National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

225

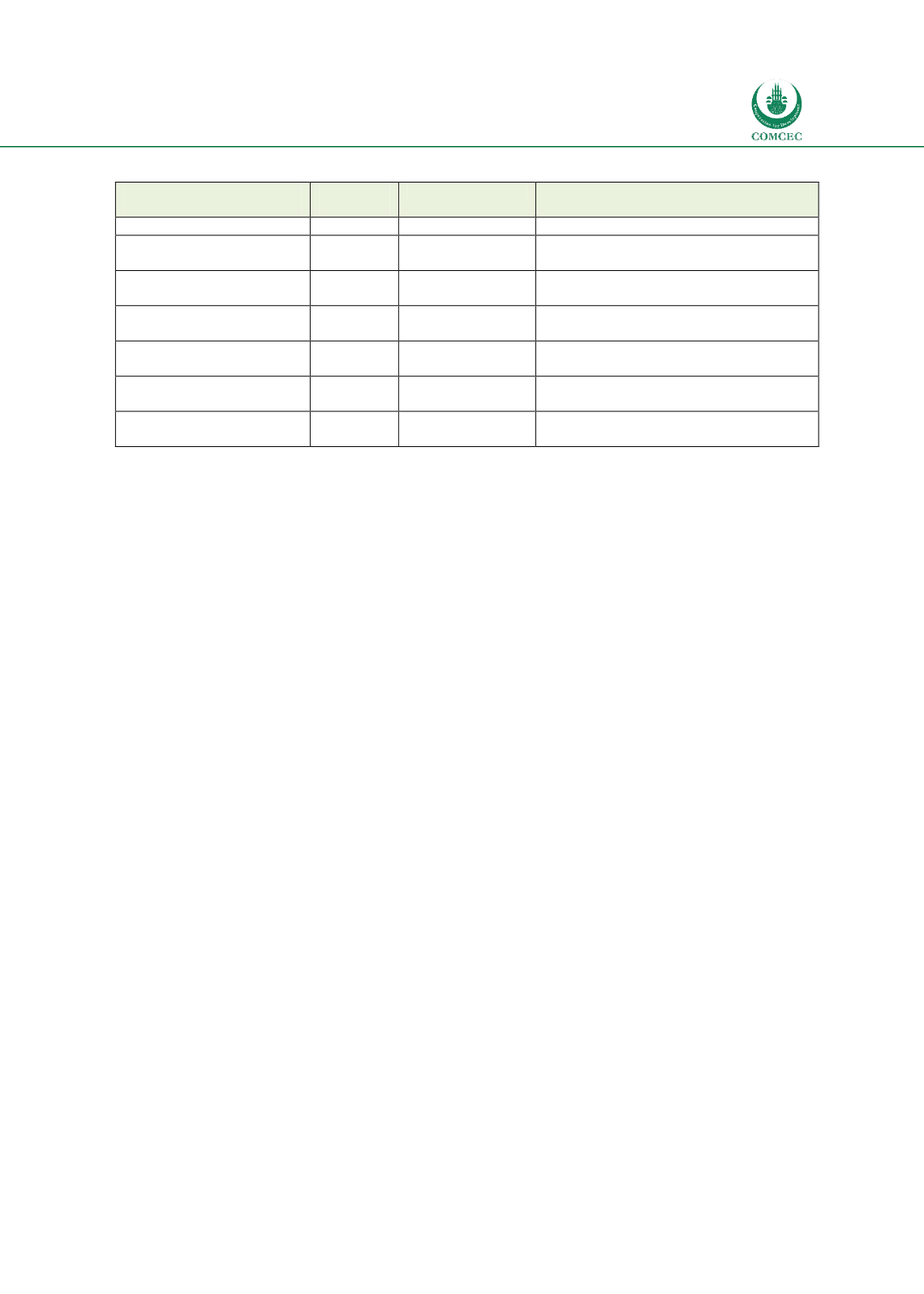

Table

8.1: Status and Responsible Stakeholders at the National Level

Infrastructure

Institutions

Overall

Averages

Overall Ranking

Responsible Stakeholders

Legal Infrastructure

57.5

Developing

Government

Regulation & Supervision

Framework

48.6

Underdeveloped

Regulators

Shariah

Governance

Regimes

47.3

Underdeveloped

Government, regulators, national Shariah

board

Liquidity Infrastructure

61.1

Developing

Government, regulators, central bank,

financial institutions

Information Infrastructure

& Transparency

50.0

Developing

Regulators,

domestic

accounting

standards body, rating agencies

Consumer

Protection

Architecture

41.6

Underdeveloped

Government,

regulators,

financial

institutions, trade associations

Human

Capital

&

Knowledge Development

69.4

Developing

Government, private sector, universities

and academic institutions

To properly reflect the transactions and operations of Islamic financial institutions, countries

can opt for using either AAOIFI accounting standards or domestic accounting standards that

are adapted for Islamic finance. Though the domestic accounting body has the responsibility to

develop the standards, the decision of requiring Islamic financial institutions to use Islamic

accounting standards has to come from the regulators. Other than the credit ratings provided

by conventional rating agencies for debt based transactions, other types of assessments may be

required for the Islamic financial sector. These include Shariah compliance ratings and

providing assessments for equity modes of financing. Accomplishing these would require

establishing processes that require knowledge and skills that are different from those used to

assess debt based transactions.

The key items identified in consumer protection architecture include laws/regulation to

protect consumers, deposit insurance and financial literacy programs. Table 8.1 indicates that

this architectural component to be the weakest for the Islamic financial sector in the countries

that were examined. One of the key issues in protecting consumers of Islamic financial sector is

to ensure Shariah compliance and its disclosure as many consumers choose Islamic finance

due to religious convictions. While instituting appropriate laws and regulations to protect

consumers and deposit insurance have to be done by the government and regulators,

improving financial literacy will require efforts at different levels. Building the content on

Islamic financial principles and products and its dissemination can be done introducing these

in the school/college curricula by the Ministry of Education and also by regulators, Islamic

financial institutions and trade associations.

Human capital and knowledge development appear to be the strongest element of the Islamic

financial architecture. However, as the industry is expected to grow, there will be increasing

demand for personnel with the appropriate knowledge and skills, particularly in countries

where the industry is relatively new. In this regards, the public and private sector entities

along with academic institutions and universities can contribute providing training and

building the knowledge base for the future growth of the industry.

Given the above, the six most important policy recommendations that will strengthen the

Islamic financial architecture at the national level are as follows: