National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

32

of the Islamic financial sector using advocacy, research awareness and information sharing and

professional development.

2.5. Global Status of Islamic Finance: An Overview

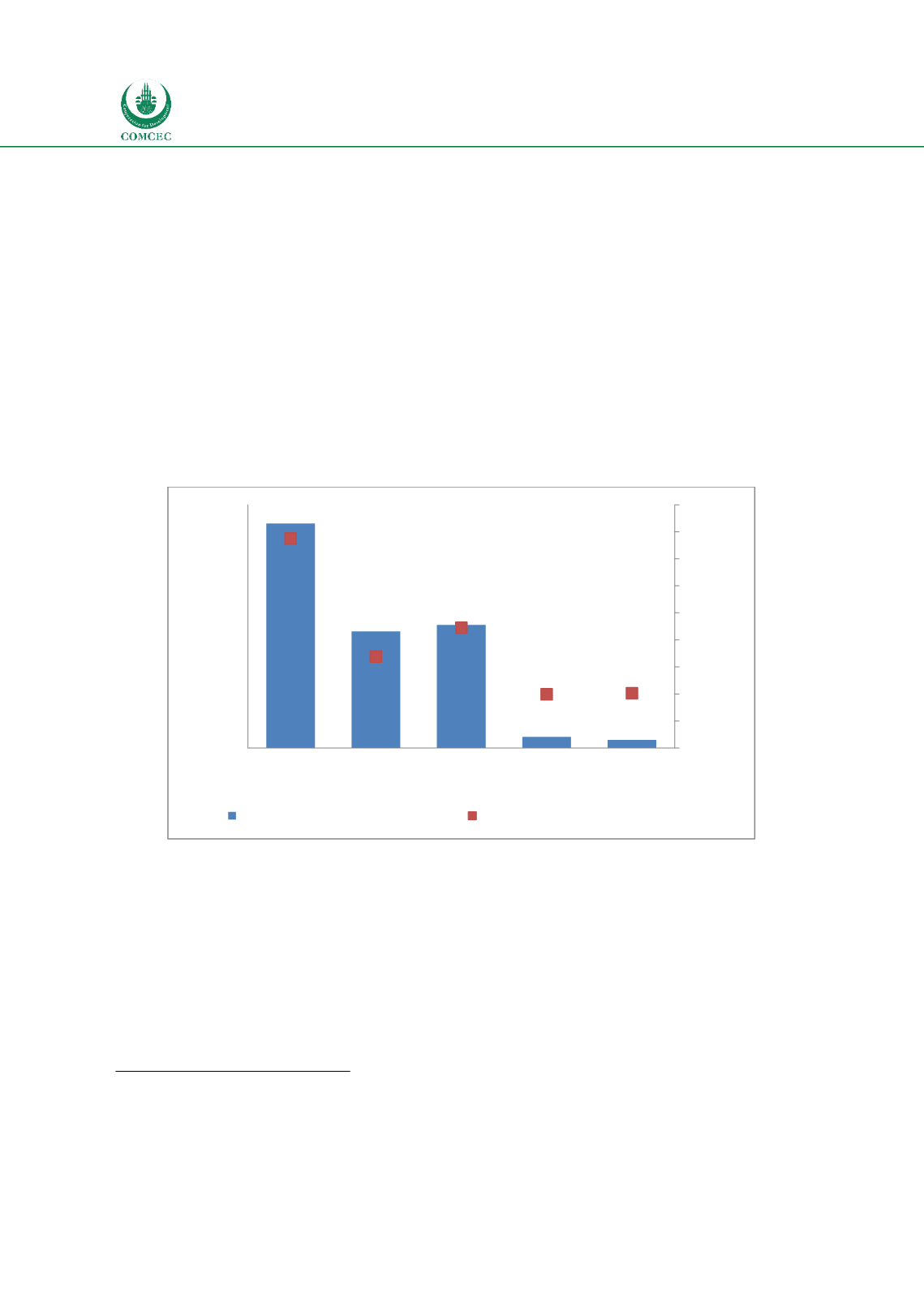

Chart 2.14 shows the regional distribution of Islamic finance.

10

Note that the countries

included in different regions, except for rest of the world (ROW), constitute 97% of the global

Islamic finance assets. GCC is clearly the leading region for Islamic finance with assets worth

USD 831.3 billion managed by 387 financial institutions. South East Asia has a total of 222

Islamic financial institutions with assets valued at USD 455.8 billion followed by the Non-GCC

MENA countries that have 169 Islamic financial institutions with assets of USD 431.7 billion.

South Asia has 99 Islamic financial institutions holding assets worth USD41.4 billion. The

remaining countries (ROW) have 101 Islamic financial institutions with assets valued at USD

29.7 billion.

Chart

2.14: Islamic Finance in Different Regions

Source: Calculated from data provide in ICD and TR (2015)

2.5.1. Islamic Financial Institutions

Chart 2.15 shows the distribution of Islamic financial assets among the largest 15 Islamic

finance economies. Malaysia has the largest share of Islamic financial assets valued at USD

415.4 billion managed by a total of 77 Islamic financial institutions, and this is followed by

Saudi Arabia that has 105 financial institutions managing USD 413 billion of Islamic financial

assets. Iran, a country with an Islamic financial system, has the third largest Islamic financial

sector with USD 345 billion assets managed by 82 financial institutions. This is followed by

four GCC countries (UAE, Kuwait Qatar and Bahrain) which have significant Islamic financial

10

The countries included in the different regions are the following: GCC

—

Bahrain, Kuwait, Qatar, Saudi

Arabia and UAE; Non-GCC

—

MENA-Egypt, Iran, Jordan, Sudan and Turkey; South East Asia

—

Indonesia and

Malaysia; South Asia

—

Bangladesh and Pakistan; ROW (Rest of the World)

—

all other countries.

831,3

431,7

455,8

41,4

29,7

387

169

222

99

101

0

50

100

150

200

250

300

350

400

450

0

100

200

300

400

500

600

700

800

900

GCC

Non GCC

MENA

South East

Asia

South Asia

ROW

No. of Institutions

UDUSD (bn.)

Islamic Finance Assets (US$ bn)

No. of Islamic Financial Institutions