56

that financial inclusion is on the top agenda of all policies. The Chief Executive Officer of Lloyd’s,

Dame Inga Beale once emphasised: “

It is incredibly important that we in the London Market

continually review the products and services we offer our customers around the world and the way

we offer them. Having the appetite and capability to provide Shari'ah-compliant risk products will

ensure London remains relevant to all communities and will reinforce our position as a centre of

innovation.

” (Matcham, 2018). One other key aspect that is trending is the InsurTech sector,

where financial technology (FinTech) is applied to scale up insurance offerings. There has not

been much development in the application of FinTech to the

Takaful

sector. FinTech provides a

great opportunity for micro-

Takaful

penetration in underserved financial communities and new

frontiers beyond the Muslim world (Oseni & Ali, 2019).

The penetration of conventional insurance is quite low in rich Muslim regions like the GCC,

whereas

Takaful

is rapidly gaining momentum, particularly in the Asia Pacific and the GCC

region, owing to a sizeable Muslim population (Alhumoudi, 2013). The OIC Member countries

account for about a quarter of the world population. The majority of the world's Muslim

population is young, with 60%of this entire population being less than 25 years of age. Catalysed

by rising levels of affluence, this large young Muslim population has the potential to represent a

customer base for a reasonably long duration if it is captured early.

The

Takaful

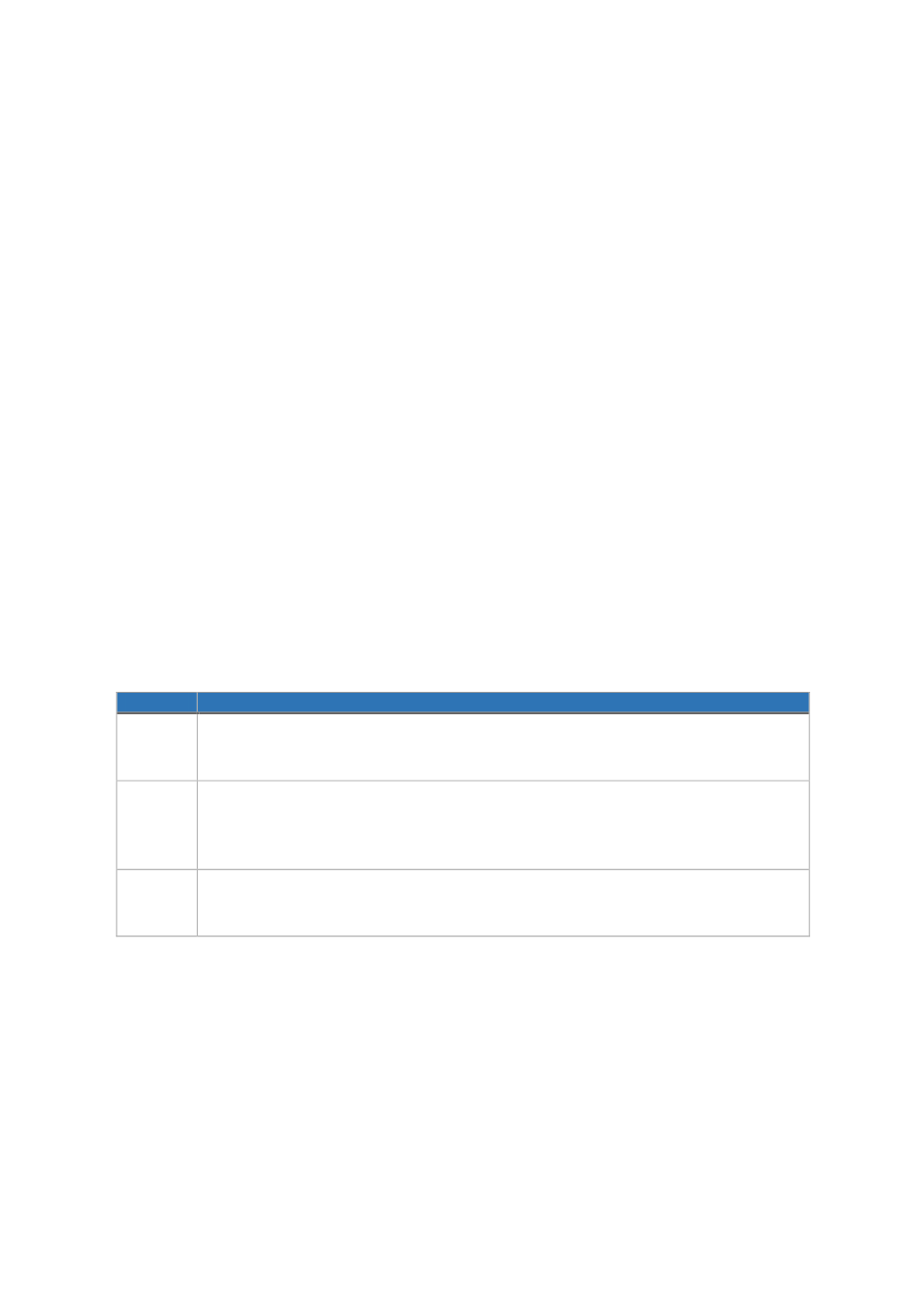

industry has gone through three strategic phases of development, as shown i

n Table 6 below:

T

ABLE

6: S

TRATEGIC

P

HASES OF

T

AKAFUL

D

EVELOPMENT

Phase

Development

Phase 1

Slow, then a stormy wave of new companies in

Takaful

, followed by

Re-Takaful

but

already retreating (Malaysian

Re-Takaful

, partly Munich Re, General

Re-Takaful

business).

Phase 2

Development of Regulations and

fatawa

for

Takaful

and

Re-Takaful

. Introduction of

Risk-Based Capital (RBC) framework for

Takaful

and

Re-Takaful

in Malaysia and RBC

in the United Arab Emirates. Further development on the 1985 fatwa for

Takaful

by

The Council of the IIFA in 2013.

Phase 3

The slowdown in the establishment of new TOs while existing operators and investors

adjust their market strategies towards individual lines in a reaction to excessive

volatility in financial results.

Source: Adopted from IFSB-WBG-2017 report

While

Takaful

has continued its steady growth in OIC countries, a focus on the four jurisdictions

identified in this study reveals the latest position of things with reference to regulatory and

supervisory authorities and market players

. Table 7 below presents the current statistics of the

Takaful

industry in the four countries:

Malaysia, Saudi Arabia, Turkey and the UK.