National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

34

Chart

2.16: Global Islamic Financial Sector -Islamic Financial Institutions (2014)

Source: Calculated from ICD and TR (2015)

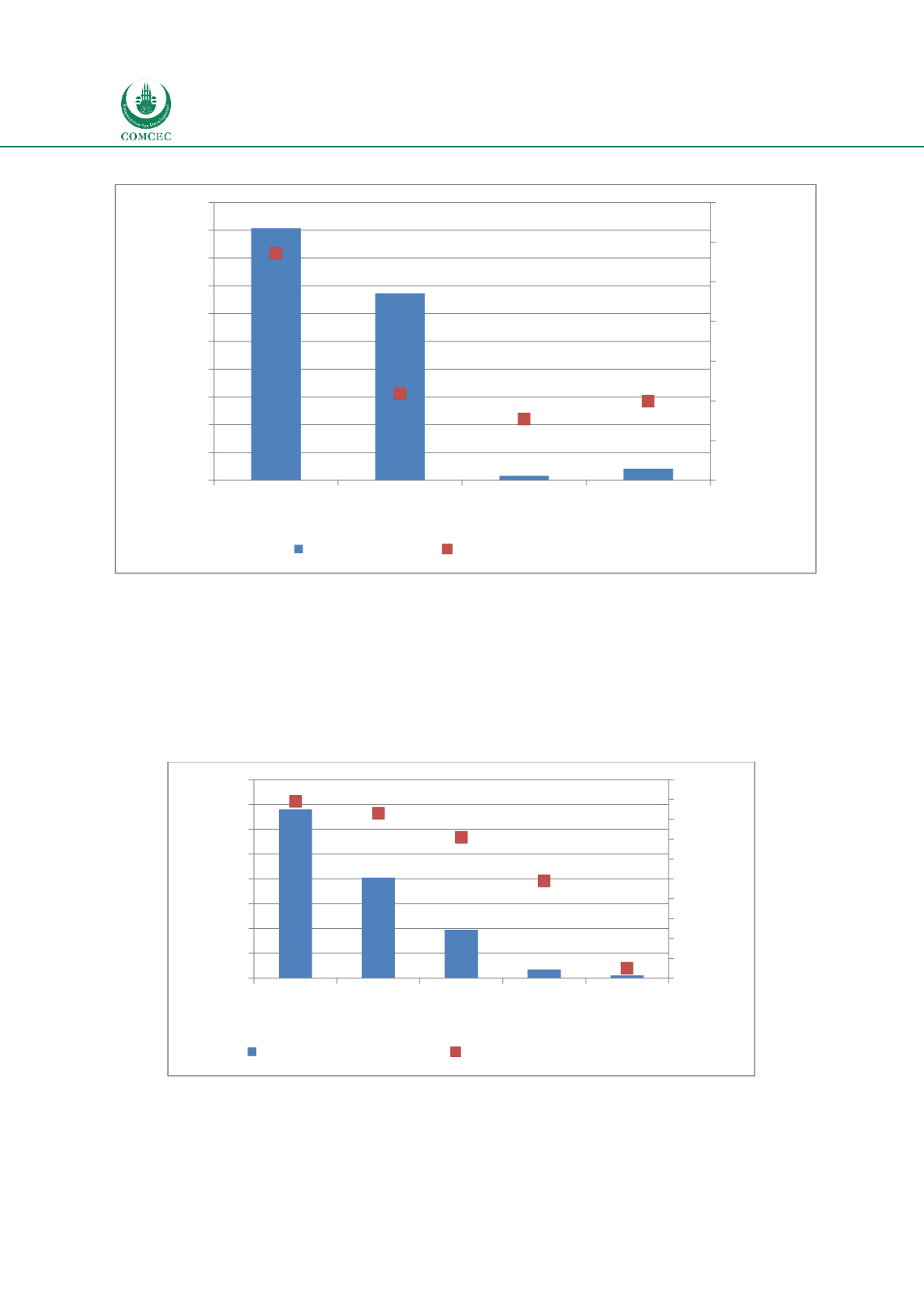

Chart 2.17 shows the Islamic banking sector in different regions of the world. With 89 Islamic

banks holding assets worth USD 680.4, GCC leads the regions followed by non-GCC MENA

countries that have 83 Islamic banks managing USD 404.8 billion assets. Islamic banking assets

in South East Asia are worth up to USD 195.7 billion held by 71 countries, and 49 Islamic banks

in South Asia hold assets worth USD 35 billion. The rest of the world has 5 Islamic banks

holding USD 11.1 billion assets.

Chart

2.17: Islamic Banking in Different Regions

Source: Calculated from data provide in ICD and TR (2015)

Chart 2.18 shows that the takaful/retakaful sector is also largest in the GCC and has 101

companies with assets of USD 15.08 billion. South East Asia has the second largest takaful

1.814,1

1.345,9

33,4

83,9

1.143

436

308

399

-

200

400

600

800

1.000

1.200

1.400

0

200

400

600

800

1.000

1.200

1.400

1.600

1.800

2.000

Islamic Finance

Assets

Islamic Banking

Assets

Takaful/Retakaful

Other Financial

Institutions

No. of Institutions

UDUSD (bn.)

Assets (US$ bn)

No.ofFinancial Institutions

680,4

404,8

195,7

35,0

11,1

89

83

71

49

5

0

10

20

30

40

50

60

70

80

90

100

0

100

200

300

400

500

600

700

800

GCC Non GCC

MENA

South East

Asia

South Asia ROW

No. of banks

UDUSD (bn.)

Islamic Banking Assets

No. of Islamic Banks/ Windows