Improving Public Debt Management

In the OIC Member Countries

10

Establishing reporting procedures to ensure that the government’s debt managers are

accountable for their assigned debt management responsibilities and assignments.

The main purpose of this study is to examine public debt management practices in the member

countries of the Organization of Islamic Cooperation (OIC) and to propose recommendations

for improving public debt management in the OIC member countries. The study explicitly

considers the institutional framework of public debt management and the debt structure.

Other important issues regarding the sustainability of public debt, such as the levels of public

budget deficits and debt, and whether debt is issued for financing investment or consumption

are beyond the scope of this study. The decision on the amount to be borrowed is made by the

government before the process of public debt management sets in.

1.2

Performance Indicators and Best Practices

The World Bank (2015) has developed the Debt Management Performance Assessment

(DeMPA) methodology to assist countries in improving their public debt management. The

DeMPA performance indicators cover five dimensions of public debt management, namely: (1)

governance and strategy development, (2) coordination with macroeconomic policies, (3)

borrowing and related financial activities, (4) cash flow forecasting and cash balance

management, and (5) debt recording and operational risk management (see Table 11 for

further details).

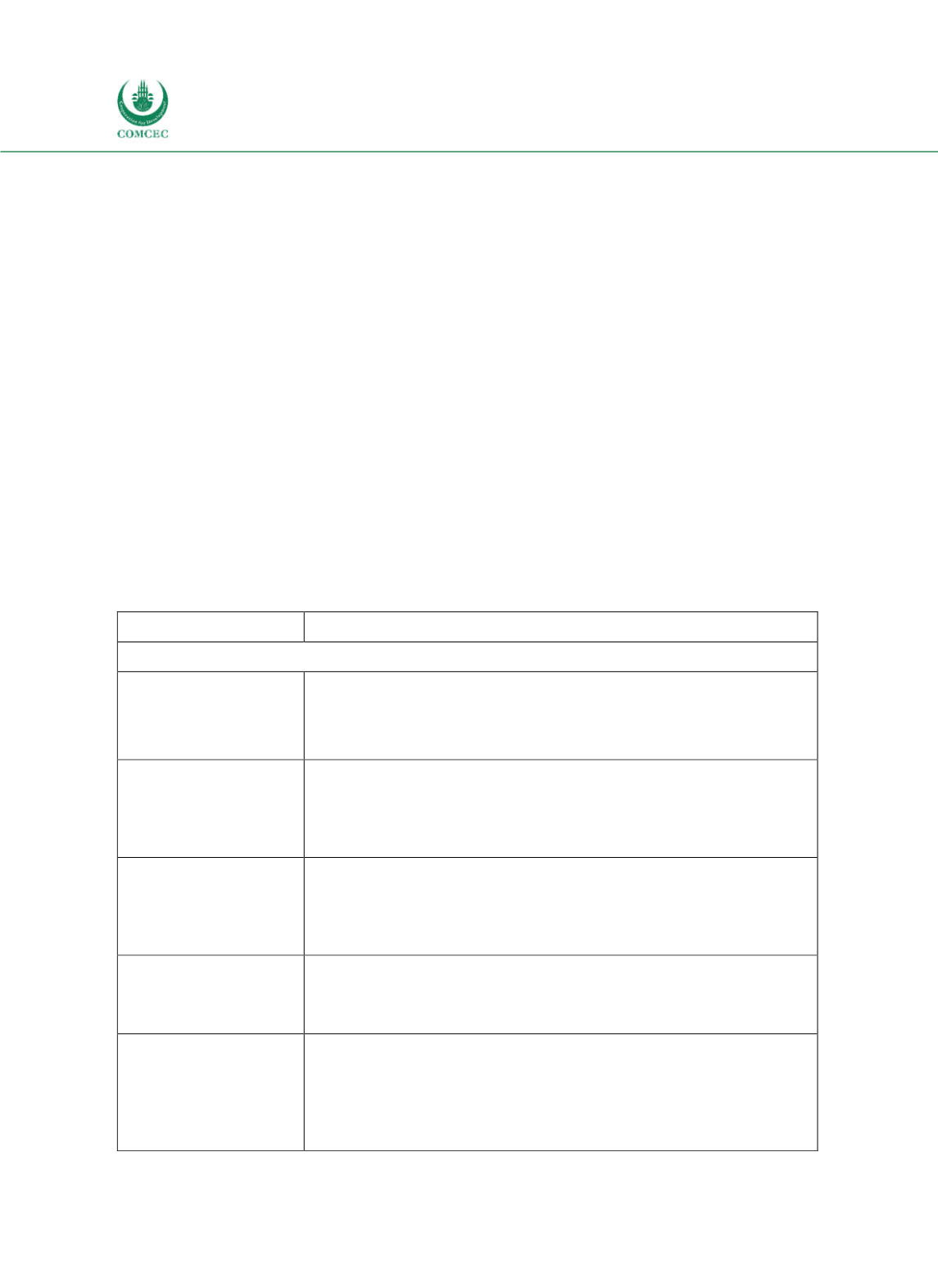

Table 1-1: World Bank DeMPA Performance Indicators

Performance Indicator Description

1. Governance and Strategy Development

Legal Framework

The existence, coverage and content of the legal framework on

authorization to borrow (in both domestic and foreign markets),

undertake debtrelated transactions (e.g. debt exchanges as well as

currency and interest swaps) and issue loan guarantees

Managerial Structure (1) Managerial structure for central government borrowing and debtrelated transactions

(2) Managerial structure for preparation and issuance of central

government loan guarantees

Debt Management

Strategy

(1) Quality of the DeM strategy document (guidelines and target

ranges of indicators for interest rate, refinancing, and foreign currency

risks) (2) Decision making process and publication of the DeM strategy

Debt Reporting and

Evaluation

(1) Publication of a statistical bulletin on debt, loan guarantees and

debtrelated operations

(2) Reporting to parliament or congress

Audit

(1) Frequency and comprehensiveness of financial, compliance, and

performance audits (of the effectiveness and efficiency of government

DeM operations, including the internal control system), and

publication of external audit reports

(2) Degree of commitment to address the outcomes from the audits