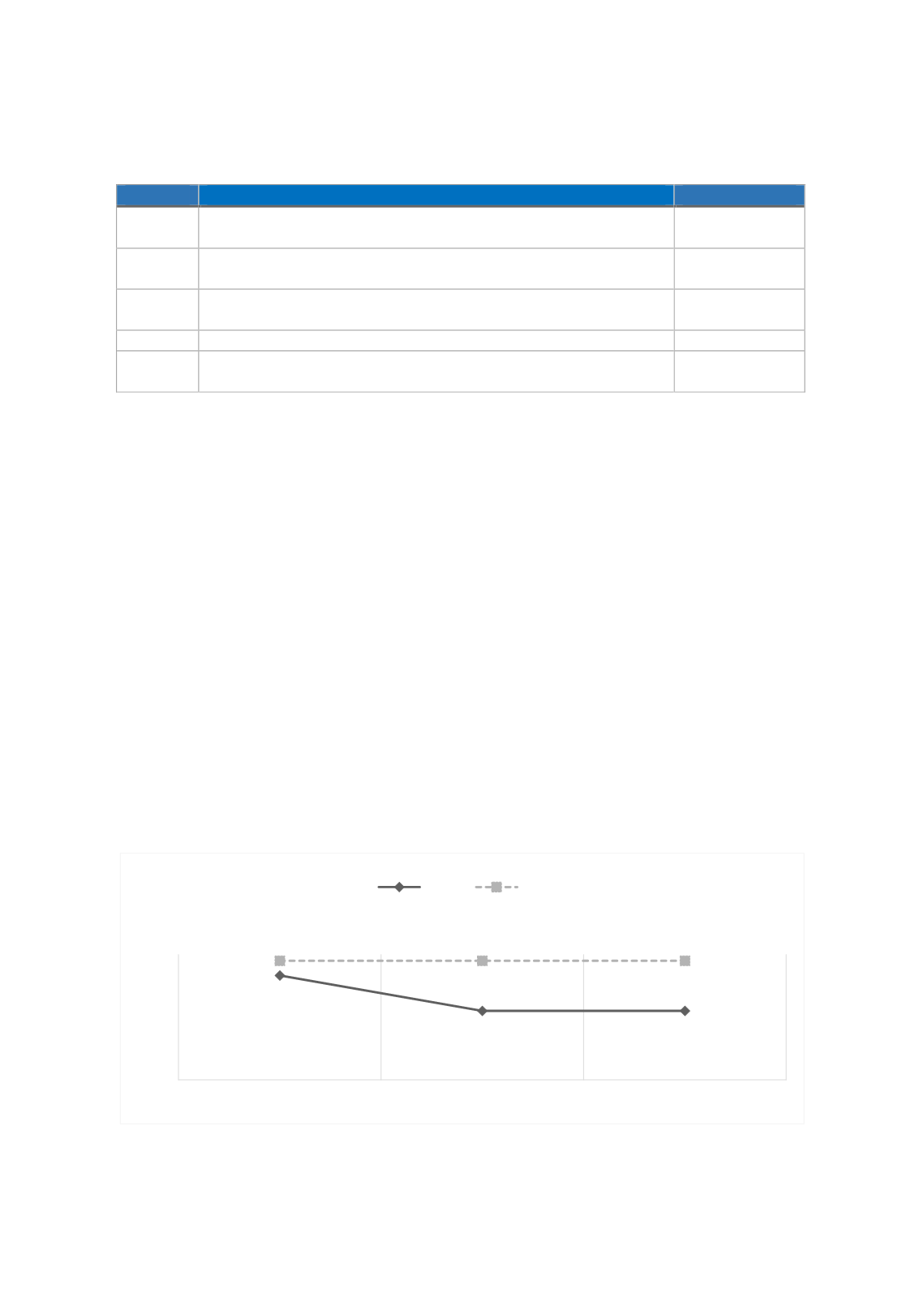

51

T

ABLE

4: M

AIN

IFSB S

TANDARDS

S

PECIFICALLY

R

ELATING TO

T

AKAFUL

Number

Standard

Date

IFSB-8

Guiding Principles on Governance for

Takaful

(Islamic

Insurance) Undertakings

December

2009

IFSB-11

Standard on Solvency Requirements for

Takaful

(Islamic

Insurance) Undertakings

December

2010

IFSB-14

Standard on Risk Management for

Takaful

(Islamic Insurance)

Undertakings

December

2013

IFSB-18 Guiding Principles for

Re-Takaful

(Islamic Reinsurance)

April 2016

IFSB-20

Key Elements in the Supervisory Review Process

of

Takaful/Re-Takaful

Undertakings

December

2018

Source: Authors

The implication of the implementation of the IFSB standards can be viewed from a soft

regulatory perspective. This implies that once the IFSB issues its relevant standard, it does not

bind the members. Once the members adopt such standards and implement them in their

jurisdictions, such standards thereafter become binding on financial institutions operating in

such jurisdictions subject to the regulatory treatment accorded to such standards by the RSA.

Similarly, the AAOIFI included its

Takaful

standard in its published

Shari'ah

standards under No.

26 (AAOIFI, 2014). It is important to note that the RSAs in Bahrain, Oman, Pakistan, Sudan, Syria

and the United Arab Emirates have all adopted the AAOIFI standards. This makes the

Takaful

standard amongst others binding on all TOs in such jurisdictions. In other countries, such as

Brunei Darussalam, Dubai International Financial Centre, France, Jordan, Kuwait, Lebanon,

Saudi Arabia, Qatar, Qatar Financial Centre, South Africa, UK, Canada, and United States, the

Shari'ah

standard on

Takaful

is considered voluntary for adoption by operators in such

jurisdictions. However, in Malaysia and Indonesia, the RSAs only use the AAOIFI

Shari'ah

standard on

Takaful

as a basis for formulating their national regulatory standards.

F

IGURE

12:

I

MPLEMENTATION OF

IFSB

T

AKAFUL

S

TANDARDS BY

R

EGULATORY AND

S

UPERVISORY

A

UTHORITIES

(2015-2016)

Source: IFSB (2017, p. 53)

50%

33%

33%

57%

57%

57%

0%

20%

40%

60%

I FSB - 8

I FSB - 11

I FSB - 14

2015

2016