45

F

IGURE

6: P

URE

M

UDARABAH

M

ODEL

Notes:

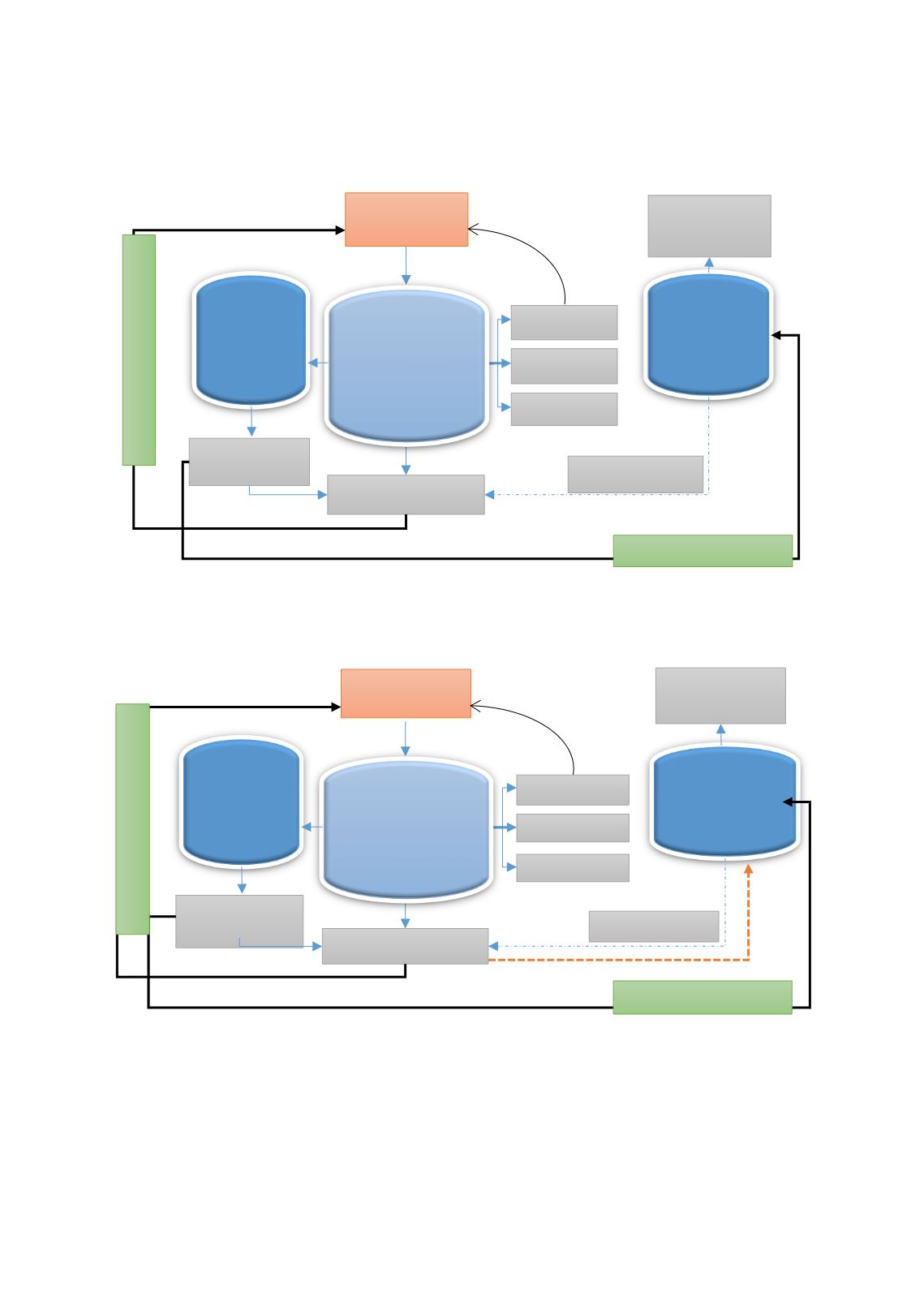

The figure presents two parties – Participants and TO.

Takaful

Fund and Shareholders’ Fund are both

managed by the TO.

Source: Adapted from PwC (2008).

F

IGURE

7: M

ODIFIED

M

UDARABAH

M

ODEL

Notes:

The figure presents two parties – Participants and TO.

Takaful

Fund and Shareholders’ Fund are both

managed by the TO.

Source: Adapted from PwC (2008).

In contrast to pure

mudarabah

model, under the modified version of this model (see

Figure 7

),

the TO shares the underwriting surplus with the participants as an incentive for efficient

management of funds.

Participants

Surplus/

Deficit

Re-Takaful

Reserves

Shari’ah

-

compliant

Investments

Investment

Profits

Shareholders’

Fund

Qard Hasan

Management

Expenses

Claims

Takaful

Fund

100% - X of Investment Profits

X of Investment Profits

Contribution

Participants

Surplus/

Deficit

Re-Takaful

Reserves

Shari’ah

-

compliant

Investments

Investment

Profits

Shareholders’

Fund

Qard Hasan

Management

Expenses

Claims

Takaful

Fund

100% - X of Investment Profits

X of Investment Profits

Contribution