46

3.2.4.

Wakalah-Mudarabah

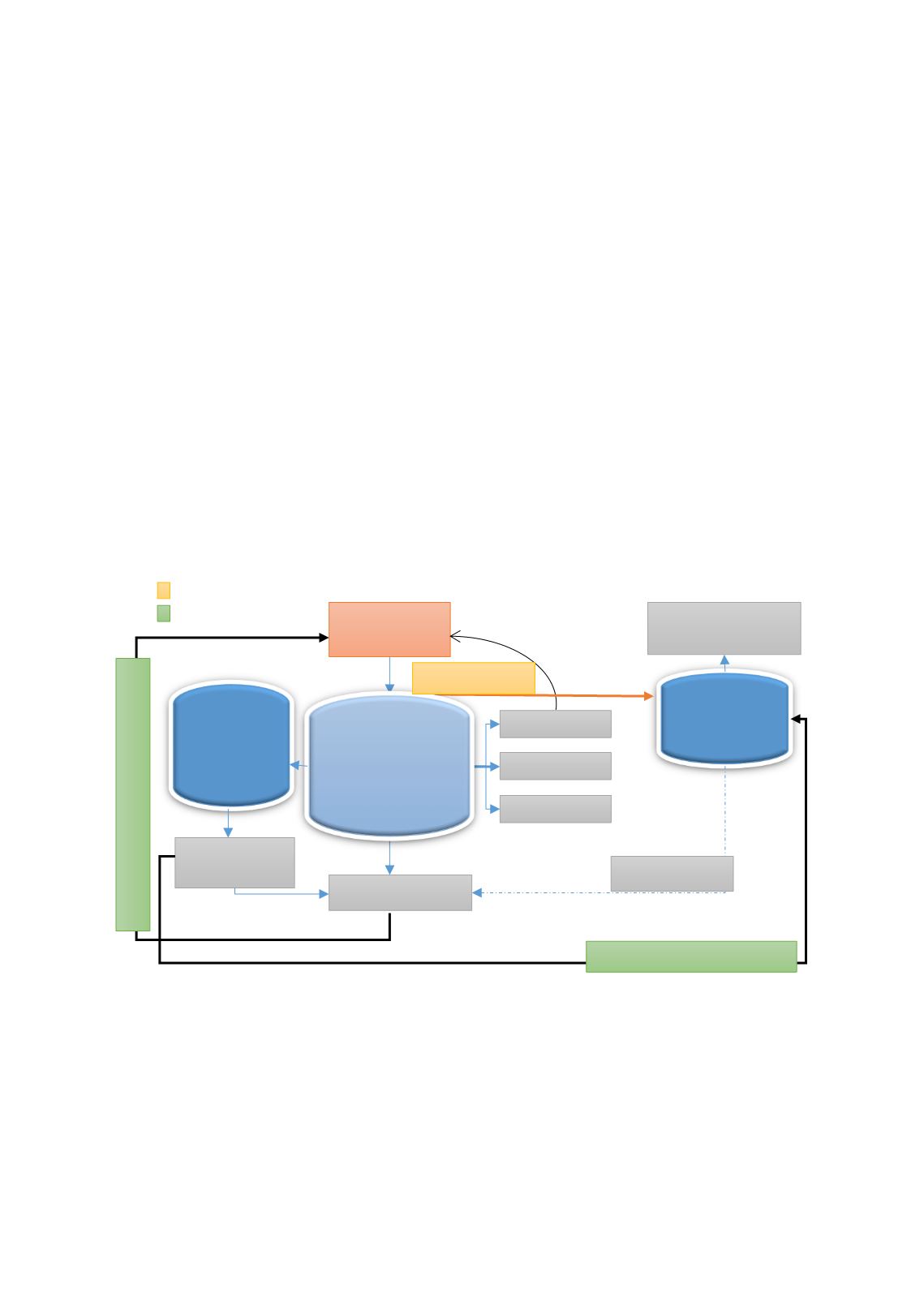

(Agency-Partnership) Hybrid Model

This hybrid model combines the features of two different models:

wakalah

and

mudarabah

. The

wakalah

contract is used for the underwriting in which the

wakalah

fee is an up-front fixed fee

charged by the TO while the

mudarabah

contract is adopted for investing the participants' fund

in the Islamic finance market and sharing the outcomes of investment.

The core factor in using the

wakalah

contract is to give the TOs the function as an agent or

wakil

.

Hence, the TO will be entrusted with the contributed funds. They are also responsible for the

underwriting process. This part pays attention to classify the risks according to their insurability

and attributing to each the appropriate rates to be paid. The importance of this is to reduce risks

and unnecessary loss of fund. Nevertheless, poor underwriting is considered one of the factors

that drive the

Takaful

companies into bankruptcy. Tolefat (2006) emphasised that the mixed

model is the prevailingmodel in theMiddle Easternmarket, and it is broadly accepted by

Takaful

companies around the world.

F

IGURE

8: W

AKALAH

-M

UDARABAH

H

YBRID

M

ODEL

Notes:

The figure presents two parties – Participants and TO. Takaful Fund and Shareholders’ Fund are both

managed by the TO.

Source: Source: Adapted from PwC (2008).

The structure of the

Wakalah-Mudarabah

Hybrid model is presented i

n Figure 8above:

1.

The participants contribute to the

Takaful

fund through

tabarru'

contract;

2.

The participants appoint the TO as agent and

mudarib

;

3.

The TO will deduct up-front fee which is called the

wakalah

fee to manage the fund;

Participants

Surplus/

Deficit

Re-Takaful

Reserves

Shari’ah

-

compliant

Investments

Investment

Profits

Shareholders’

Fund

Qard Hasan

Management

Expenses

Claims

Takaful

Fund

Wakalah Fee

100% - X of Investment Profits

X of Investment Profits

Contribution

Wakalah

Mudarabah