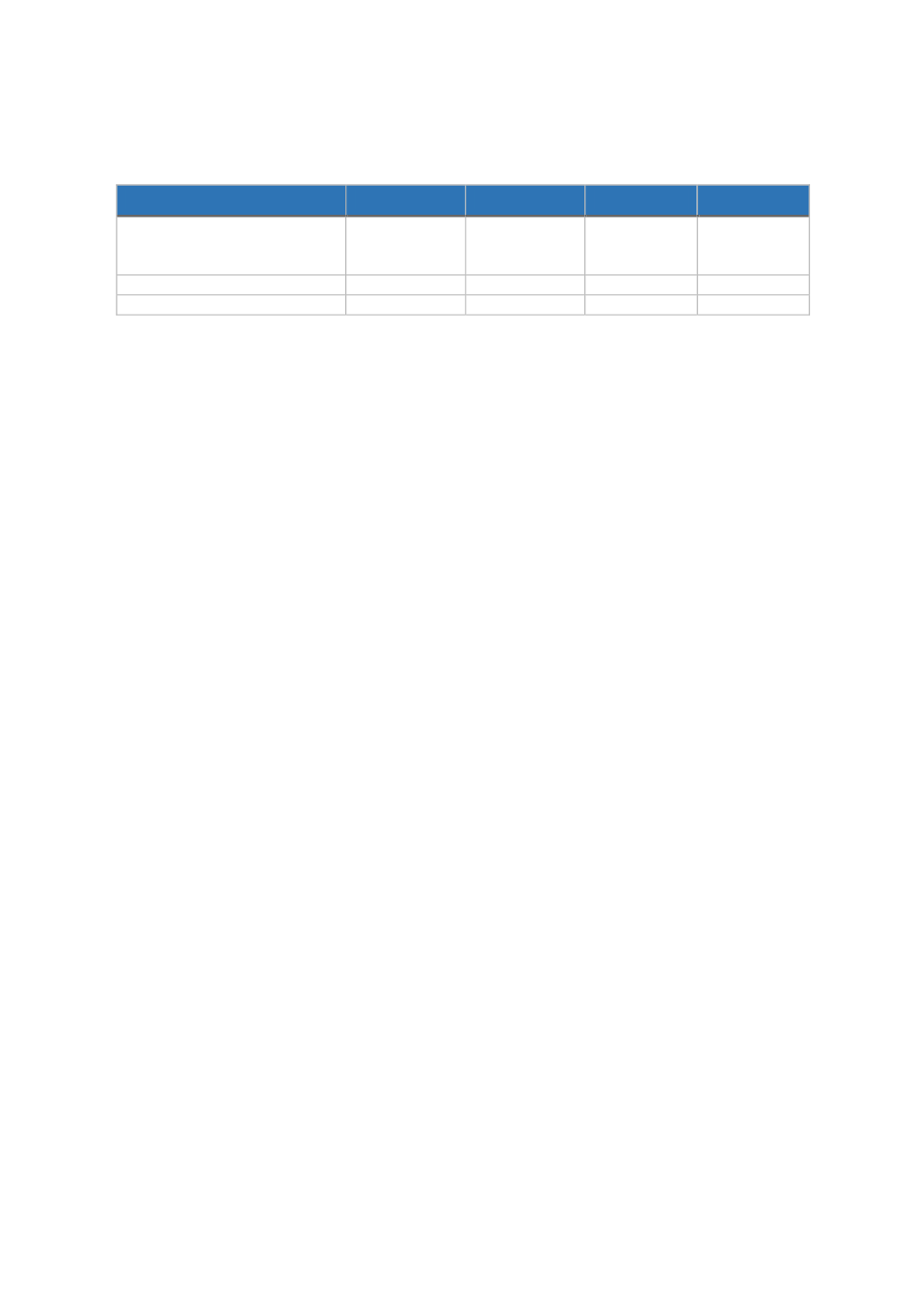

57

T

ABLE

7: C

OMPARISON OF

S

ELECTED

C

OUNTRIES

Country of observation

Malaysia

Saudi Arabia

Turkey

UK

Supervisory/Regulatory body

BNM

SAMA

Ministry of

Treasury and

Finance

FCA and PRA

Number of TOs

15

32

12

6

Number of RTOs

4

1

-

-

Source: Authors’ own

4.4.

Takaful

from the Legal Perspective

This section specifically focuses on the main legal issues underpinning

Takaful

ranging from the

corporate legal personality of the

Takaful

company, conflict of laws issues, to

Takaful

contracts

and interpretation of clauses.

From the onset, it is pertinent to observe that except for a few

jurisdictions, most of the insurance laws applicable to

Takaful

in various jurisdictions were not

originally designed for

Shari'ah

-compliant finance models (Abd Hamid, 2014); hence, there are

several legal issues that have cropped up since the modern emergence of

Takaful

in the Islamic

financial services industry. While some of the legal issues are peculiar to certain jurisdictions,

some selected legal concepts discussed briefly here are corporate personality, legal

documentation, and conflict of laws. These legal issues, among others, need to be addressed to

improve the

Takaful

sector in any country, particularly in Muslim jurisdictions.

4.4.1. Corporate Personality of

Takaful

Company

The nomenclature of the corporate entity of a TO remains a subject of legal debate. The status of

such a company vis-à-vis

Takaful

contributors requires clear identification of roles with

particular reference to ownership. For instance, a

Takaful

corporate structure has been referred

to as a “firm within a firm”, i.e. “a

mutual operating within the set-up of a proprietorship body

corporate

.” (Hussain, 2009, p. 70). It is therefore important to examine the laws of each

particular country to determine whether the set-up of a “mutual” is acceptable or provided for

under the domestic laws (Hussain, 2009). This is important when one considers different legal

structures in various jurisdictions under the OIC. One may need to produce a legal cartography

of the corporate and insurance laws of various OIC jurisdictions to determine which legal

structure fits best into the domestic laws. This legal issue goes to the very foundation of the

nature and functions of a

Takaful

company vis-à-vis its contractual relationship with the

Takaful

participants and other stakeholders in the corporate structure. For example, in the absence of a

“mutual” company set-up, it might be difficult from the legal perspective to set up a

Takaful

company without shareholders.

It is relevant to note that a fundamental question that needs to be clarified under the domestic

laws of a country is to determine whether a

Takaful

scheme is a mutual or proprietorship. A

mutual structure would envisage a contractual arrangement where the

Takaful

participants,

who make the

Takaful

contributions, effectively own the

Takaful

fund. They are responsible for