National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

33

sectors. These four countries together have 282 Islamic financial institutions managing USD

418.4 billion worth of assets. Though the financial sector of Sudan is Islamic, it has 44 financial

institutions with Islamic financial assets valued at USD 10.7 billion. It is worth noting that

Switzerland is the only non-Muslim country that makes the list of those with a significant

Islamic financial sector with 3 Islamic financial institutions holding USD 6.9 billion of assets.

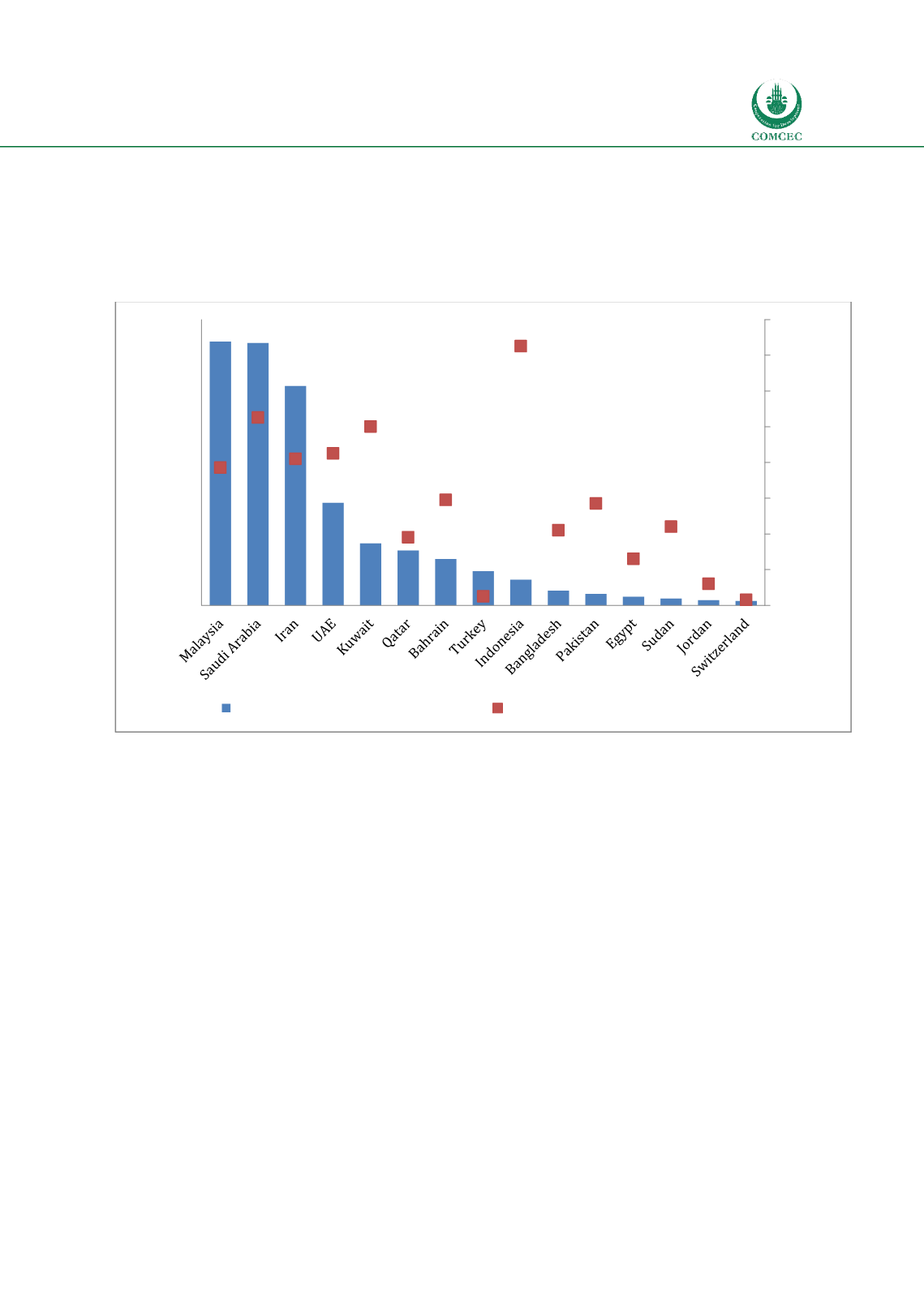

Chart

2.15: Islamic Finance in 15 Largest Islamic Finance Economies

Source: Calculated from ICD and TR (2015)

Chart 2.16 shows the total Islamic financial assets and their distribution among different

financial institutions in 2014. The total global Islamic finance assets were USD 1.814 trillion

managed by 1,143 Islamic financial institutions. The dominant sector was the Islamic banking

sector with assets under the management of USD 1,345.9 trillion and 436 Islamic banks. The

takaful and retakaful sector is relatively small with 308 companies holding USD33.4 billion in

assets. A relatively smaller size of takaful assets is reflective of the overall smaller size of the

insurance industry discussed above. There were 399 other Islamic financial institutions such

as investment banks, leasing companies, finance companies, etc. with assets valued at USD 83.9

billion.

415,4 413,0

345,4

161,4

97,6

86,5

72,8

53,9

40,4

23,2 18,3 13,5 10,7

8,2 6,9

77

105

82 85

100

38

59

5

145

42

57

26

44

12

3

0

20

40

60

80

100

120

140

160

0

50

100

150

200

250

300

350

400

450

No. of Institutins

USD (bn.)

Islamic Finance Assets (US$ bn)

No. of Islamic Financial Institutions