National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

37

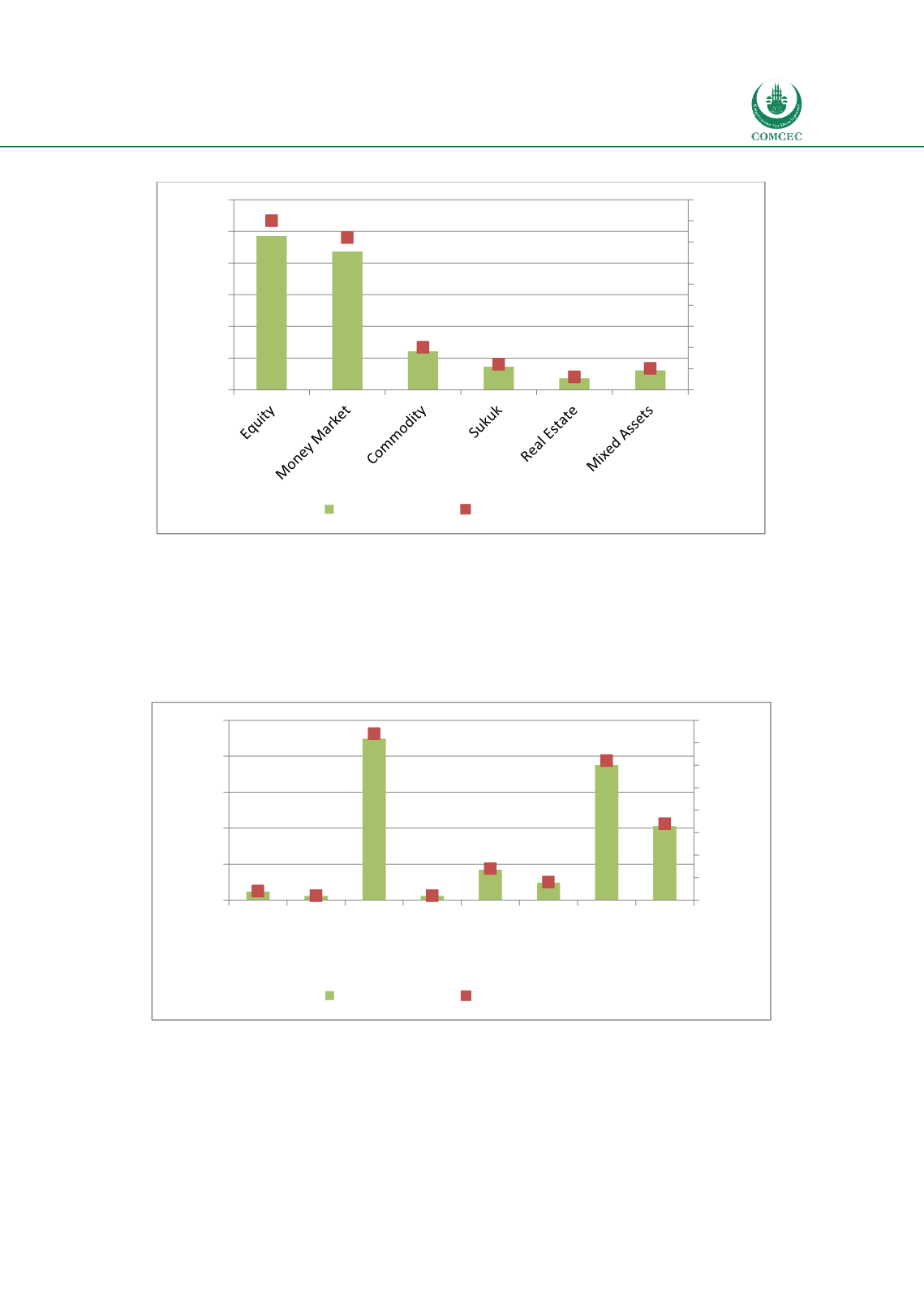

Chart

2.21: Global Islamic Funds: Asset Class (2014)

Source: Calculated from Thomson Reuters Global Islamic Asset Management Outlook 2015

Chart 2.22 shows the geographical distribution of Islamic funds. The GCC region is the host to

most (37%) of the funds worth USD 22.44 billion followed by South East Asia with funds of

USD 18.8 billion. The assets under management of the rest of the world (ROW) amount to USD

10.31 billion (17%) with North America being at USD 4.25 billion (7%) and the remaining

regions having less than 5% of the funds.

Chart

2.22: Global Islamic Funds: Geographical Distribution of Issuances (2014)

Source: Calculated from Thomson Reuters Global Islamic Asset Management Outlook 2015

During the year 2014, a total of 100 new funds worth USD 2.27 billion were launched. Charts

2.23 and 2.24 show the status of Islamic funds for the year 2014 with the former showing the

geographical origins of the new funds launched during the year and the latter showing their

asset classes. The bulk of the new sukuk issued in 2014 (USD 1157.7 million) originated from

South East Asia. While GCC launched funds were worth USD 317.80 million (14% of the total)

24,26

21,83

6,07

3,64

1,82

3,03

40

36

10

6

3

5

0

5

10

15

20

25

30

35

40

45

0

5

10

15

20

25

30

Percentage

UDUSD (bn.)

AuM (US$, bn.)

Percentage of Total

1,21

0,61

22,44

0,61

4,25 2,43

18,80

10,31

2

1

37

1

7

4

31

17

0

5

10

15

20

25

30

35

40

0

5

10

15

20

25

Africa Europe GCC Non

GCC

MENA

North

America

Other

Asia

South

East

Asia

ROW

Percentage

USD (bn.)

AuM (US$, bn.)

Percentage of Total