imports of agricultural products. Among the three country groups, it is possible to say

that the African group countries are least open to agricultural trade.

In order to demonstrate the export destinations and countries of origins for the import products,

the following section presents an overview of the top five export and import product divisions

of the country groups for the period of 2014-2016. Tables F.3 and F.4 in Annex F show the

average percentage shares of the top 5 export and import products among total import and

export value of the three country groups. The tree map in Figure 3.5 shows that the top 5 export

and import products differ according to the three country groups. The breakdown of the product

groups pictured in Figure 3.5 shows that export combinations for the three OIC groups have

distinct patterns, reflecting competitive advantage of respective regions in production of

different product divisions. For example, coffee for the African group, oils for the Asian group,

and vegetables and fruits for the Arab group stand out as some key product divisions. With

regards to imports, cereal is the top import product for all three country groups.

69%

60%

Agri-raw

9%

Agri-raw

Fish

70%

10%

24%

12%

24%

63%

Agri-food

37%

30%

Fish

26%

4%

54%

Agri-food

47%

29%

1%

29%

African Group

Arab Group

Asian Group

Export

Import