National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

38

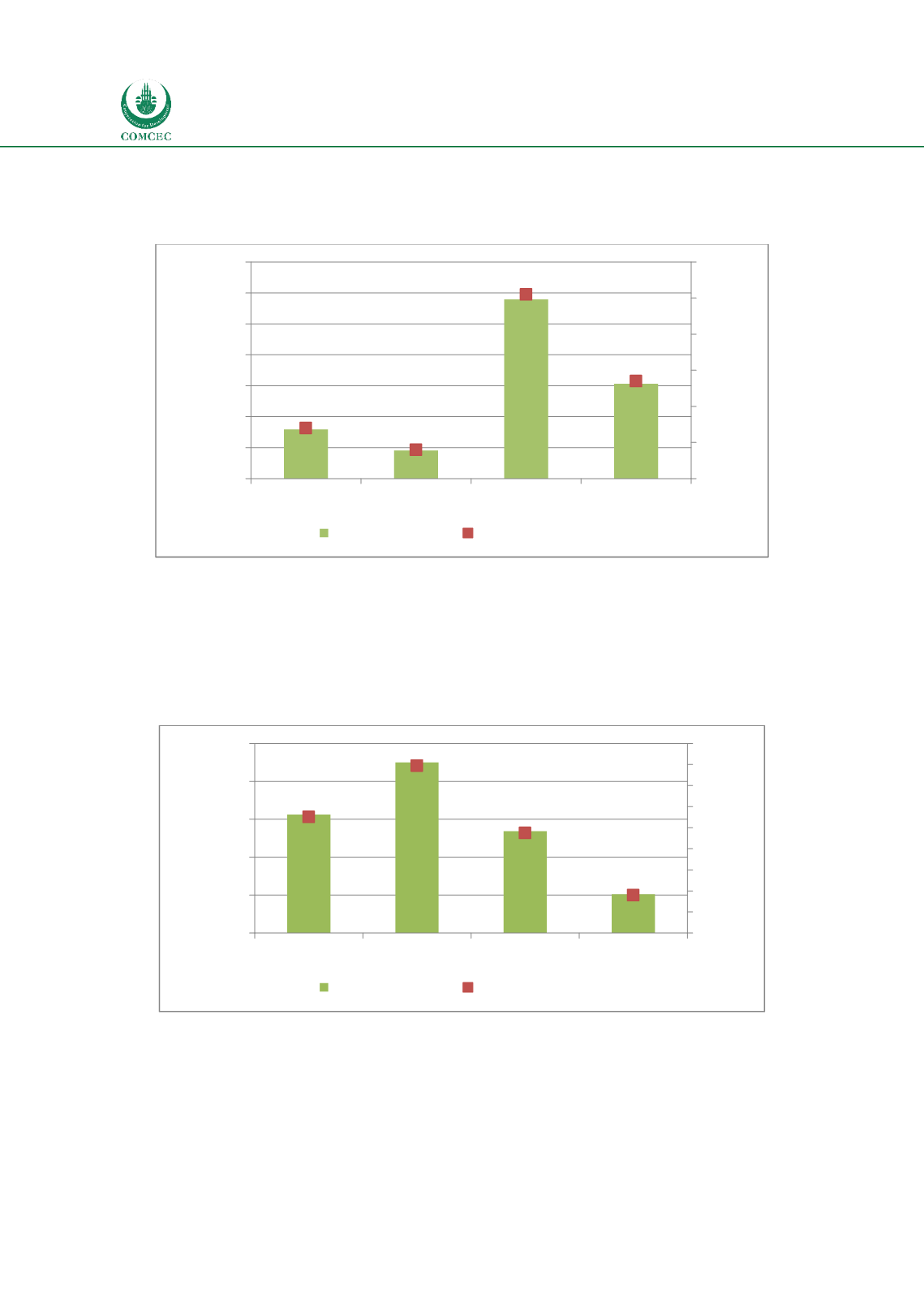

and other Asian countries USD 181.6 million (8% of the total), the remaining funds worth USD

612.0 million constituting 27% of the total for 2014 were initiated in other countries (ROW).

Chart

2.23: Islamic Funds Launched in 2014: Geographical Origins

Source: Calculated from Thomson Reuters Global Islamic Asset Management Outlook 2015

Chart 2.24 presents the asset classes of the funds that were launched in 2014. The bulk of the

funds (40%) worth USD 900 million were money market funds and 28% valued at USD 625

million were equity-based funds. A total of USD 538 million sukuk-based funds (24%) were

initiated during the year. The remaining 9% of the funds were mixed funds valued at USD 204

million.

Chart

2.24: Global Islamic Funds Launched in 2014: Asset Class

Source: Calculated from Thomson Reuters Global Islamic Asset Management Outlook 2015

Sukuk

The total number of sukuk issued globally between 2001-2015 was 6014 valued at USD 767.1

billion. Of these, 5655 sukuk worth USD 618.3 billion (or 80.6%) were domestic and 359 sukuk

worth USD 148.8 (19.4%) were international. The total outstanding value of the sukuk in

317,80

181,60

1157,70

612,90

14

8

51

27

0

10

20

30

40

50

60

0

200

400

600

800

1000

1200

1400

GCC

Other Asia South East Asia ROW

Percentage

USD (mn.)

AuM (US$, mn.)

Percentage of Total

625

900

538

204

28

40

24

9

0

5

10

15

20

25

30

35

40

45

0

200

400

600

800

1000

Equity Money Market Mixed Assets

Sukuk

Percentage

USD (mn.)

AuM (US$, mn.)

Percentage of Total