50

F

IGURE

11: T

OP

G

LOBAL

T

AKAFUL

M

ARKETS

2017

Source: Thomson Reuters (2018)

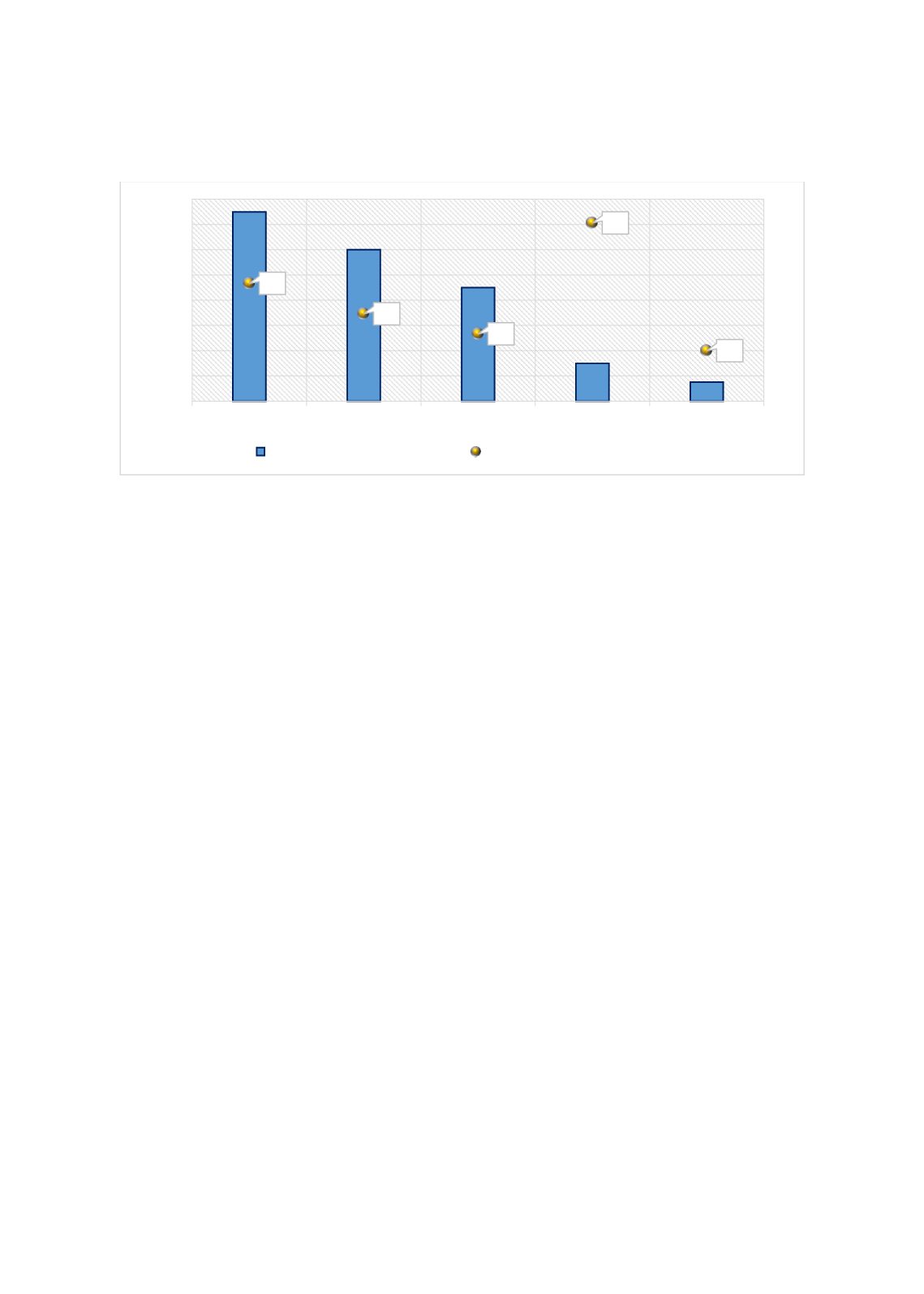

Based on IFSB (2019), there was 6.9% CAGR between the years 2011-2017 in the global

Takaful

industry. In the Gulf Corporation Council (GCC), there was 6.87% decrease by 2017, whereas

there was 8.2% increase in MENA markets in the same period. In 2017,

Takaful

contributions in

South East Asia (SEA) is estimated to have reached US$ 3.86 billion up from US$ 2.82 billion in

2016. In Sub-Saharan Africa, even though the market growth is insignificant (US$ 10.2 million),

it is believed the region has a tremendous market potential for

Takaful

.

4.2. Trends in Global Regulation of

Takaful

Modern trends in

Takaful

can be viewed from three main perspectives: regulation and

governance, products, and

Shari'ah

compliance. First, from the regulatory and governance

perspective, there have been significant developments in different jurisdictions, which led to the

emergence of different governance models. The international regulatory landscape remains

dominated by the IFSB and AAOIFI through soft regulatory standards (AAOIFI, 2014; Bhatty,

2010; Ullah, Khanam, & Tasnim, 2018).

The IFSB has published five standards and guiding principles regulating the

Takaful

Industry.

The standards and guiding principles are identified in

Table 4below. In addition to these

standards, there are other general standards issued by IFSB for IFIs that are applicable to TOs.

These include standards on governance framework, the conduct of business, stress testing and

liquidity management (IFSB, 2013). Many jurisdictions across the world, particularly members

of the IFSB, have adopted the above standards amongst others. The implementation of the three

IFSB standards relating to Takaful by Regulatory and Supervisory Authorities (RSA) in 2016 as

depicted in Figure 12 below highlights the significant improvement in the adoption of the

standards (IFSB, 2017).

15

12

9

3

1,5

35

26

20

53

15

0

10

20

30

40

50

60

0

2

4

6

8

10

12

14

16

Saudi Arabia

Iran

Malaysia

Indonesia

UAE

Total Assets (US$ Billion)

Takaful Assets (US$ Billion)

Number of Takaful Operators*