National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

36

2.5.2. Islamic Financial Markets

Islamic Funds

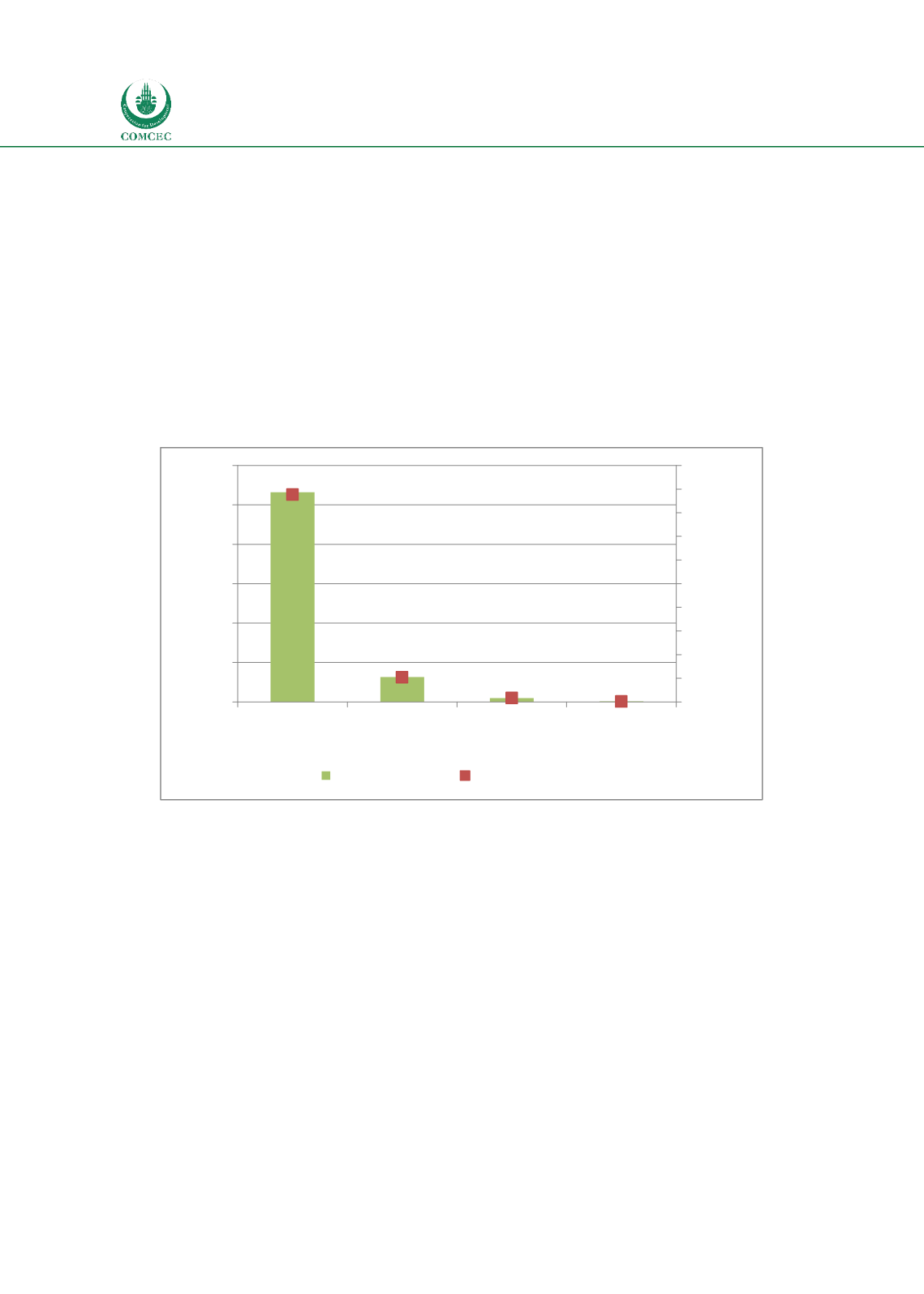

After providing information on various aspects of the Islamic funds segment of capital markets,

this section presents the initiatives taken in 2014. There were a total of 1,181 Islamic funds

with a total value of USD 60.65 billion in 2014. Table 2.20 shows the distribution of the Islamic

funds according to their types. Mutual funds constitute the bulk (87.7%) of the Islamic funds

valued at USD 53.17 billion, and this is followed by ETFs worth USD 6.33 billion which

constitute 10.4% of total Islamic funds. Insurance funds and pensions funds are still very small

with the former having assets of just over USD 1 billion and the latter having a minuscule

amount of only USD 0.15 billion.

Chart

2.20: Global Islamic Funds: Fund Types (2014)

Source: Calculated from Thomson Reuters Global Islamic Asset Management Outlook 2015

Table 2.21 shows the asset classes of different Islamic funds. Equity based funds equal USD

24.26 billion (constituting 40% of the total) followed by money market funds of USD 21.83

billion constituting 36% of the total Islamic funds. Commodity funds and sukuk funds are

valued at USD 6.07 and USD 3.64 billion and together are 16% of the total. The remaining

Islamic funds are in the form of real estate funds (USD 1.82 billion) and mixed funds (3.03

billion).

53,17

6,33

1,01

0,15

87,7

10,4

1,7

0,2

0

10

20

30

40

50

60

70

80

90

100

0

10

20

30

40

50

60

Mutual funds

(bn).

ETFs

Insurance

funds

Pension funds

Percentage

USD (bn.)

AuM (US$, bn.)

Percentage of Total