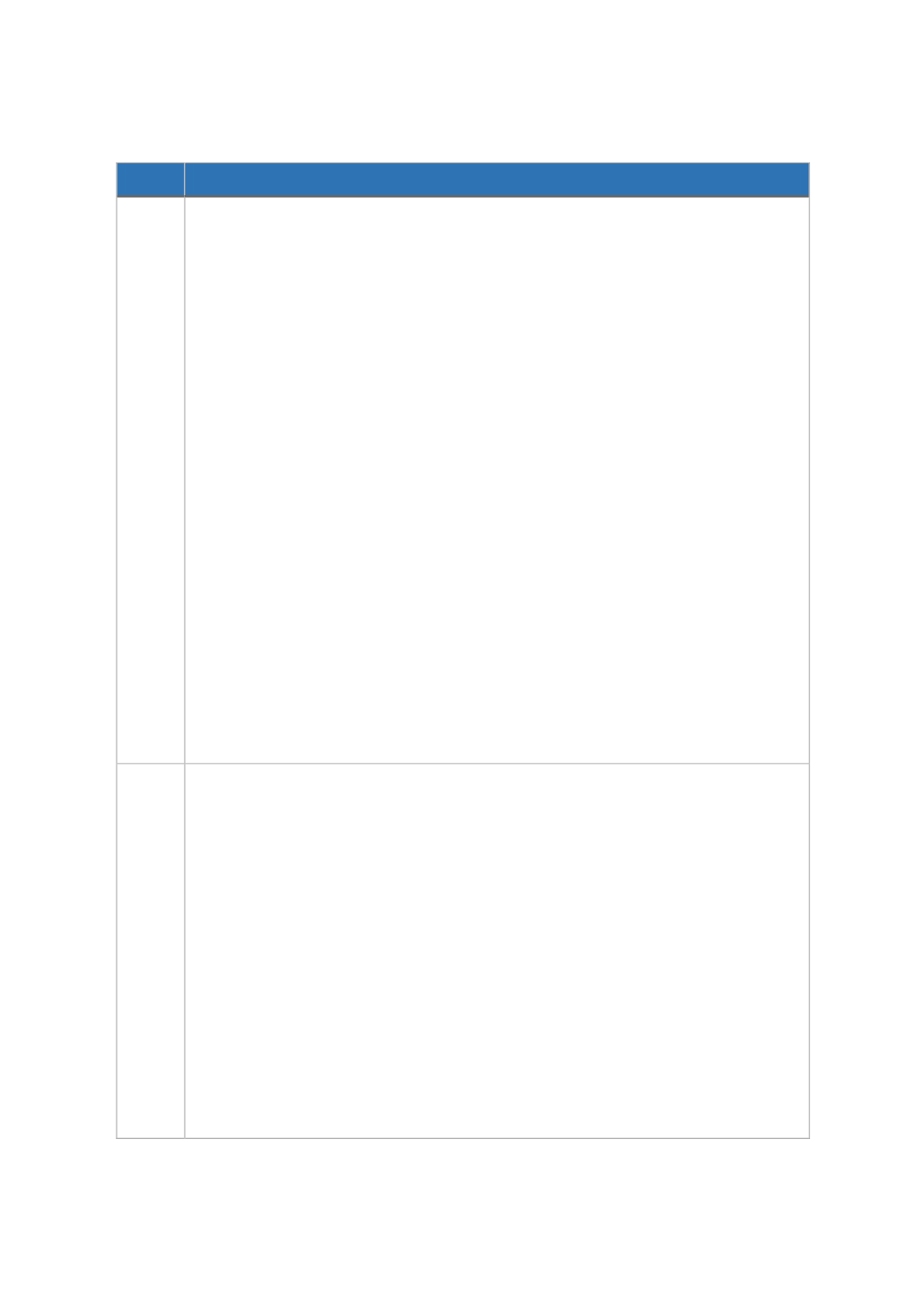

54

Period Developments

2000s

2000:

The first

Takaful

company - Wethaq

Takaful

- opened the doors for others to

enter in Kuwait;

2002:

Lebanon–Al Aman

Takaful

established.

2002:

IFSB inaugurated in Malaysia. IFSB issues global standards and guiding

principles for IFI.

2003:

First

Takaful

company incorporated in Pakistan.

2003:

The Kuwait National

Takaful

Company started its operations;

2003:

Abu Dhabi National

Takaful

Co.P.S.C ('

Takaful

') was established in the UAE.

2005:

SAMA regulations for cooperative insurance supervision enacted.

2005:

Bahrain Monetary Authority enacts rules for

Takaful

companies.

2005:

Securities and Exchange Commission of Pakistan (SECP) issues

Takaful

Rules in

Pakistan.

2006:

Three new TOs such as Ritaj, Al-Khalijiyah, and Al-Safat operators started in

Kuwait;

2007:

Hannover re-enters the

Re-Takaful

market in Germany.

2008:

Takaful

launched in the UK with the establishment of Salaam Insurance.

2008:

Methaq

Takaful

Insurance Company is a registered and licensed General

Takaful

Company in the United Arab Emirates.

2008/9:

Malaysian Re, Munich Re, Swiss re-enters the

Re-Takaful

industry in Malaysia.

2009:

IFSB issues principles on

Takaful

governance (IFSB-8) and

Shari'ah

governance

(IFSB-10).

2009:

The first

Takaful

company Neova Insurance started its operations in Turkey.

2010s

2010:

IFSB issues principles on solvency requirements for

Takaful

(IFSB-11).

2010:

Takaful

regulation introduced in the UAE.

2010:

Takaful

launched in Brunei with the establishment of

Takaful

Brunei

Darussalam.

2011:

Oman enters the Islamic finance sector following the lifting of decades-long

restrictions on

Takaful

.

2011:

Takaful launched in Kenya with the establishment of

Takaful

Insurance Africa.

2011:

Takaful launched in Palestine with the establishment of Al-Takaful Palestine

Insurance.

2012:

SECP draft Takaful Rules allow window Takaful operations in Pakistan.

2012:

London-based Cobalt, set up in 2012 to promote the growth of

Takaful

,

announces the development of a new

Shari'ah

-compliant insurance platform using a

syndication model to spread risk more efficiently.

2013:

BNM issues a concept paper on the Life Insurance and Family

Takaful

for

Everyone (LIFE) framework. The offers cover, among others, operating flexibility,